Key Points

- The dollar stages a recovery, boosting the USD/JPY recovery case.

- Has the hawkish shift from the Bank of Japan already been priced in?

- All eyes are on a busy week for US employment, headed by Friday’s NFP main event.

- The bulls are not yet in control of USD/JPY, but there are signs this market can stage a broader recovery.

The Dollar Stages A Recovery

It was no secret that the US dollar had a tough August. In fact, it was the biggest monthly drop seen in the DXY since November 2022. This was mainly due to the confirmation of a shift in Fed policy stance with rate cuts just around the corner. This is not US-specific, though, as most central banks are looking to follow suit. That starts this week, with the Bank of Canada expecting to cut rates by 0.25% on Wednesday.

As per the CME Fed Watch Tool, there is a 69% chance that the Federal Reserve will cut interest rates by 25bps. This still leaves the door open for a 50bps cut, which explains the dollar sell-off in recent weeks. I feel this is too aggressive, and at the moment, it is more likely that Jerome Powell will cut in small increments rather than surprise with a bigger cut.

Is Ueda’s Hawkishness Priced In?

The data in Japan, on the whole, has been robust over recent weeks. This has fuelled inflation, and last week’s CPI report was a surprise as it surpassed expectations. This gives Ueda more scope for hawkishness, and he did hint at Jackson Hole that another hike could be on the way.

However, it is important to note these hikes are small and rare. Also, interest rates are still extremely low relative to the Federal Reserve. Ueda sounded encouraged by the stronger data prints, but he won’t want to reverse his work by hiking too aggressively. This probably explains the uncertainty in the USDJPY price action over the last few weeks.

All Eyes On A BIG Week For US Employment

Markets have started slowly with Labor Day today but do not get too settled with lower volatility. This week is big for the US labor market, with US Non-Farm Payrolls Day on Friday. After an unusually weak US Non-Farm Employment change figure of just 114k and a downward revision of 880,000 fewer jobs than originally reported in the 12 months through March 2024, this puts the spotlight firmly on this week’s print.

There will naturally be concerns about whether to trust the figure released anyway after that huge downward revision. Still, either way, this figure will likely be the determining factor for a 50bps or 25bps cut in the Federal Reserve meeting in just a few weeks. Should the report be much more positive than last time, expect 25bps to be all but guaranteed, and USD/JPY may stage a broader recovery. However, a report as weak as last time is likely to cause more panic selling in USD/JPY.

There Are Early Signs Of A USD/JPY Reversal

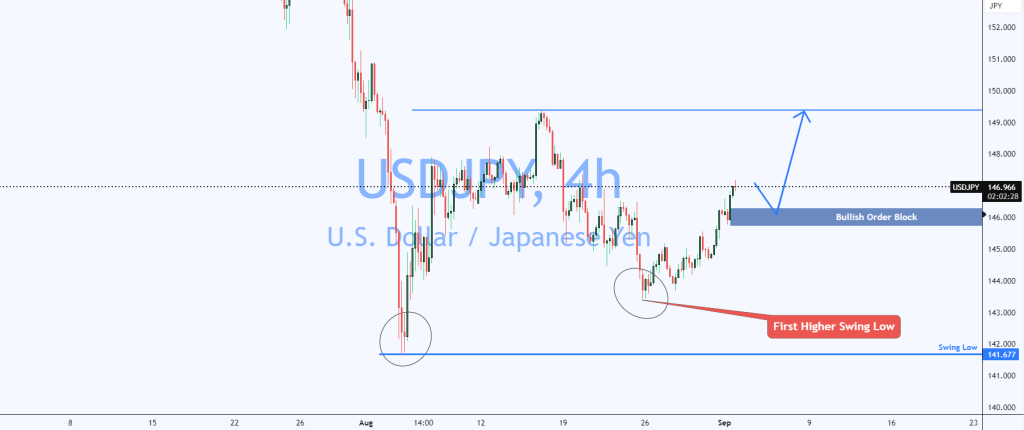

USD/JPY has been consolidating in the mid-140s for a couple of weeks now, and there have been early signs that a base is forming to spring higher. The main evidence is printing the first higher low in the broad market structure at 143.400.

However, until a break of 149.000, it will be difficult to argue that the bulls are in control right now. However, traders may want to utilize the bullish order block at 146.320 and target the key high at 149.384. This high could be broken by the end of the week should the NFP report come in strong. However, a weaker NFP report will likely bring the swing low at 141.677 into play as the pressure mounts on the US dollar.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.