Key Points

- XAG/USD prices are down more than 6.5% for November.

- The long-term trend for silver remains bullish.

- Subsiding uncertainty, the AI boom, and Fed policy are the key market drivers in play for the XAG/USD.

Market Overview

Since Election Day, silver (XAG/USD) has been on the ropes. Prices are down more than 6.5% for November on heavy selling. Although silver is still up big on the year, traders are beginning to question whether an inflection point for precious metals is now upon us.

Market Drivers

Political and geopolitical uncertainties have driven silver north throughout 2024. Factor in a pending AI boom, and silver demand has grown significantly since last January.

However, this dynamic is beginning to change. Trump’s landslide 2024 victory brings an entirely new outlook to precious metals, particularly silver. Campaign promises regarding swift ends to Russia/Ukraine and Israel/Hamas bring potential conclusions to these wars into view. If negotiations are successful, then both situations may be rectified sooner rather than later.

On the other hand, new moves from Google, Amazon, and Microsoft bring the viability of nuclear power into play. There’s no question that the AI boom has an unprecedented upside; the only problem is securing the energy and conductors needed for the job. If nuclear energy resources become the backbone of AI, then the demand for conductors, especially silver, will spike.

The fundamental outlook for silver is as follows. On the bearish side, the recessions of uncertainties stemming from the US election and ongoing wars are driving sentiment. Conversely, solving the energy variable facing the AI boom is a tremendous bullish driver of silver demand.

Add it all up: silver is in a transitional period.

Fed Expectations

From a financial perspective, silver prices are greatly impacted by Fed policy. The relationship isn’t a complex one: when interest rates go up, silver prices go down; when interest rates go down, silver prices go up. It’s the fundamental inverse relationship between interest rates and commodity prices.

With Election 2024 complete, traders are pondering the future of US Fed monetary policy. At last September’s FOMC Announcements, the Fed’s forward guidance suggested a collection of rate cuts through the end of 2025 was the likely way forward. Now, in mid-November, things have changed.

Recently, several FOMC members have reinforced the Fed’s “data dependent” theme established by Jerome Powell at the November meeting:

- Alberto Musalem, St. Louis Fed President: “I expect inflation to converge toward 2% over the medium term. [But] the risk of inflation ceasing to converge toward 2%, or moving higher, has risen.”

- Lorie Logan, Dallas Fed President: “I anticipate the FOMC will most likely need more rate cuts to finish the journey. [But] it’s best to proceed with caution; if we cut too far, past neutral, inflation could reaccelerate, and the FOMC could need to reverse direction.”

- Neel Kashkari, Minneapolis Fed President: “We’ve got another month or six weeks of data to analyze before we make any decisions.”

Policy uncertainty is negatively impacting silver prices. Nonetheless, silver will be poised for a dovish-policy bounce if rate cuts come back into vogue. If not, early November’s bearish correction will continue.

XAG/USD: Technical Outlook

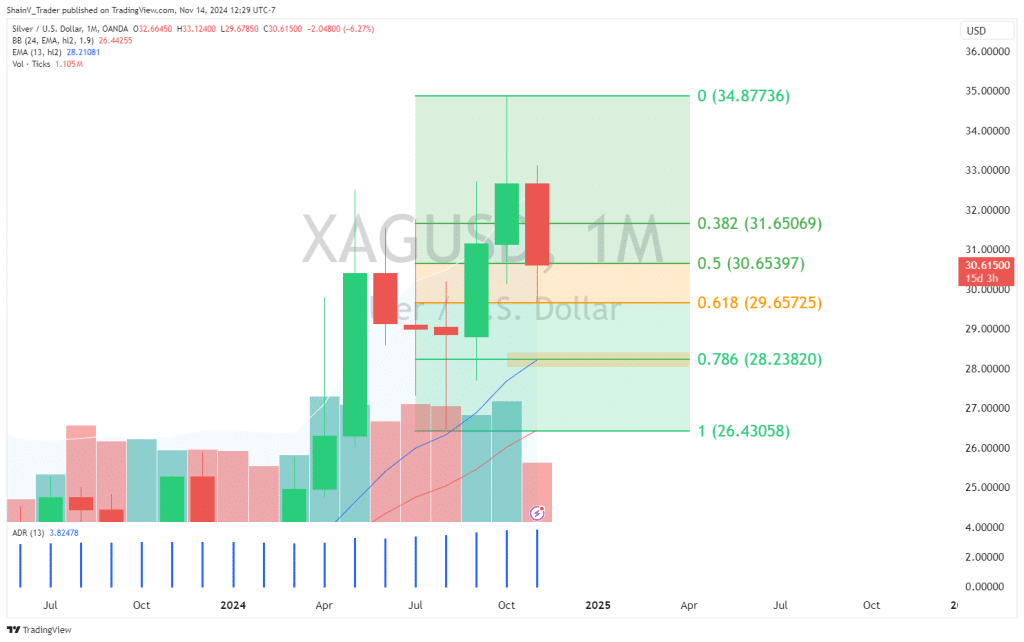

The monthly chart gives us a great look at the XAG/USD. A short-term bottom has been established at the Monthly 62% Fibonacci Retracement (29.65). If this level is taken out, the next port of call is the 78% Fibonacci Retracement (28.23). Both areas offer solid bidding opportunities should they come into play.

When trading macro trends, patience is a virtue. At press time, the XAG/USD long-term trend is bullish. If a deeper pullback develops, then premium buying opportunities will arise. Only time will tell — stay vigilant, manage your risk aggressively, and good things will happen!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.