Key Points

- Bitcoin (BTC) has broken out to new all-time highs, and $100,000 is quickly coming into play.

- Gold (XAU/USD) has pulled back amid a post-election rally in the USD.

- Deregulation of crypto and shifting interest rate expectations are the key market drivers for BTC and gold.

Market Overview

Election 2024 is over, and traders are aggressively pricing the fallout. The action has been extreme for gold (XAU/USD) and Bitcoin (BTC), with both assets seeing heavy volumes. The big winner has been Bitcoin, which tested the $90,000 area. On the other hand, gold is pulling back from pre-election all-time highs.

While no one knows what the future holds, one thing is for sure: traded volumes are heavy, and volatility is present in nearly every market.

Bitcoin (BTC) Explodes Following Trump Win

The most prominent market driver facing cryptocurrencies is regulation. Regulation of crypto has periodically smashed prices, bringing sellers to the market in mass. A great example of this phenomenon was the US Securities and Exchange Commission (SEC) going after Ripple. XRP saw significant selling pressure and long periods of flat pricing amid numerous SEC lawsuits.

There’s no question that regulation is bad for crypto prices. However, the opposite is also true. Any moves toward deregulation tend to send prices higher. That’s the current state of crypto; the new Trump administration is considered pro-cryptocurrency, favoring deregulation. In fact, sitting SEC Chairman Gary Gensler is widely expected to step down once Trump takes office. Many names are being circulated as Gensler’s replacement, including Dan Gallagher, Mark Uyeda, and Heath Tarbert. Gensler’s term is up in 2026; as of this writing, there is no official word on whether he will resign or be fired.

The bottom line is that the new administration is likely to push for crypto deregulation. This has been a bullish market driver for Bitcoin, spiking prices by 28% since Election Day.

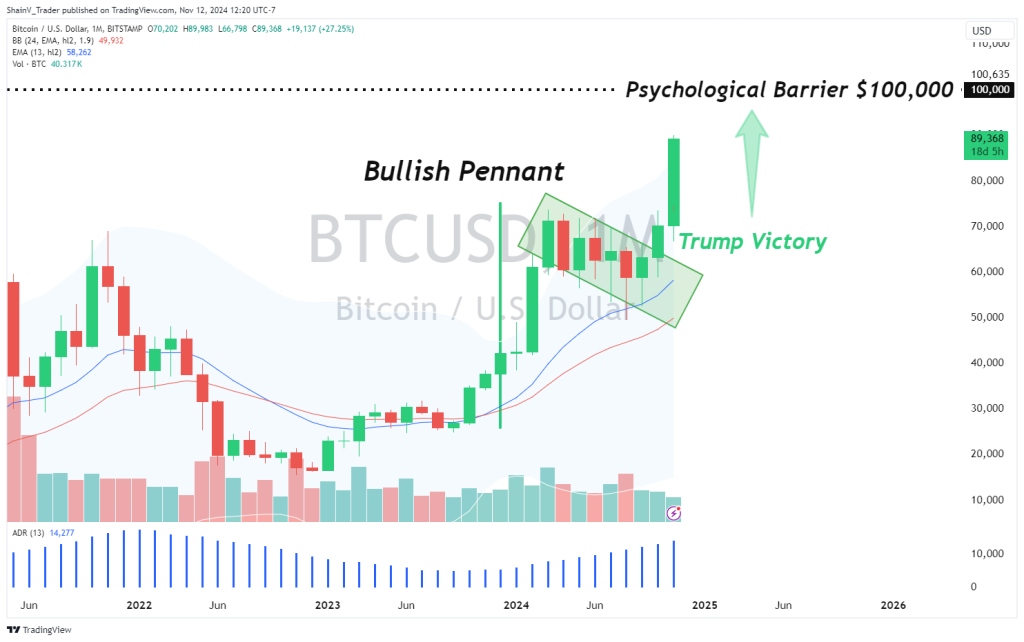

BTC: Technical Outlook

When a market breaks out to new all-time highs, the technical analysis becomes relatively simple. The numbers to watch are areas of natural resistance. In the case of BTC, $90,000 and $100,000 are very important.

By far, the most watched number for BTC is $100,000. It has long been a target for bulls, and crypto traders are happy to buy pullbacks until this psychological barrier is tested.

USD Rallies, Gold Pulls Back

While BTC is soaring, gold is taking a break from the massive 2024 bull market. Since 1 January 2024, the XAU/USD is up more than 26%. Traders and investors have snatched up bullion to mitigate political and geopolitical risk. With the US election now over, much of the political uncertainty has subsided.

Typically, when the USD gains ground, gold pulls back. That has been the case since Election Day, as evidenced by the USD Index (DXY) rallying above 106.000 and gold posting a 5% loss.

The USD is up, anticipating fewer Fed rate cuts in 2025 and potential Trump tariffs. This week, FOMC members Mester and Kashkari stated that it was unlikely that the Fed would stick to September’s policy forward guidance. The market is pricing in a near 50/50 chance of one more rate cut this year. Also, it looks improbable that rates will come down a whole point by this time next year. Given these new hawkish expectations, gold is steadily falling.

XAU/USD: Technical Outlook

Although gold is on a retracement, the macro trend remains bullish. On the monthly chart, key support is located at $2,482.30. This level is the Monthly 38% Fibonacci retracement and a key area to watch as the current pullback develops. If bullion continues to fall, expect significant bidding from the $2,500 – $2,482 area.

Like $100,000 for BTC, the $3,000 level for gold is a popular topside bullish target. Nonetheless, the Fed dialing back its dovish policy is likely to have a bearish impact on XAU/USD pricing, at least for the short term. Ultimately, only time will tell how the transition to the new Trump administration will play out.

As always, take caution when trading and ensure your leverage is reasonable. Volatility is palpable across the markets, with each day bringing swift moves in asset prices. Given this super-charged environment, there’s nothing wrong with being conservative until the post-election hysteria recedes. After all, there’s plenty of time to trade BTC and gold — a brand-new trading year is right around the corner!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.