Key Points

- The XAU/USD remains in bullish territory but is trading flat on Election Day.

- The race for the White House continues to be too close to call; a final decision may take some time to render.

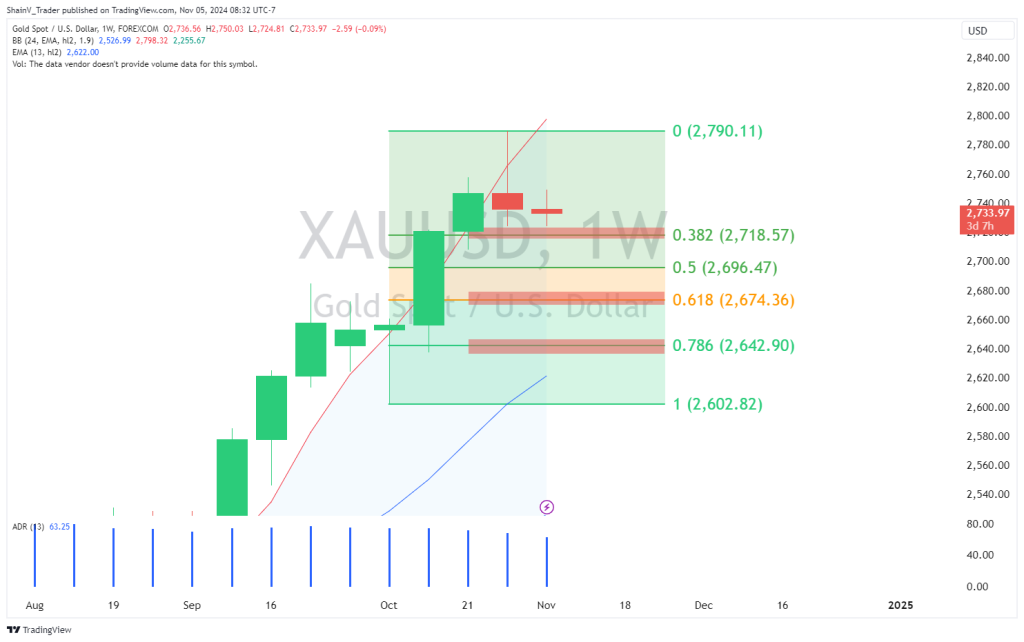

- Retracement buys in XAU/USD from 2719, 2675, and 2643 are solid post-election scalps.

Market Overview

The number one market driver in the world is the US Election. Thus far, gold (XAU/USD) has held firm, but is trading sideways. Despite the slow action, business will soon pick up as Election 2024 continues.

Election Expectations

Predicting election results can be a challenging task. Polling data is historically inaccurate, and final vote tallies often take multiple days to finalize. However, the betting markets offer the public an idea of where the money is being wagered on Election Day.

At press time, the largest political trading website Polymarket has Republican Candidate Donald Trump as an approximate 63/37 favorite over Democrat Kamala Harris. This market has registered over $2 billion in turnover and is one of the largest in the world.

Several other political markets are worthy of note. Predictit.org is now assigning a near 50/50 split between Harris and Trump. Upstart website Kalshi is listing the race as being 60/40 in favor of Trump. As of now, the result of today’s election is very much up in the air.

Generally, anything that drives uncertainty is bullish for gold. That hasn’t been the case today, as traders are happy to let the election returns come in before diving into or out of bullion.

Technical Outlook For XAU/USD

The weekly XAU/USD chart says it all: a bullish bias is warranted. The trend is up, with prices trading well above downside support. As long as bidders defend the 38% Fibonacci Retracement (2718 – 20), then one is well advised to be long rather than short.

Of course, anything can happen to prices after election uncertainty subsides. For gold, a smooth transfer of power is likely to bring about selling pressure. Why? A final answer for US leadership and removal of political uncertainty. If we do see a swift resolution to the election, XAU/USD bids from the 62% Fibonacci Retracement (2674) and 78% Fibonacci Retracement (2642) are solid ways to play the action.

Ultimately, only time will tell if Election 2024 will be a bullish or bearish gold market driver. Stay tuned!

Fed Announcements

With so much happening in US politics, it’s easy to overlook Thursday’s US Fed Announcements. The Fed is expected to cut interest rates by ¼ point on Thursday as the central bankers continue to enact dovish policy.

Perhaps the most important aspect of Thursday’s announcements is the forward guidance. Last Friday’s dreadful NFP number has many in the markets predicting an American recession to develop in the next two quarters. The Fed is fully aware of this and is preparing to accelerate the rate cut cycle to engineer a “soft landing.”

If J. Powell and the FOMC promise deep rate cuts by year’s end, gold could be headed much higher. Rate cuts and a dovish dollar promote higher commodity prices; in the case of gold, a series of ½ point cuts could bring $3,000 into play by New Year’s Eve.

It’s a big week on the markets. Be sure to manage your risk aggressively and be ready for anything as the US Elections and Fed Announcements take center stage.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.