Key Points

- Gold is trading flat near the $2,400 handle.

- Kamala Harris is now the presumptive Democratic nominee for the US Presidency.

- The PCE Price Index (Friday) will be this week’s key economic event for gold.

- XAU/USD faces support at $2,388.75 and resistance at $2,422.09

Market Overview

Gold (XAU/USD) has entered a rotational phase in the vicinity of $2,400. In the markets, “rotation” is a term used to describe flat or sideways price action. Characteristics of a rotational market are reduced daily ranges and modest participation. Trading conditions like these pose many challenges, as the market structure is often choppy and disjointed.

One of the best things about rotational markets is that they are relatively predictable. Without any major market drivers scheduled for the immediate future, playing reversion-to-the-mean strategies may be the best way forward for bullion.

Economic Calendar

Existing Home Sales (June) was released to the public during the Tuesday US Session. Existing Home Sales are viewed as being a leading indicator and a strong consumption metric. The number came in at 3.89 million, just beneath the 3.99 million expected and the 4.11 million previous.

Lagging new home sales suggest a downturn in consumer sentiment, which can contribute to an economic contraction. Today’s Existing Home Sales numbers support this case, and indirectly, Fed interest rate cuts.

The remainder of the week features a few events that can sway gold. Thursday, US Durable Goods and GDP are due out. Friday is the headliner, with release of the PCE Price Index. PCE prices are expected to decline, furthering the case for disinflation. Gold traders will be watching this event closely as it hits newswires Friday (8:30 AM EST).

Technical Outlook: Gold (XAU/USD)

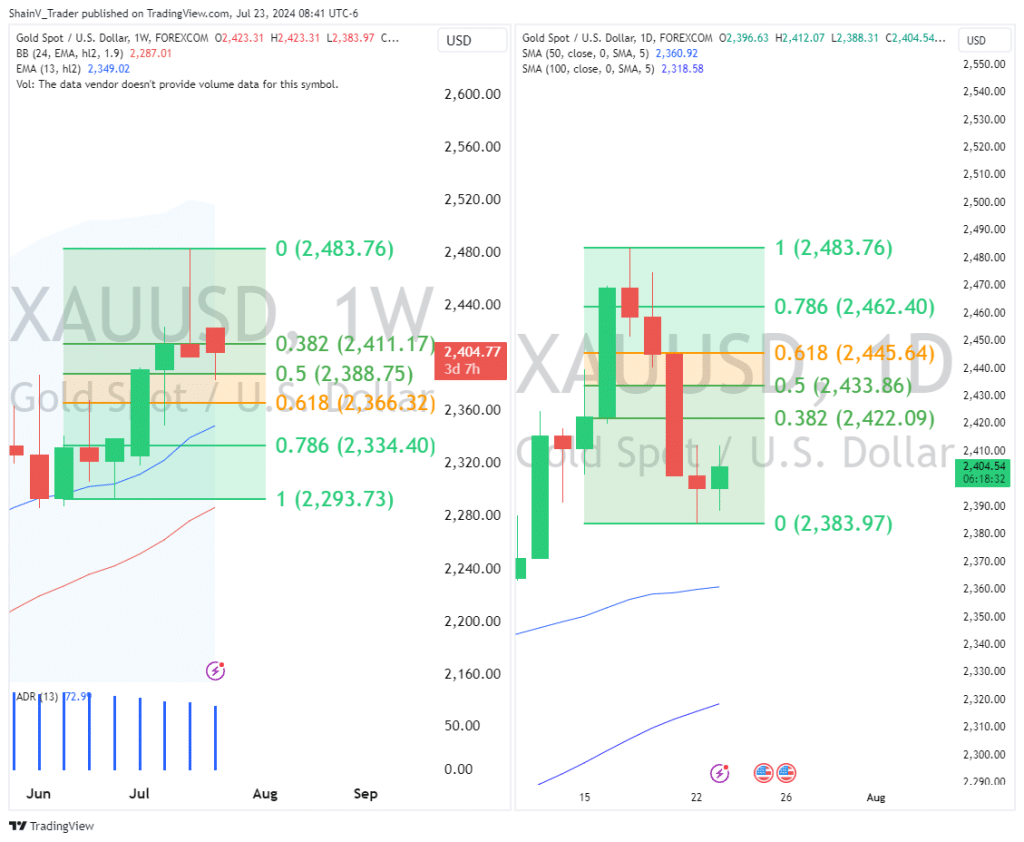

The technical outlook for gold is relatively straightforward. The long-term trend is up, but rotation is present on the daily and weekly timeframes. For the time being, traders are no longer willing to commit to the topside of bullion. Yet, this market refuses to enter corrective territory.

Until Friday’s bell, traders will watch for breakouts in the XAU/USD. On the other hand, there is staunch resistance at the Daily 38% Fibonacci Retracement ($2,422.09) and support at the Weekly 78% Fibonacci Retracement ($2,388.75).

Currently, the point of control is at or near the 2,400 handle. Until the market breaks from this zone, price action is likely to be choppy and erratic.

Election 2024 Update

Political uncertainty has been a huge market driver for the 2024 gold market. The latest developments have the sitting US POTUS Biden stepping down from his re-election campaign.

The presumptive Democratic nominee is Vice President Kamala Harris. Since Biden’s Sunday departure, Harris has reportedly secured enough delegates to win the nomination at next month’s Democratic National Convention. Also, it is being reported that Harris has raised a record $80 million in funds in just over 24 hours.

As of this writing, political markets estimate that the odds of winning the US Presidency stand at 65/35 in favor of Republican candidate Donald Trump. These probabilities are sure to change as the election rolls forward. Upon the odds shifting, fresh political uncertainty will enter the markets. This circumstance will send the gold markets reeling. If you’re trading gold in 2024, it will pay to stay current on US politics!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.