Key Points

- CPI came in above expectations, sending bids to the USD.

- The CME Fedwatch Index is now pricing in a ¼ point rate cut in November, not a ½ point.

- 2600 is the critical technical level in gold. If it fails as downside support, a significant correction may quickly develop.

Market Overview

It’s been a big week for gold (XAU/USD). Traders have driven prices all over the board in an attempt to price last Friday’s hot US NFP report, Wednesday’s FOMC Minutes, and today’s CPI data. What’s next for gold? Currently, there are more questions than answers.

Another Hot CPI Report?

During the Thursday pre-Wall Street Open, the US Consumer Price Index (CPI) report for September hit newswires. CPI came in at 0.2% for the month, above expectations (0.1%) and on par with the previous release (0.2%). The raw CPI Index remains at all-time highs (315.30), failing yet again to post any pullback.

The story was the same for Core CPI. Core CPI is CPI without the volatile food and energy categories included. For September, Core CPI came in at 0.3%, above expectations (0.2%) and unchanged from August’s figure (0.3%).

Following the CPI release, uncertainty once again permeated market sentiment. The number one question is now this: Did the US Fed declare victory over inflation too soon? Considering today’s hot CPI numbers, one has to admit that the Fed’s September ½ point rate cut was premature.

Interest Rate Expectations

CPI is always a key driver of interest rate expectations. And, the primary tool that the markets use to evaluate current rate expectations is the CME FedWatch Index. Immediately after the CPI release, the CME FedWatch assigned a 20% chance of no rate cut in November. At press time, that probability had fallen to approximately 11%.

Going into last Friday’s NFP report, the markets were aggressively pricing another ½ point rate cut at the Fed’s November meeting. Upon NFP shattering expectations to the topside, this changed dramatically. Now, following a hot CPI number, it appears that a ¼ point rate cut may be the ticket in November. Without question, November’s NFP and CPI releases will be the key to the future of Fed policy.

For gold, a hawkish pivot in the market’s USD pricing is a bearish market driver. In the event that the USD continues to strengthen in October, a significant pullback in the XAU/USD is possible.

XAU/USD: Technical Outlook

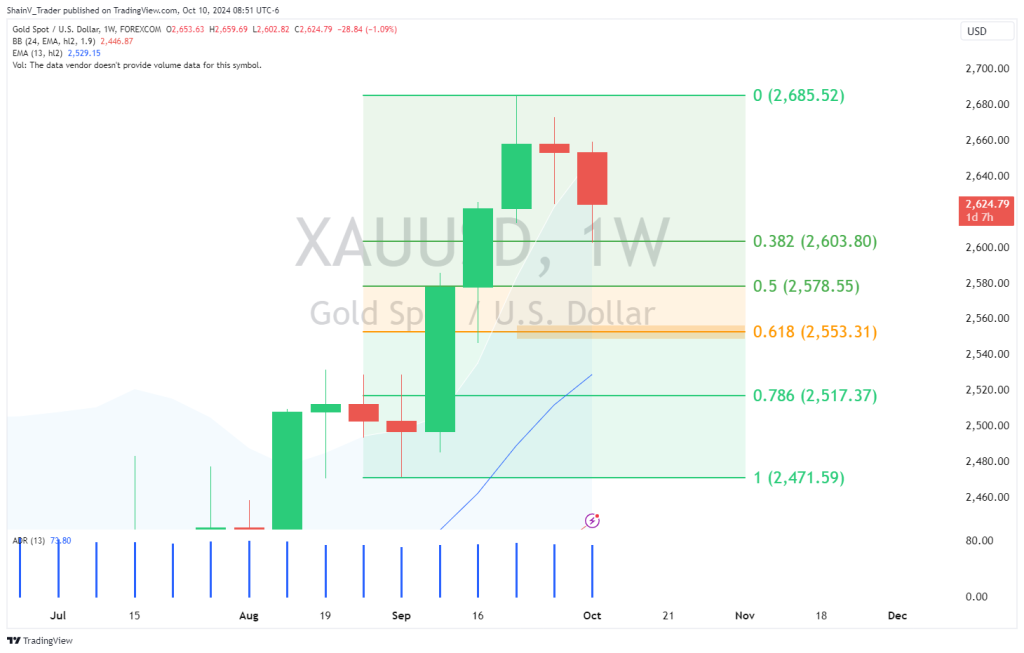

2024 has been a bullish year for gold. Despite the October shift in interest rate projections, the uptrend remains valid, with gold trading near all-time highs (2685.52).

The key number in the XAU/USD market is the Weekly 38% Fibonacci Retracement (2603.80). This area has been tested repeatedly and held up beautifully as downside support. You did very well if you bid the 2605 to 2603 area this week.

Of course, nothing lasts forever. If the 2600 area finally fails as downside support, be ready for a deep weekly correction in gold. Should this scenario unfold, buying in from the zone just north of the Weekly 62% Fibonacci Retracement (2553-2557.50) is a rock-solid bullish entry.

The Fed’s Dual Mandate

The most important thing to remember about the Fed is its dual mandate: promote maximum employment and ensure pricing stability. As we roll into Q4, the employment side of the equation is positive, while pricing stability is questionable.

In Wednesday’s FOMC Minutes, the FOMC Committee stressed that the reason for cutting interest rates by 50 basis points in September was twofold. First, the jobs market had softened consistently throughout 2024. Second, inflation appeared to be headed toward the Fed’s 2% objective.

Unfortunately for the FOMC, both of these reasons to cut are now in question. Uncertainty toward the USD is back, as the future of Fed policy has shifted dramatically since last Thursday. In truth, no one knows how the rest of this year will play out. If you’re an active trader, it will pay to be ready for anything in Q4.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.