Key Points

- Gold blasts to the upside, creating fresh all-time highs as the consolidation period is officially over.

- This week is all about the FOMC, with the markets now favoring a 50bps hike.

- The dollar index is approaching 100, which should help gold prices rise even further.

- As gold prices surge, can we expect more upside this week?

Market Overview

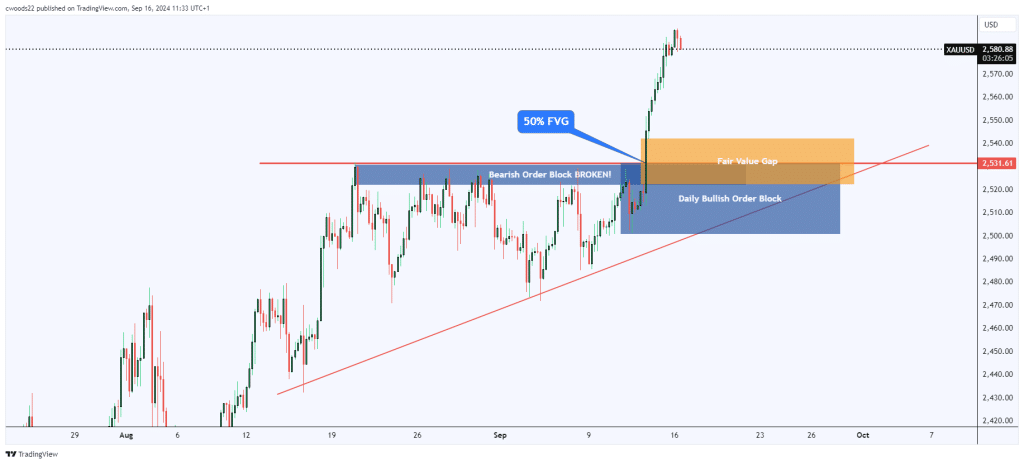

The gold market made a huge move to the upside last week, pleasing the bulls after a few weeks of consolidation. In previous articles such as this one, I mentioned that gold threatened a break-out as it knocked on the door of $2530 a staggering eight times. Once this area was broken, there was no stopping the upside, and now gold trades at $2580.

After opening the year at $2056, gold prices are up 25%. To put that into perspective, between 1971 and March 2024, gold had an average annual return of 7.98%! This shows the global uncertainty, as gold is a perfect safe haven investment. If prices continue this way, gold prices could increase 40% this year, exceeding 2005’s gain of 35%.

All Eyes On Fedweek!

The world will be watching on Wednesday when the Federal Reserve delivers its next monetary policy decision, and there is every reason to expect fireworks in the markets. This is no normal decision either, as it will mark a new era of policy for the Fed, i.e., rate cuts. The million-dollar question is, 25bps or 50bps?

According to the CME Fed Watch tool, there is now a 57% chance that the Federal Reserve will cut interest rates by 50bps to 4.75%. There is a 43% chance that the cut will be 25bps, with the chance of holding rates practically 0. It is quite rare that the decision is a near 50/50 split like this, adding extra volatility to the gold market come Wednesday.

On top of the interest rate decision, traders will have access to the monetary policy statement, economic projections, and a live press conference by Jerome Powell. A more dovish tone from Powell will likely continue the dollar’s downward spiral, which is now rapidly approaching 100 on the DXY. As a result, this could push gold prices beyond $2600. However, should Powell announce a 25bps cut and push back on the cut projections for this year, the dollar should receive a welcome bounce, limiting gold’s gains this week.

Will Gold Continue Higher?

As you can see from the H4 gold chart below, once $2530 was broken, there was little to no resistance to $2380. There are likely thousands of traders feeling the effects of FOMO right now if they missed this move, but there is no need to panic and make rash decisions. Gold is now overbought in most time frames; therefore, we must exercise patience to benefit from the next big move.

Multiple support confluences are now sitting at $2530; the first is a daily order block, which is the footprint of large institutional buying. Secondly, the previous bearish order block at $2530 that was broken can now be used as a support area, and thirdly, this area sits bang on the 50% of the Fair Value Gap in the orange box. This makes $2530 a very tempting support level to buy gold, but if the Federal Reserve is more dovish, it may not get that far, and we should then expect a continuation of the strong bullish trend to push gold prices to at least $2600.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.