Automated vs Manual Forex Trading

We’re in the 21st century. Our computers do everything for us, including our forex trading. And with the meteoric rise of Artificial Intelligence, questions about the use of automated trading have only gotten louder.

So, what should you use? Manual trading or automated trading? This lesson deals with that.

What is Manual Forex Trading?

Manual forex trading is the kind of trading where all the trading decisions are made by you, the human. You sit behind your computer screen, monitor the charts, and take your trades when the opportunities come. You also set your trading orders as you see fit.

As a manual trader, you’ll rely on forex trading tools, such as indicators and fundamental analysis and technical analysis. And pretty much everything that has to be done only gets done by you. This is what manual trading is about.

Advantages of Manual Trading

- As a manual trader, you get to analyze the chart yourself. This way, you can make intuitive decisions about your trades.

- A manual trader can read the market condition. For instance, you may decide to take a break from trading if you find that the market is either dead or too choppy.

- Manual trading allows for a lot of flexibility. If your strategy isn’t working well, for instance, you can just tweak it until it works well. And if it still doesn’t go well, you can simply learn another strategy.

Disadvantages of Manual Trading

- Manual trading is prone to human errors.

- Manual trading is time-consuming. The trader must first learn their strategy, backtest the strategy, and foreward-test on demo accounts before even going live. All of these could take months, depending on the trading strategy.

- Humans are limited in the number of currency pairs they can monitor simultaneously. As a result, we will naturally miss out on trading opportunities.

- We are susceptible to our emotional biases. These emotions tend to get into our trading and ruin our decision making. That’s why staying disciplined is a huge issue for manual traders.

What is Automated Forex Trading?

Automated trading (algorithmic trading or algo trading) uses automation, mathematical models, and programmed bits of code to make trades according to preset rules and strategies. These pieces of code are often called Expert Advisors on the MetaTrader trading platforms and some other platforms.

They first start out as a trading strategy with trading plans and rules. Then, a developer has to convert these rules into programs that can run on a trading platform.

Automated trading is great for traders who don’t have so much time to trade the forex market themselves.

Advantages of Automated Trading

- Automated trading is fast and accurate. There will never be issues of mistakes or human errors with automated trading.

- The volume of trades an automated trading system can take on far trumps what a human trader can do. An algorithm can make tens or hundreds of trades in a day. A human would find it hard to achieve that number.

- Automated trading systems free time for their users to do other things.

- Emotions and indiscipline are completely eradicated because automated trading relies solely on strict rules. It can break these rules.

Disadvantages of Automated Trading

- Automated trading can be a smart way to trade, but it isn’t an intelligent way to trade. Algorithms can’t make decisions themselves. They can only execute your instructions smartly. But outside those instructions, they’re completely useless.

- Hiring a programmer to code a trading strategy can be costly.

- Automated trading won’t adapt to market conditions the way humans would.

- There’s always the risk of technical glitches and bugs with automated trading. This could cause the trader to lose more money than necessary.

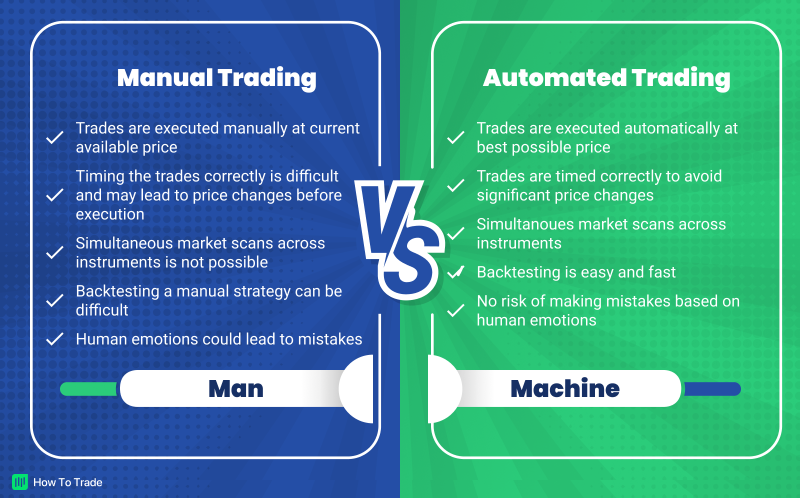

Manual Trading Vs. Automated Trading: Major Differences

These are the major differences between manual trading and automated trading:

- Automated trading robots can only execute trades based on the scenarios that were programmed into them. However, humans who trade manually can take into account everything that is going on, including market conditions, and process it altogether.

- Unlike manual trading which is filled with undisciplined trading, automated systems stick to the trading plan and trading strategy you set up. Robots ain’t got no time to rebel. Neither do they feel human emotions.

- Humans can take into account fundamentals that are occurring unexpectedly. Automated trading won’t be of much help there, though.

- Forex robots will ALWAYS execute your trades correctly. An automated trading software won’t buy when it should sell. It won’t enter the wrong lot size. These mistakes, however, are common among human traders. Even the best traders make these mistakes.

- Humans can decide when they reach their profit targets and when they think the momentum will continue in their favor.

- Forex robots can take in more historical data than human traders. That means if your strategy applies to many different currency pairs or multiple markets, you can probably only monitor a few at once. With an automated system, you just plug it in, and it’ll monitor everything you want monitored.

- Humans can see the market moving extremely slowly or unreasonably erratically and pull out their trades.

- Unlike manual traders, Forex robots don’t get tired and can be plugged away at the markets 24 hours a day. That is 3, 4, maybe 10 times as much as a manual trader trades in the Foreign Exchange market.

- Manual Forex trading gives you the real feel and thrill of the Forex market.

- Supply and demand are influenced by human variables, which most computers cannot analyze or predict.

- Humans can use qualitative factors to judge the current market scenarios and make smart trading decisions.

- And most importantly, experience, knowledge, and intuition will ALWAYS outperform computation logic. With a manual strategy, most traders have more control over their trading decisions, profit levels, and finding trading opportunities.

Automated vs Manual Trading: Which is Better?

There is a place for automation in your trading by using automated trading systems. But in all honesty, the use of automated trading systems only works with human input.

You MUST understand why the market moves in a certain direction and couple this knowledge with a technical overview. There are NO shortcuts to successful trading.

You need to put in the effort, develop a disciplined mindset, and set specific rules if you expect to succeed. If you have the passion and dedication, you will eventually succeed and set yourself up for financial independence.

That said, no one said you had to pick just one. You can work with the two. For instance, many traders use automated systems to alert them when there are potential trading opportunities in the market. They then analyze these market conditions and decide whether to enter the trades manually.

Ultimately, we advise new traders to start with manual trading. Because at the end of the day, automated systems are only a result of trading strategies developed by humans. So, if there’s a need, you can override the decisions of your algorithm.

Key Takeaways

- Manual trading simply means a human trading themselves. Automated trading refers to the use of computer programs and algorithms in placing trades.

- The biggest difference between them is that humans can make intelligent decisions. We can decide to take opportunities that are not necessarily part of our manual trading strategy. We can even opt out of trades when we “feel” the conditions are unfavorable.

- Automated trading, on the other hand, can only make smart decisions. In other words, they can be fast and accurate about their decisions since they are based on pure programmed logic.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."

Save $228 on our Trade Together program, paid for by our partner.

Learn MoreSave $228 on our Trade Together program, paid for by our partner.

Learn More