Key Points

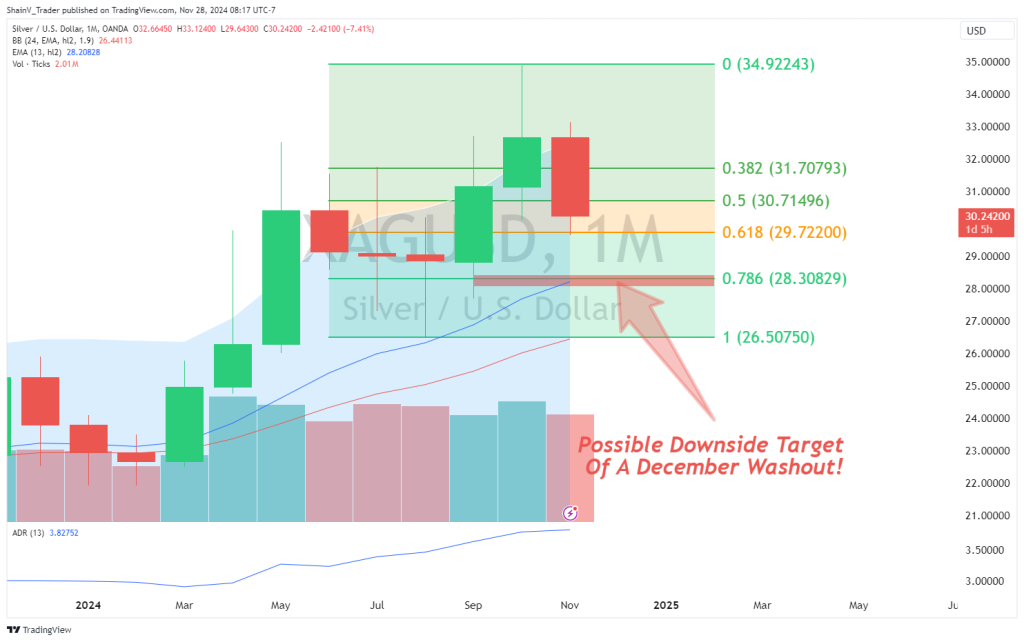

- November has been a corrective month for silver, with prices falling more than 7%.

- Russia has launched a large-scale missile strike against Ukraine, targeting the electrical infrastructure.

- The 29.722 price point continues to be robust support for the XAG/USD.

Market Overview

Election 2024 has become a primary bearish market driver for silver (XAG/USD). Prices are down big for the month, off more than 7.25%. Although the long-term uptrend remains valid, November’s correction is significant.

Can prices rebound in December? The answer depends on two factors: geopolitics and Fed policy.

Evolving Geopolitics: Russia/Ukraine In View

During the US overnight session, Russia launched a fresh round of missile attacks on Ukraine. The strikes are being reported as targeting the Ukrainian power grid. At this hour, Putin has stated Russia “carried out a comprehensive strike.”

Conversely, Zelenskyy accused the attack of being a “despicable escalation,” stating that in multiple locations, “strikes with cluster munitions were recorded, and they targeted civilian infrastructure.”

As a result of the bombing runs, it is being reported that more than 1 million Ukrainians are without electricity. For silver, no reaction has been measured. Prices are up a modest 0.30% as US liquidity providers are out of the office for the Thanksgiving Holiday.

However, such escalations are a bullish market driver for silver. Over the past week, there have been long-range missile strikes by Ukraine into Russia. The missiles were supplied by US and UK alliances, drawing harsh condemnation from Russia. Escalation is the new theme in the Russia/Ukraine War, potentially sending bids to precious metals.

XAG/USD: Technical Outlook

Over the past several weeks, we have issued multiple silver trade ideas and market reads. During this time, not much has changed. The long-term trend is up, November is in corrective territory, and our Monthly 62% Fibonacci Retracement (29.722) has held up beautifully as downside support.

Unfortunately, all good things must come to an end. Our Key Level at 29.722 has been repeatedly challenged over the past ten days. Eventually, all support and resistance levels lose their efficacy. If price breaks beneath this critical zone, be ready for a swift drop and further correction in the silver market. This move will likely come in early December as institutional traders test the strength of this market beneath November’s low.

Fed Policy

Much has been written about the shifting interest rate expectations from the United States Federal Reserve (Fed). Last September, the FOMC’s forward guidance suggested that rates would likely fall by at least 1.25% by the end of 2025. These were extremely dovish projections that now look to be off the table.

At press time, the CME FedWatch Index assigns a 70% chance of a ¼ point rate cut for the December 2024 meeting. After that, the picture becomes opaque. As it stands, expectations point toward holding rates firm through the March 2025 Fed Meeting.

The future of Fed policy is wildly uncertain. Since the COVID-19 pandemic, monetary policy has been relatively clear. The markets anticipated interest rates to go to 0% and then be raised consistently once the pandemic concluded. Now, the markets aren’t sure how persistent inflation and a weaker jobs market will impact policy.

A dovish Fed is bullish for silver. Only time will tell if rate cuts are delivered and how these policy choices impact the precious metals markets. Stay tuned — we should know much more ahead of the new year.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.