Key Points

- Compared to last week, this week features a quiet news cycle.

- The key events for gold are the SNB Interest Rate Decision (Thursday), Jerome Powell’s statements (Thursday), and the PCE Price Index (Friday).

- Pullback buys from downside support are a solid trend-following approach for the coming five days on the gold market.

Market Overview

It’s been a quiet beginning to the trading week. Stocks are flat and precious metals are moving sideways. Is there a move in store for gold (XAU/USD)? Perhaps. However, the news cycle is modest early this week, with no key market movers scheduled until Thursday. This may be good for retail traders, especially those looking to engage rotational markets.

Key Events

Compared to last week, the coming five days on the markets are expected to be slow. Nonetheless, there are several events that may influence gold. Wednesday features US New Home Sales and Building Permits. If real estate shows signs of contraction, the “recession” grumblings will become louder and louder.

The Swiss National Bank is due with their interest rate statement during the Thursday London session. This will be a key event fo the Swissy, but may also influence gold. Analysts believe that the SNB will slash rates by 25 basis points, from 1.25% to 1.0%. If history has taught us anything, the SNB has a mind of its own; it will pay to be ready for anything ahead of the SNB announcements.

Lastly, inflation will be considered beginning on Thursday with Fed Chair Jerome Powell’s statements. Also, the PCE Price Index will be released on Friday, which is a sure market mover. So, if you’re trading gold, keep a close eye on the news cycle beginning with the Thursday session.

XAU/USD: Technical Outlook

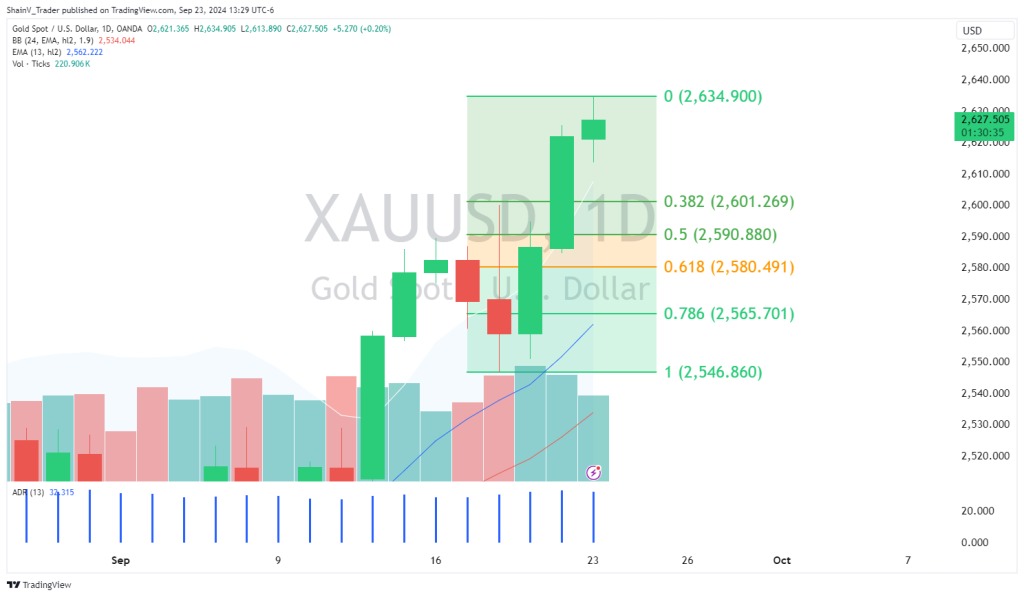

At press time, the XAU/USD is trading near all-time highs. The trend is up, and a bullish bias remains warranted. Until this market shows signs of exhaustion, buying pullbacks isn’t a bad way to engage.

The high watermark for spot gold is just above 2,635. If this market pulls back from the current top, buys from just above $2,600 are ideal. With a stop loss slightly beneath $2,575, this swing trade has a solid shot at producing a crisp $25 with the prevailing trend.

Once again, the key events for this week’s gold market are Jerome Powell’s statements, the SNB Interest Rate Decision, and the PCE Price Index. Business is due to pick up Thursday; until then, gold pullback buys offer the best shot at making money ahead of the weekend.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.