Key Points

- US GDP came in hot at 2.8% for Q2. This is a bearish market driver for silver (XAG/USD).

- Friday’s PCE Price Index is sure to bring heavy volatility to precious metals.

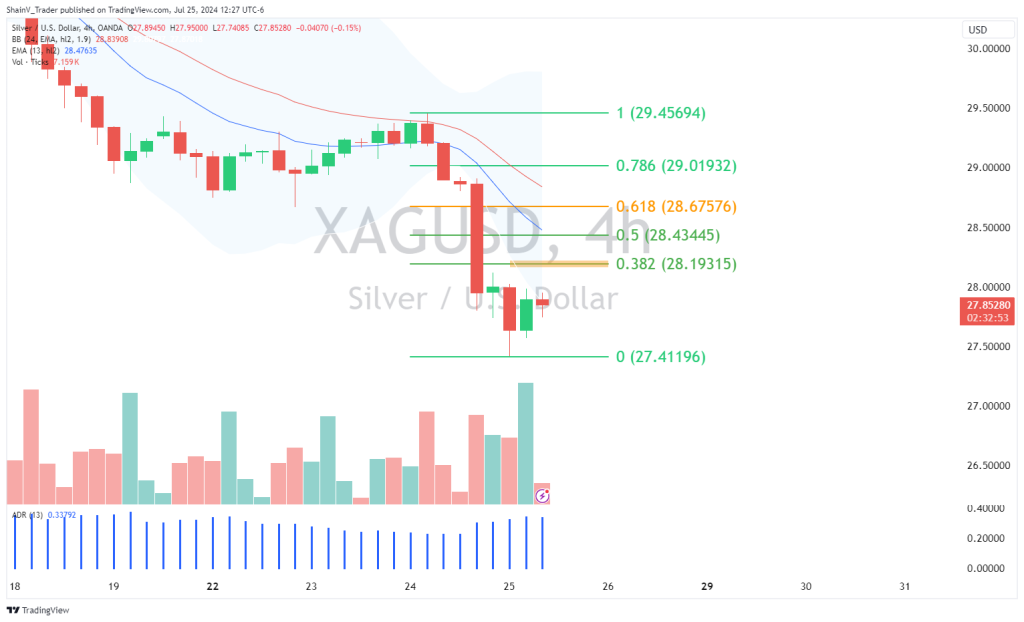

- 4-hour short scalps from 28.19 aren’t bad ways to trade the XAG/USD ahead of PCE.

Market Overview

It’s been a rough month for Silver (XAG/USD). Sellers have dominated the action, prompting a significant pullback in pricing. Today’s US GDP numbers haven’t helped silver bugs, as Q2 economic expansion has become the day’s theme.

US GDP (Q2) Comes In Hot

During the US pre-market hours, the preliminary report for Q2 US GDP hit newswires. The figures came in better than expected, posting 2.8% quarterly growth. The market consensus projected 2.0% GDP growth, up from Q1’s 1.4%.

Created and disseminated by the US Bureau of Economic Analysis, GDP is the primary indicator of a country’s economic performance. High growth numbers are viewed as being bullish for US stocks and USD and bearish for commodities. It’s as much a political football as an economic one. Today’s statement from POTUS Biden is a prime illustration:

“Today’s GDP report makes clear we now have the strongest economy in the world. Thanks to my and Vice President Harris’s economic agenda, our economy grew a robust 2.8% over the last quarter, based on strong American consumers and business investment.”

There’s no question that this morning’s US GDP report is a positive one. Of course, it’s a preliminary number; there are two revisions coming. Will the revisions be up, down, or negligible? The markets will find out in the coming months.

XAG/USD: Technical Outlook

Silver remains in a macro uptrend. However, the bullish trend of 2024 is currently under fire. Q2 GDP provided the backdrop for the economic growth narrative — a bearish market driver for the XAG/USD.

The XAG/USD four-hour chart provides a good look at current price action. The trend is down, and the market is consolidating in a bearish way. Sells from the 28.19 area aren’t a bad way to scalp the action.

Friday features release of the PCE Price Index. The PCE Price Index is the Fed’s number one inflationary metric. Analysts expect PCE and Core PCE to rise slightly month-over-month but fall year-over-year. If you’re trading silver, be sure to keep a close eye on PCE. It’s sure to bring volatility to all markets, especially precious metals.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.