Key Points

- Expect a highly volatile week ahead, with many high-impact news events.

- Federal Reserve will likely give little away in this meeting but look for clues on cuts at the next meeting.

- There is a £22bn hole in the UK economy.

- Will GBP/USD continue its slide lower?

Highly Charged Week Ahead

Who said summer markets are quiet? Wow! What a week we have in store in the financial markets. The Bank of Japan, the Federal Reserve, and the Bank of England will all deliver their interest rate decisions this week. Add into the mix US Non-Farm Payrolls Day and earnings reports from Amazon, Meta, and Microsoft, you can understand why volatility this week will likely be extremely high. It goes without saying, please trade with extra care around these news events. However, if you can keep your emotions in check on a week like this, you could be in for some pips, and GBP/USD is shaping up for a big move!

Fed To Give Little Away

On Wednesday, the Federal Reserve will deliver its next interest rate decision. According to the CME Fed Watch Tool, there is a 96% chance the interest rate will remain unchanged at 5.50%, so you could safely say that will be the case. However, the communication around the remaining meetings of the year will spark the dollar’s volatility.

Since the last meeting, the data has pointed to two interest rate cuts at the end of the year, something the markets have priced in. Although Jerome Powell is likely to give little away in this meeting, any indication that the markets have this wrong will likely result in an immediate GBP/USD downside. There are so many unanswered questions right now, so prepare for all options in Wednesday’s meeting.

The $22bn Hole In The UK Economy

Across the pond, tensions were high in the House of Commons as Britain’s Finance Minister Rachel Reeves claimed the UK is in a £22bn hole. As a result, “necessary,” “urgent,” and “incredibly tough” choices were needed to restore economic stability. From a currency point of view, it is not something that the pound bulls would have enjoyed hearing. Depending on the severity of these “difficult decisions,” the pound could be set up for a rocky ride and, therefore, could set up more GBP/USD downside.

GBP/USD To Continue Sliding?

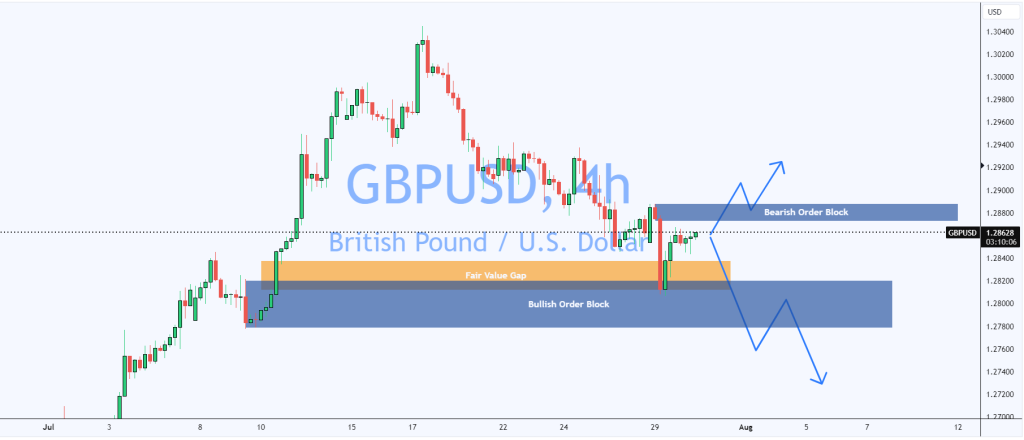

GBP/USD’s bearish structure has been confirmed by a series of lower lows and lower highs in recent weeks. As predicted in my previous GBP/USD article, the price has reached the level of 1.28200 and filled the Fair Value Gap.

As you can see from the chart, the price has reacted from a bullish order block, which is the main support area on the chart. The short-term direction of GBPUSD will depend on how the price reacts to the bearish order block at 1.28800. If the price continues its downward trend, then this will need to act as a resistance area, and then the price will be pulled below the bullish order block. From there, 1.27000 is possible.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.