Key Points

- Expect a quieter week in the markets, but there may be fallout from Jackson Hole.

- Will the dollar rebound with a stronger-than-expected Core PCE report?

- Keir Starmer admits the autumn budget will be “painful.”

- Is GBPUSD due for a correction?

The Fallout From Jackson Hole

Last week ended spectacularly, with Jerome Powell confirming that rate cuts are coming from September. Powell had remained very tight-lipped about his approach, but he made it clear that the time has come for the interest rate cycle to reverse its direction, which excited gold and stock traders, as I mentioned in this MSN article.

This is a new week, which means a fresh set of opportunities. Many traders will now debate how long this US dollar massacre can go on, as most avenues point to an oversold dollar, yet it continues to trade lower.

Core PCE Report In Focus

Undoubtedly, this is a more muted week from an economic perspective than the previous couple. However, there is a high-impact release on Friday that all traders should pay attention to: core PCE. This is the Federal Reserve’s primary inflation gauge, and the annual core PCE inflation forecast is a rise of 0.1% to 2.7%.

Although this is unlikely to stop the Fed cutting in September, the CME Fed Watch Tool still believes there is a 28.5% chance of a 50bps cut at the next meeting. A higher core PCE report would lower these chances and cause a dollar bounce, and vice versa for a weaker report.

Keir Starmer’s “Painful” Announcement

In this morning’s Downing Street speech, UK Prime Minister Keir Starmer revealed that the upcoming autumn budget on October 30th would be a painful one. This is a strong hint that tax hikes are on the horizon. In fact, he claims “things are worse than we could have ever imagined,” but he vowed this would achieve long-term gain. The prospects for the UK have seemed bright, helping a pound rally. The Bank of England is concerned about inflation creeping higher, and that is why traders are betting that it may not cut rates at the next meeting.

GBP/USD Due A Shallow Correction?

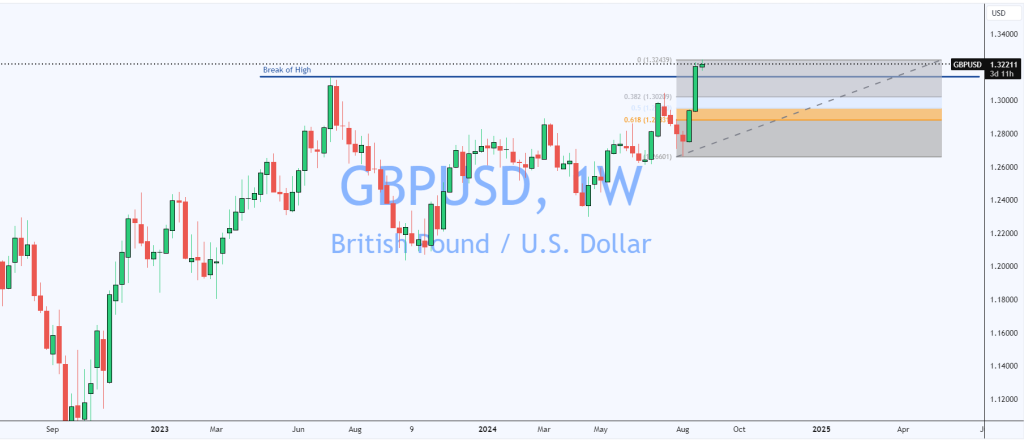

GBP/USD’s bullish structure has been confirmed by convincingly breaking above the recent swing high at 1.31400. In fact, the weekly time frame shows a series of higher highs and higher lows.

Now that a new high has been printed, it could be time for a correction within the bullish structure. Traders may want to utilize the golden area of the Fibonacci retracement, which sits at 1.30000, a key psychological level and whole number. Once the price trades into this area, traders could use a lower time frame order block to access a high-risk vs.-reward buying opportunity.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.