Key Points

- Tuesday, Jerome Powell stated that inflation isn’t the only risk to the US economy.

- This week’s US CPI report is sure to spike volatility in the gold market. CPI will be released on Thursday at 8:30 AM EST.

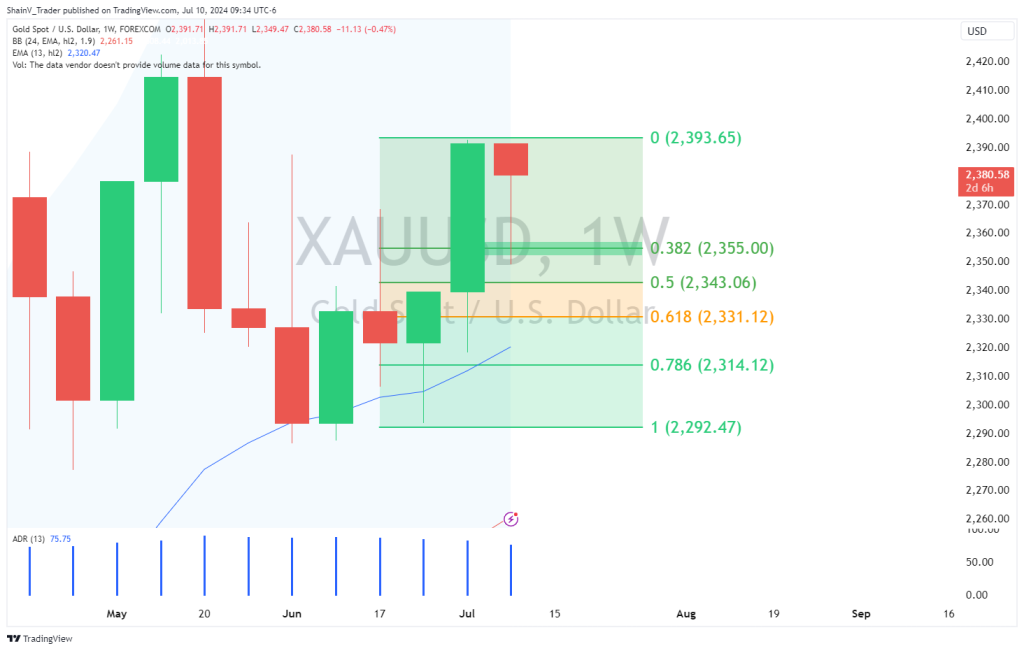

- The 2355.00 area is a key support zone for spot gold (XAU/USD).

Market Overview

Following Monday’s 1.35% plunge, many analysts were calling for a broad correction in gold (XAU/USD). Despite these grumblings, the yellow metal bounced back in a big way. Over the past 48 hours, traders have bought the dip, and gold has pared the early-week losses.

Powell Testifies

The biggest market mover this week has been the Congressional testimony of Jerome Powell. In fact, Monday’s bullion sell-off came in anticipation of an unapologetically hawkish Powell. This has not been the case. Powell gone dovish, stressing the importance of preserving the labor market and avoiding an economic slowdown:

“In light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation isn’t the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

The Federal Reserve has two jobs: ensuring pricing stability and promoting maximum employment. Until now, the Fed’s primary focus has been restoring pricing stability. It appears that a greater emphasis will be placed on supporting the jobs market moving forward.

The end result? Growing expectations of a September rate cut, which now stand at 74% according to the CME FedWatch Index. Gold has responded, rallying in anticipation of a soon-to-be weaker USD.

XAU/USD: Technical Outlook

On the weekly chart, robust downside support is located at the 2355.00 area. 2355.00 represents the Weekly 38% Fibonacci Retracement. It has withstood several tests and has been a solid bullish entry all week long.

If it isn’t broke, don’t fix it. Bids from the 2355.00 zone will remain valid until this important Fibonacci retracement level fails.

Gold traders will be on their toes at Thursday’s US CPI release. CPI is a top-tier economic event, and volatility will spike as it hits newswires at 8:30 AM EST. Active market participants are well-advised to limit risk exposure just before, during, and after the report’s dissemination.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.