Key Takeaways

- The Fed and BoE interest rate announcements have driven huge volatility to the GBP/USD.

- Due to the central bank policies of the past 24 hours, a bullish bias is warranted for the Cable.

- Pullback buys from the 1.3200 area are solid ways to get in on the action.

Market Overview

Central banks have been the big story this week, with the US Federal Reserve (Fed), Bank of England (BoE), and Bank of Japan (BoJ) making headlines. The Fed didn’t disappoint, dropping interest rates for the first time since the onset of COVID-19. On the other hand, the BoE held rates firm. For the GBP/USD, volatility became the rule as forex players digested September’s policy decisions from the Fed and BoE.

Rate Cuts!

Wednesday, the Fed slashed interest rates by 50 bps, defying history. The move marked the first cuts in three years, dating back to the COVID-19 era policy of “Unlimited QE.”

At the FOMC Press Conference, Fed Chairman Jerome Powell stated that the central bank is not “behind the curve” and the jumbo rate cut signals the Fed’s “commitment” to staying on top of the current economic dynamic. Here’s more from Powell:

“The labor market is in solid condition, and our intention with our policy move today is to keep it there. You can say that about the whole economy: the US economy is in good shape. It’s growing at a solid pace; inflation is coming down, and the labor market is strong. We want to keep it there.”

Aside from his views on the broader economy, Powell stressed the way forward would depend on the data. So, the Fed is going to make any future adjustments as deemed necessary. Today, the CME FedWatch assigns a 60% chance of another 25 bps reduction in the prime rate in November. We’ll see how this prediction unfolds as the markets receive more jobs and inflation data ahead of November’s meeting.

It’s important to note the decision to cut by ½ point wasn’t unanimous. Fed governor Michelle Bowman dissented, opting for a ¼ point rate cut instead. This was the first dissenting vote by a Fed governor since 2005 (Marc Olson).

Bottom line: the ½ point jumbo cut is dovish for the USD, as is the expected November cut.

BoE Holds Firm

During the Thursday London session, the Bank of England elected to hold lending rates firm at 5%. The BoE’s policy move, or lack thereof, fell in line with concensus estimates. Monetary Policy Committee members voted 8-1 to keep interest rates at a flat 5%. The decision comes on the heels of last month’s rate cut.

In addition to holding rates static, the BoE announced that it would extend its bond reduction plan. BoE Governor Andrew Bailey took a cautious tone:

“It’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

Given this concern over inflation, England maintains a 5% prime rate, while the US holds a 4.75% rate. However, Bailey did leave the door open for dovish policy, telling the media that he was “optimistic” rates would come down as evidence for disinflation mounts.

Bottom Line: Higher interest rates suggest a bullish bias towards the GBP is warranted.

GBP/USD: Technical Outlook

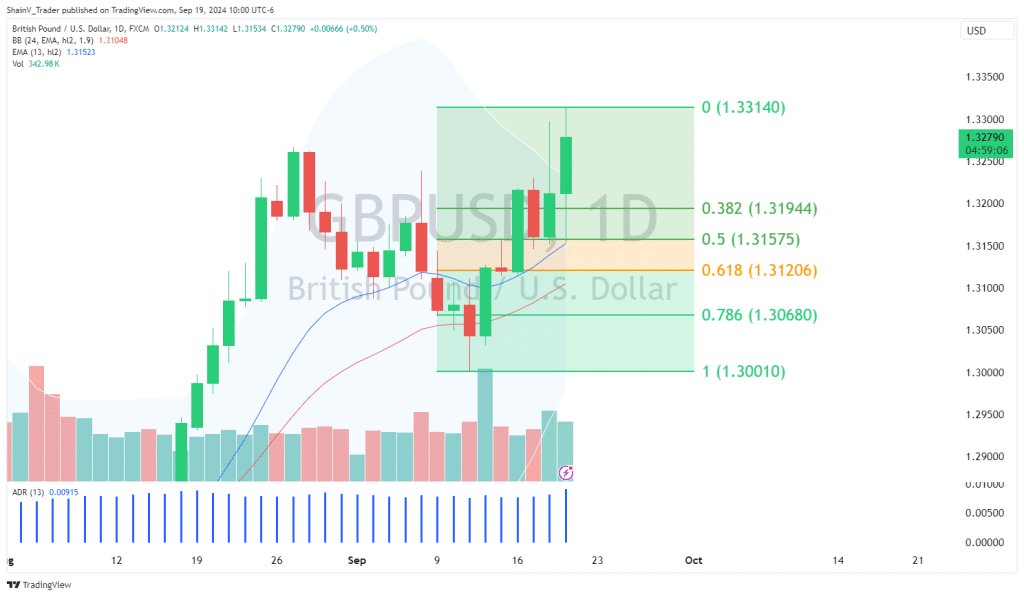

From a technical point of view, the bulls are in control of the GBP/USD. Pullback buys are an appropriate way forward, at least until the next round of inflation and jobs data hits newswires.

On the daily chart, support levels are present at 1.3194 (38% retracement) and 1.3120 (62% retracement). If we get a pullback from current highs (1.3300-1.3325), these buy entries will have a positive expectancy.

It’s a great time to trade GBP/USD. Interest rate decisions always move markets, and Fed/BoE dialogue should do that for the rest of 2024. Be ready for an array of solid trading opportunities in the GBP/USD; it is one of our top FX pairs to target for the remainder of the calendar year.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.