Key Points

- Silver is down big this week, diverging from gold.

- Fed interest rate expectations and Trump’s speech at the RNC are key market drivers.

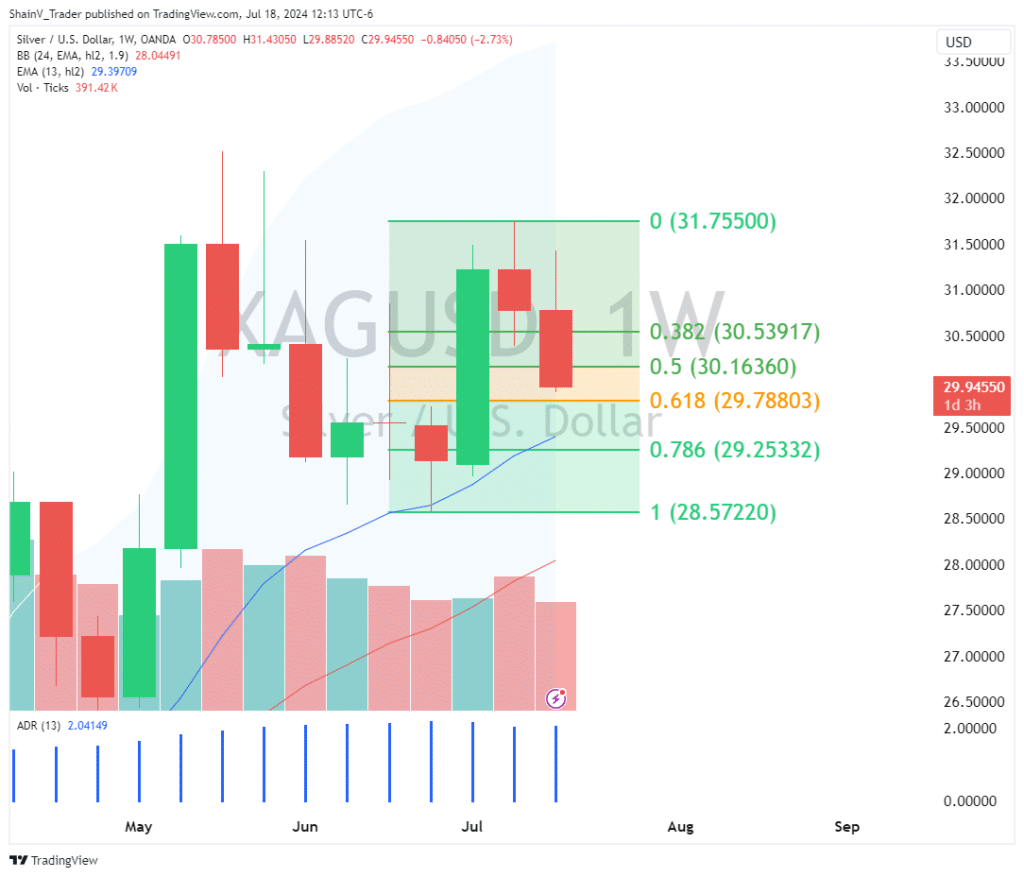

- Weekly downside support in the XAG/USD is present at 29.7880.

Market Overview

In some cases, safe havens don’t run together. This week, we have seen this in gold and silver (XAG/USD). Gold has made all-time highs, while silver is stuck in the mud. However, this dynamic may produce a great opportunity to bid silver.

USD Expectations

The USD is a vital market driver for commodities. Silver, gold, crude oil, corn—you name it—are all priced in dollars. When the USD goes up, commodities typically go down; when the USD falls, commodities often rally. So, if you’re a commodity trader, it pays to keep a close eye on the Greenback.

On Monday, Jerome Powell told the Economic Club of Washington D.C. that the Fed would not wait for inflation to hit the 2% target to cut rates. Further, Powell suggested that if the Fed doesn’t cut until inflation officially hits 2%, it may be too late.

These comments reverberated throughout the markets, prompting the CME FedWatch Index to assign a 100% chance of a Fed rate cut in September. The promise of rate cuts should have sent silver higher; they didn’t. Now, traders are looking to bid pullbacks as the metals markets digest an intense week of rate-cut mania and political news.

XAG/USD: Technical Outlook

At press time, the XAG/USD is trading just above 30.0000. Prices are holding firm, being down just under 1% on the session.

Nearly two weeks ago, silver was the darling of the markets, jumping more than 7%. These gains have been pared in the past nine trading days, with the market taking back more than 60% of the rally.

It’s always tough to catch a falling knife. But, bids from the Weekly 62% Fibonacci Retracement (29.7880) area aren’t bad market entry to the long.

Election 2024 Update

The US Presidential Election of 2024 took a shocking twist last Saturday with the attempted assassination of former POTUS Donald Trump. Since that point, the markets have been relatively chaotic. The CBOE Volatility Index (VIX) has jumped 25.52% on the week, a sign that traders are becoming hesitant to assume more risk. The VIX, also known as Wall Street’s “Fear Index,” will be an important indicator for traders of all asset classes to watch from now until Election Day.

During the upcoming US overnight session, former President Trump will formally accept the Republican nomination for the Presidency. This primary political event is likely to shake the markets. If you’re holding open positions during this time, be sure to manage risk aggressively, as anything can happen in the current political environment.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.