Key Points

- Gold has established fresh all-time highs.

- US election uncertainty and ECB rate cuts are the day’s key market drivers.

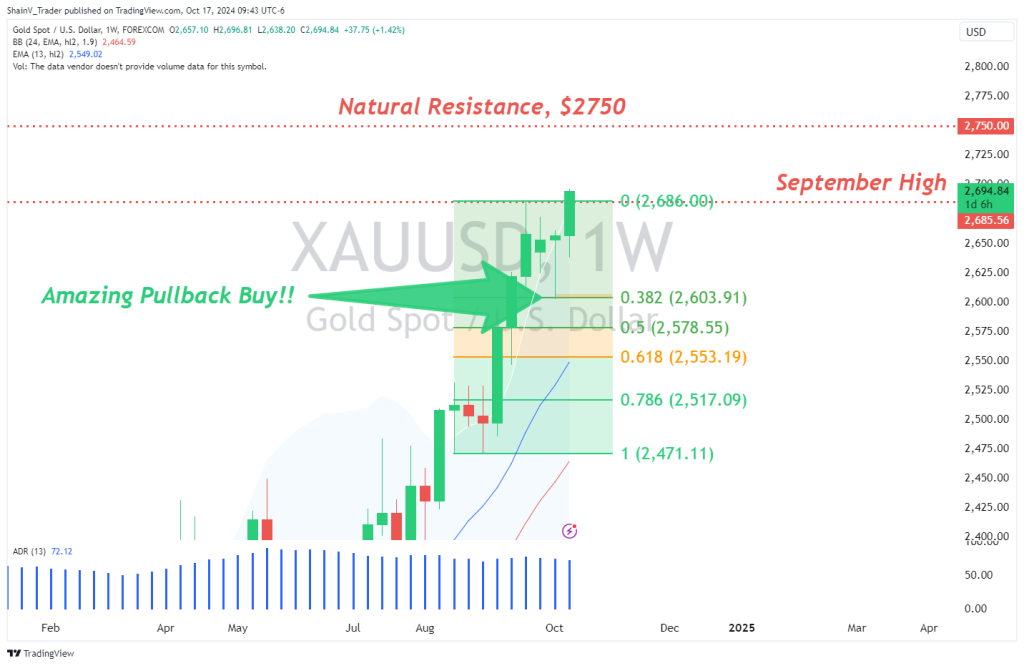

- Natural resistance is present at $2,750.

Market Overview

Another day, another new all-time high for gold (XAU/USD). Bullion prices are closing in on $2,700 per ounce as the world’s central bankers slash rates to promote economic growth.

So, what’s next for the yellow metal? Is there a top in sight? Only time will tell. Politics, geopolitical pressures, and monetary policy continue to drive gold north.

US Election Update

With under three weeks until Election Day, the political tone in the US has reached a fever pitch. Both the Trump and Harris campaigns are in attack mode, each holding daily events. At press time, the race appears “too close to call.”

However, the betting markets have swung in favor of Trump. On Polymarket, Trump is trending higher to win the presidency, with odds now at 62/38 over Harris. Over at Predictit.org, Trump holds a narrower 54/48 lead. Most national polls show the Harris/Trump race to be within a 3% margin of error.

What does all this mean? Collectively, these factors suggest that significant political uncertainty remains. And, with 5 November rapidly approaching, many investors are bracing for a multitude of potential outcomes. Civil unrest, electoral challenges, and a delayed final result are all possibilities. If these scenarios play out, market chaos is likely. That’s one reason gold is trending higher — it’s the ultimate safe haven asset.

The ECB Cuts Rates

The ECB brought the latest round of central bank rate cuts during the Thursday EU session. A 25 basis point reduction across the board was the order of the day. In the official ECB statement, Christine Lagarde made a case for the cut:

“The incoming information on inflation shows that the disinflationary process is well on track. The inflation outlook is also affected by recent downside surprises in indicators of economic activity.”

Generally, rate cuts mean bullish gold prices. That’s the story today, as bullion is trending higher, up more than 0.70%.

XAU/USD: Technical Outlook

The technical outlook for gold is simple: the trend is bullish. Bidders are dominating this market and price is on the doorstep of $2,700.

Until proven otherwise, buying pullbacks is the way to approach the gold market. Of course, one is always free to scalp against the trend. For the XAU/USD, scalps in front of $2,750 are likely strong plays. With a tight risk vs reward of 1:1, sells from the 2747.50 area have a great shot at producing $5 to $7.50.

If you’re in the gold market, it will pay to stay abreast of US election developments. Also, escalations between Israel/Hamas and Russia/Ukraine have the potential to drive gold even higher. Without question, opportunity is afoot in the gold market.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.