Key Points

- Russia/Ukraine escalations are the number one fundamental market driver across all asset classes.

- Surprisingly, gold is down to open the week.

- Pullback bids from 2500-2475 are solid plays for the remainder of November.

Market Overview

Gold (XAU/USD) is off to a rough start this week, trending south by more than 3%. The price action is a bit baffling; Russia/Ukraine tensions continue to escalate, bringing fresh uncertainty to the markets. Typically, that’s a bullish market driver for bullion. Not this time. Sellers are in complete control to open Thanksgiving Week.

World War 3 Vs. Monetary Policy

Reports are hitting newswires that Ukraine has launched a barrage of ballistic missiles into Russia. This news comes on the heels of a mass drone attack conducted by Russia earlier today. Without question, Russia/Ukraine/NATO tensions are reaching a crescendo.

As traders, our political views don’t matter. What does matter is price action. We are seeing big volatility across all asset classes, and it has to do with escalation—nine times out of ten, gold rallies when geopolitical tensions rise. However, the situation facing gold is unique.

The monetary policy scene in the United States has shifted dramatically over the past month. Since the election of Donald Trump as the new POTUS, the Fed is tempering rate cut expectations. 2025 was to be the year of rate cuts, upwards of 1.25%. Now, FOMC members are hinting that “higher for longer” may be the policy way forward. As a result, the USD is up and commodities are down. Metals have been especially hard-hit, with gold and silver taking it on the chin, posting upwards of 3% losses.

So, which is the critical market driver for gold? WW3 or a hawkish Fed? The answer is WW3! If we see a global escalation in Russia/Ukraine, brace for a dovish Fed and more inflation. This will mark an epic shift in both geopolitics and monetary policy. While many believe this is impossible, be ready for anything in an incredibly fluid situation.

XAU/USD: Technical Outlook

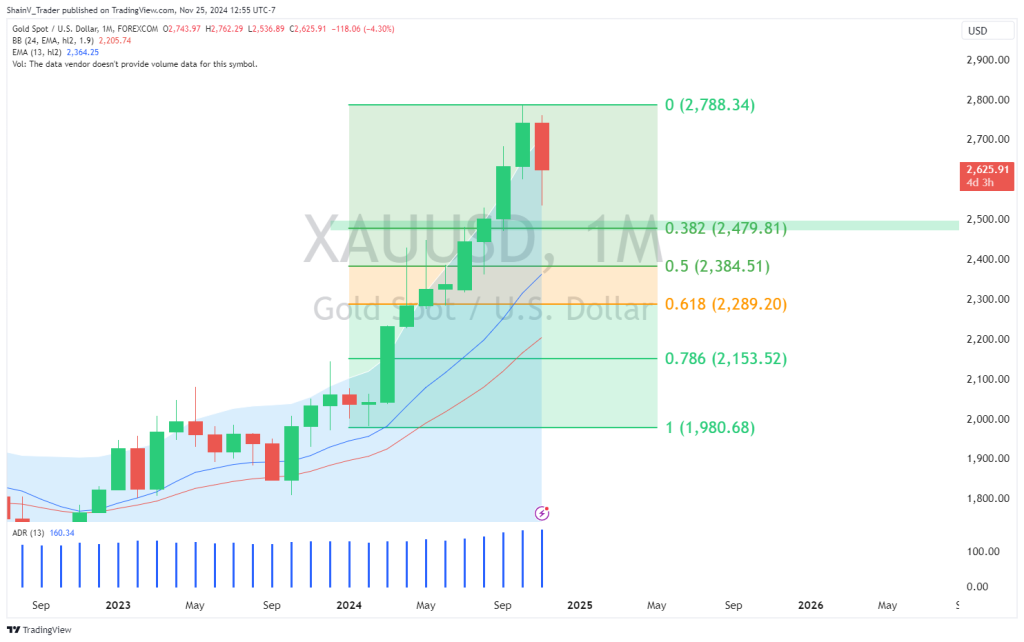

The gold market’s fundamentals are conflicted, but the technicals aren’t! The long-term trend is up; buying dips is how to approach the XAU/USD.

From a macro perspective, the 2475 to 2500 area is vital downside support. At press time, the XAU/USD is trading near 2625. It may seem like a $125 short-term selloff is impossible; it isn’t! Given the current news cycle, anything can happen in the days ahead. Bids from the 2475-2500 area are a fantastic way to play the remainder of November.

Holiday Trading

A quick reminder: it’s Thanksgiving Week here in the United States. That means liquidity will be sporadic as the week rolls on. As traders, we have to understand the market dynamic, namely participation.

Beginning Wednesday afternoon, liquidity will begin to leave the markets. Thursday is Thanksgiving, featuring a US stock market closure and an early halt to futures trading. Friday has the potential to be a big day on the markets; look out for a significant late-week move in many assets.

If you want to get in on the action, check out our partner broker Switchmarkets.com. Take advantage of Switch’s Black Friday specials, and trade well!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.