Key Points

- US CPI (year-over-year) came in at the lowest rate since March 2021.

- Interest rate expectations are changing, with now only a 43.5% chance of a ½ point Fed rate cut in September.

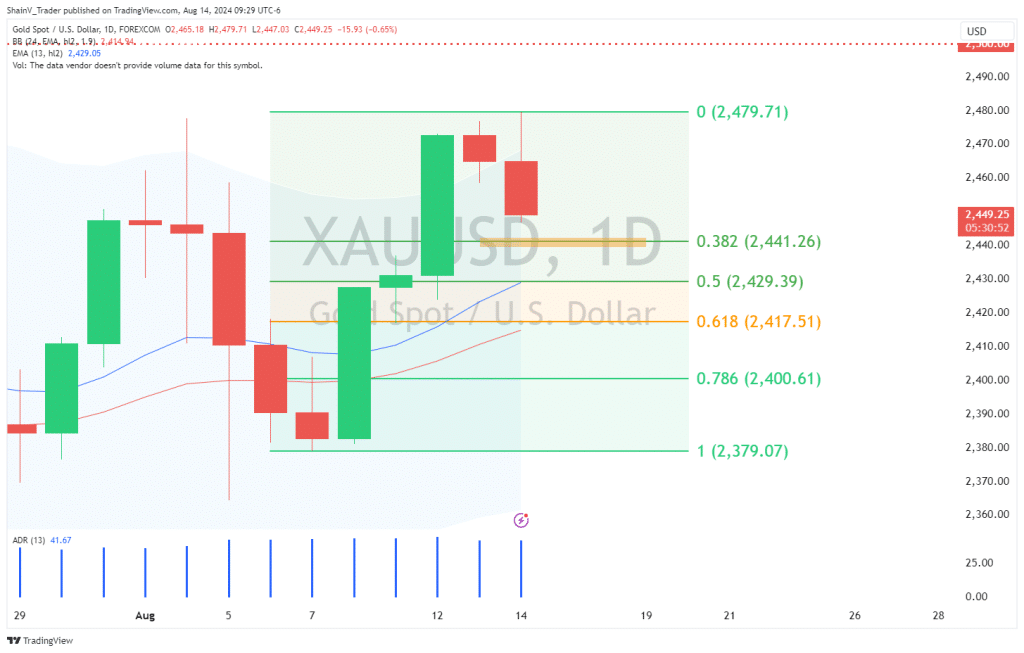

- Key support is present at 2441.26 for the XAU/USD.

Market Overview

Wednesday was a wild session on the forex market, headlined by the US Consumer Price Index (CPI) report. A much-maligned number, CPI is one of the biggest economic releases on the calendar.

Upon its 8:30 AM EST release, volatility swept all markets, including bullion. However, gold traded in a largely sideways fashion. Prices were slightly negative, but not trending. So, what’s next for gold?

Is Inflation Slowing?

July’s CPI came in beneath expectations, a dovish signal for the USD. In fact, yearly CPI growth at 2.9% was the lowest since March 2021. Many analysts are suggesting that the uptick in prices is over and that the disinflationary cycle has begun.

CPI posted 0.2% growth for July, up from -0.1% in June but in line with expectations. Core CPI, which is CPI without food and energy, also rose at 0.2%, as expected. All in all, the markets viewed Wednesday’s CPI numbers as welcomed news.

However, despite the positive sentiment, “choppy” was the best word to describe the immediate post-CPI action. The gold market was no different, with whipsaw action being the rule.

Fed Expectations

CPI can greatly sway the market’s views toward the future of Fed policy. That happened today with July’s CPI report. The markets widely anticipated a 50 bps rate cut for September; the odds of that now stand at only 43.5% following the latest batch of inflation numbers.

At press time, the CME FedWatch Index assigns a 56.5% chance of a ¼ point rate cut at the September meeting. After September, things get interesting. Will it be a one-off rate cut or the beginning of something much bigger? The FedWatch assigns a 43.2% probability of the Federal Funds rate ending the year at 4.25 – 4.50%.

If the market’s assessment of Fed policy is correct, then gold fundamentals are bullish. Of course, it’s anyone’s guess where J. Powell and the FOMC will be four months from now.

XAU/USD: Technical Outlook

During key economic events such as CPI, many traders go all out on short time frames. Without question, that strategy can be extremely rewarding — not to mention risky. A more conservative way to trade during these tumultuous periods is by referencing a larger timeframe. For the current XAU/USD market, the daily chart gives us a great look at prevailing market conditions.

A solid support level is present at the Daily 38% Fibonacci retracement (2441.26). This zone has a great chance of coming into play later this week. If it is tested, then buying the market isn’t a bad way to trade the post-CPI action.

Wednesday’s CPI release was this week’s headline event. Be ready for anything from now until Friday’s close as traders digest the action.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.