Key Points

- Monday’s market plunge was the worst since the early COVID era.

- A possible emergency Fed meeting and geopolitical tensions are being dubbed the drivers of the crash.

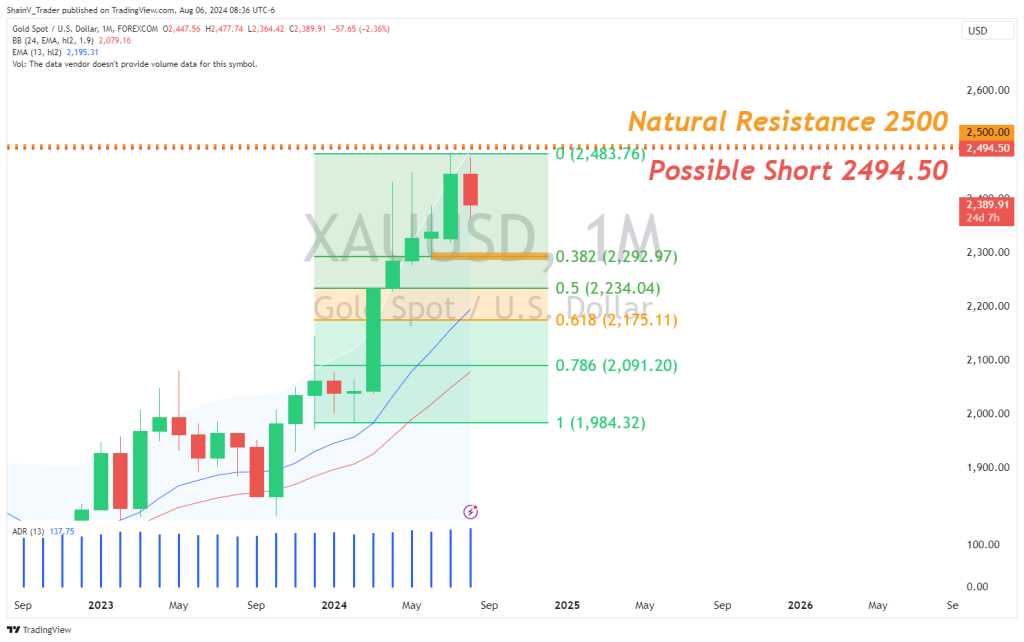

- 2,300 is a key macro-support area for gold (XAU/USD).

Market Overview

The past 36 hours have been epic on the financial markets. A global equities meltdown has led to the most fear since March 2020. In situations like this, gold usually prospers. That hasn’t been the case this week, with sellers hitting bullion hard. Is gold (XAU/USD) up for a rebound? We’ll soon find out.

Market Crash!

Monday’s session was a bloodbath on Wall Street, headlined by major plunges in the DOW, S&P 500 and NASDAQ. At one point, the NASDAQ was down more than 1,000 points. This was the first time in history that the NASDAQ fell more than 1,000 points in a single trading day.

Wall Street’s “fear gauge,” the CBOE’s volatility index or VIX, spiked to levels not witnessed since the COVID craziness of March 2020. The VIX rose north of 65 as fears of a global economic collapse permeated market sentiment. The huge rally in the VIX represented a near three-fold intraday increase.

Gold typically performs well during times of uncertainty. Monday was the exception to this rule, with bullion falling more than 1.25%. Tuesday has been a bit better; prices are down just under ½ percent, indicating relative calm in today’s trade.

Drivers Of The Crash

At press time, the reasons behind Monday’s crash remain obscure. However, converging factors likely contributed to the strife.

Escalations in the Russia/Ukraine and Israel/Hamas wars didn’t help market sentiment. Reports of a hot war breaking out between Israel and Iran dominated the media cycle, culminating with statements from the White House that conflict was imminent. At this hour, the US has deployed multiple battle groups to the Middle East region.

In addition to the Israel/Iran situation, news of Ukraine deploying US F-16s against Russia hit newswires over the weekend. These stories marked a significant escalation in the Ukraine/Russia War.

Perhaps the largest market driver of Monday’s collapse were fears of a broad-based economic collapse. Huge selloffs in Japanese and European equities set the stage for US stock market weakness. Speculation began circulating that the Fed was considering an “emergency rate cut” to stabilize the plunge. Recession concerns spread like wildfire, prompting a “risk off” attitude toward asset classes across the board.

Here’s the bottom line: the current geopolitical and economic environment points to a bull market in gold. Rate cuts and war are likely to send bullion much higher; the only question is when.

XAU/USD: Technical Outlook

In last week’s gold update, we outlined the importance of the 2,500 psychological barrier. Unfortunately, price didn’t reach our short entry of 2494.50 before reversing. While this area is still in play for a sell sometime in the future, our attention has turned to bidding pullbacks.

Huge macro-support is present in the vicinity of 2,300. In fact, 2,292.97 is the Monthly 38% Fibonacci Retracement. If price tests this area, it’s a premium bidding opportunity as the markets roll into the fall months.

A word of warning to active traders: be aware of breaking news! Wars, emergency Fed meetings, and global market crashes can happen at any time. It will pay to stay aware of these key market drivers. Manage risk exposure and look for anything that may shock the markets. Do those two things, and you will come out on top of the chaos.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.