Key Points

- The failed assassination attempt on former POTUS Trump and projected Fed rate cuts are driving gold to new all-time highs.

- Trump is now firmly ahead in a majority of key battleground states.

- The CME FedWatch Index is assigning a 100% chance of at least a ¼ point September rate cut.

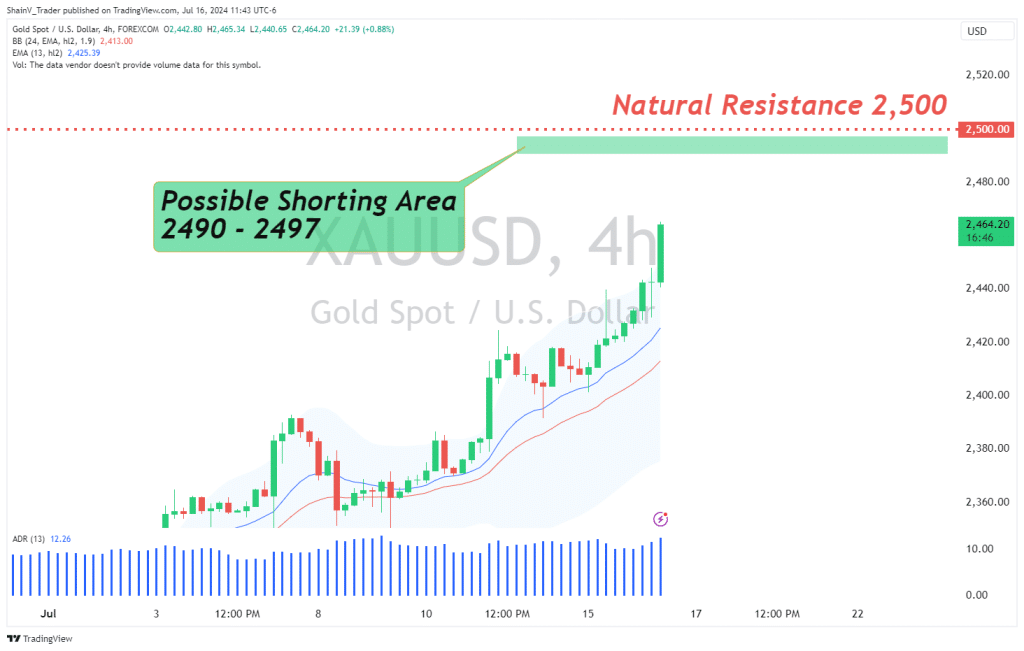

- $2,500 is on the horizon as short-term, natural resistance for the XAU/USD.

Market Overview

The financial markets are on fire after a fresh wave of rate-cut mania and an assassination attempt on former US President Donald Trump. Gold (XAU/USD) is no exception. Prices are up more than 1.5% on the session as bidders have driven bullion to fresh all-time highs. As of this writing, a formal test of $2,500 may come sooner rather than later.

Rate-Cut Mania

During Monday’s US session, Fed Chairman Jerome Powell suggested that interest rate cuts were coming for 2024. In an engagement with the Economic Club of Washington DC, Powell stated that the Fed would not wait until inflation hits the official 2% objective before cutting rates:

“The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%.”

Basically, Powell is saying that the tightening cycle is coming to an end for the USD. The markets certainly believe this to be the case. The CME FedWatch Index quickly adjusted to a 100% chance of rate cuts at the September meeting. This huge step forward has brought bidders to risk assets and gold alike.

Trump Assassination Attempt Fails

At a Saturday campaign rally in Butler, Pennsylvania, an attempt was made on the life of former President of the United States Donald Trump. A lone shooter was identified as the person responsible. We won’t mention the shooter’s name in this article because he isn’t worthy of recognition.

The near-miss on Trump is a stark reminder of how divided and volatile the United States has become. Surprisingly, some of the uncertainty surrounding November’s US elections has subsided. According to Real Clear Politics, Trump now has large leads in almost all battleground states.

However, despite the recession of political uncertainty, many traders are looking to safe havens for insulation from potential US social unrest. Given the current political tone and forthcoming rate cuts, gold has exploded to the bull.

XAU/USD Technical Analysis

Sometimes, technical analysis is simple. At press time, a bullish bias toward the XAU/USD is warranted as nearly all time frames point to topside extension.

However, there may be a great short-scalping opportunity on the horizon. The big round number of 2,500 is coming into view. Sells from 2,490-2,497 offer solid trade location to the bear. As long as a tight stop loss is utilized from the 2,509 area, it’s possible to cash in on a retracement of $5 to $10, depending on one’s exact entry point.

There is one unavoidable truth for gold for the rest of 2024: volatility will be the rule as political uncertainty and Fed policy take center stage.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.