Key Points

- Israel/Iran escalations are now the primary market driver of gold.

- US Non-Farm Payrolls (Friday, 8:30 AM EST) will bring heavy volatility to the market.

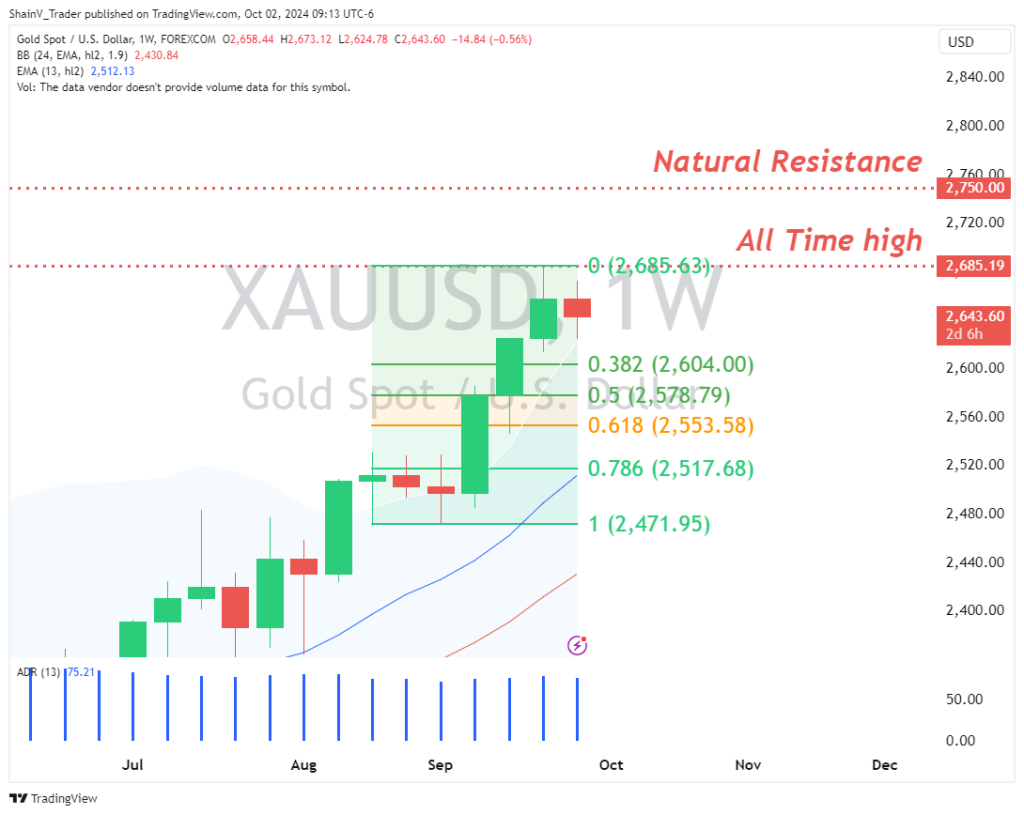

- Key XAU/USD levels to watch are the current all-time high (2685.63) and natural resistance (2750)

Market Overview

It’s a critical news week for the markets, headlined by Friday’s US Non-Farm Payrolls (NFP) report. However, Tuesday’s Iranian missile strike against Israel has trumped previously scheduled economic events. Spot gold (XAU/USD) has been surprisingly flat — is there a move on the way for bullion? More than likely, yes.

Middle East Escalations

The Israel/Hamas War took a new path Tuesday when Iran launched hundreds of ballistic missiles at locations within Israel. Upon the news going global, WTI crude oil posted a near 5% rally, with most commodities trading to the bull; US stocks felt pressure as uncertainty dominated global sentiment. Gold was quiet as traders priced war escalation.

Geopolitical uncertainty typically produces a bullish gold market. In this instance, the Iranian strike did not. Why? Any guess is purely speculative. But, there are a few reasons that suggest a sluggish gold market was probable.

First, rumors of the attack began to surface over the weekend. So, it was not a complete surprise to metals traders. Second, Iran launched missiles at Israel last spring. From this point of view, the attack was not unprecedented. Lastly, the XAU/USD was already trading near all-time highs (2685.63); thus, an argument can be made that the tensions were already “priced in” to the market.

Escalation?

The question that the markets are asking is this: Is the situation in the Middle East going to escalate? There is a case to be made for either “yes” or “no.” It may be best to focus on what makes this Iran/Israel exchange different.

In the wake of the attack, open declarations of war have come from both Israel and Iran. This was new. Statements from Israeli PM Benjamin Netanyahu suggest that military action is imminent:

“The regime of Iran does not understand our determination to defend ourselves. They will understand. We will stand by the rule we established: Whoever attacks, we will attack them.”

At press time, the world awaits Israel’s response. A large scale retaliation within Iran is without question a bullish market driver for gold. Given this scenario, new all-time highs in the XAU/USD are all but assured.

XAU/USD: Technical Outlook

The technical outlook for gold is fairly simple. A bullish bias is warranted, and the market is currently in rotation amid the super-charged news cycle.

Since Sunday’s open, XAU/USD price action has produced a doji on the weekly chart. Price remains above the current wave 38% Fibonacci retracement (2604), confirming the bullish trend’s validity. A few key levels to watch are the all-time high (2685.63) and the big-round number of 2750.

If price breaks above the all-time highs, a test of 2750 in the short term is highly likely. Upon price reaching 2750, expect some heavy-two way action. The area just beneath this zone (2745-47) is a solid short scalping opportunity.

With such an active news cycle, traders will have many chances to engage the gold market. If your one of them, be ready for Friday’s US employment report. This will be a big market mover and drive volatility to the market. Have your stops down and leverage in check ahead of US NFP, Friday at 8:30 AM EST!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.