Key Points

- This week features a huge news cycle, headlined by the Fed Announcements (Wednesday) and US NFP (Friday).

- The first Fed rate cut in several years isn’t expected until September.

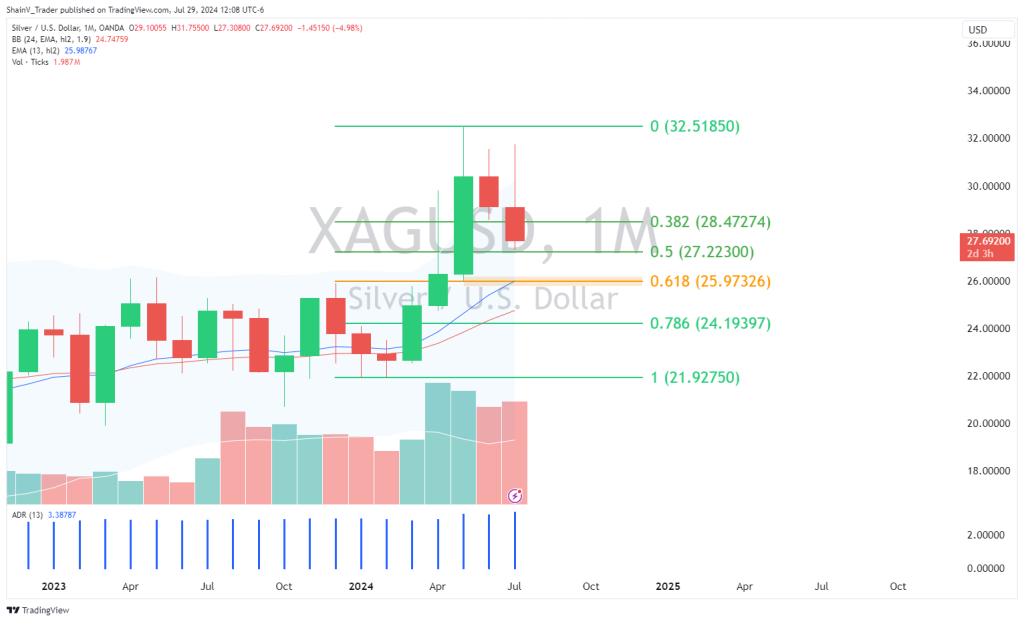

- A key macro support level is present in the XAG/USD just beneath 26.0000.

Market Overview

It’s been a bearish open to the week on the commodities markets. For silver (XAG/USD), prices are off by more than 0.50% as traders limit exposure ahead of a super-charged news week. With the Fed, BoJ, BoE, and NFP scheduled for the coming five days, it’s anyone’s guess where precious metals will be trading next Monday.

US Fed To Cut Rates?

Rate-cut mania is sweeping the markets as traders eagerly anticipate the first Fed rate cut in several years. At press time, the CME FedWatch Index assigns a 95% chance of rates being held firm at Wednesday’s Fed Interest Rate Announcement.

However, September is a much different story. The FedWatch Index currently estimates a 100% chance of at least a ¼ point rate cut at the September meeting. This is a major shift from earlier this year but represents a hard consensus regarding the future of Fed monetary policy.

The bottom line is this: Jerome Powell and the US Fed are preparing to enter an extended rate-cut cycle. This will likely send the USD lower and commodities like silver higher over the intermediate term. It will be fascinating to see how this shift in policy will impact the markets over the next 60 days.

XAG/USD: Technical Outlook

Last week, we broke down a key 4-hour resistance level in the XAG/USD at 28.1931. This area has held firm, effectively capping the market. Now, the question remains — is silver headed lower or poised for a rebound?

August’s trade will be upon us in the coming days, so it’s a good time to look at the monthly charts! For the XAG/USD, there is a macro support zone at the 62% Monthly Retracement (25.9732). Accordingly, the 26.0000 area is a premium bidding zone for silver. If the current correction spills into August, 26.0000 may be a fantastic place to “buy the dip.”

US Non-Farm Payrolls

Friday marks the release of US Non-Farm Payrolls (NFP) for July. Analysts project NFP to come in at 177,000, down from the previous release of 206,000. Friday’s report has two keys: revisions and the Unemployment Rate.

2024 has been the year for downward revisions to NFP numbers. This is likely to be the case again for July. Also, the US Unemployment Rate now sits at 4.1%, above the Fed’s benchmark of 4%. If Unemployment spikes again, prepare for a fresh deluge of rate cut talk.

It will pay to be aware of the news in the coming five days. Be ready for anything surrounding Wednesday’s Fed meeting and Friday’s US NFP report. Silver is certain to be impacted, as will most other asset classes.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.