German automakers and banks faced downward pressure due to U.S. tariffs and potential banking deregulation, while Siemens Energy and RWE provided support with positive performance.

Key Points

- DAX 40 rose 1.19% today after recent volatility from U.S. trade and Eurozone data impacts.

- Eurozone GDP and employment data today may influence ECB rate cut expectations.

- U.S. CPI boosted Fed rate cut hopes, possibly attracting investment in DAX 40.

DAX 40 Daily Price Analysis – 14/11/2024

The DAX 40 opened today at 18,995.25, registering a 1.19% increase in early trading. This movement follows a challenging Wednesday session, where the DAX dropped by 0.16%, closing at 19,003. The index has been under pressure from investor concerns around US tariffs, specifically affecting German automakers and financial stocks.

On Tuesday, DAX saw a significant drop of 2.13%, marking the first close below 19,000 since October 8. This recent volatility highlights the ongoing sensitivity to external economic pressures, including US trade policies and Eurozone economic data.

Sectoral Performance and Major Stock Movers

German automakers continue to bear the brunt of trade tensions. Porsche faced a substantial drop of 6.17% on Wednesday, while Volkswagen fell by 2.45%, and BMW and Mercedes Benz also ended in negative territory. With the potential for US tariffs targeting the German automotive sector, investor caution remains high.

German bank stocks similarly reflected this cautious sentiment. Expectations of US banking deregulation created a ripple effect, impacting demand for Commerzbank and Deutsche Bank, which fell by 1.45% and 0.44%, respectively. However, Siemens Energy AG bucked the trend, surging by 18.95% after raising its mid-term outlook, while RWE AG added resilience to the index with a 6.14% rally following a share buyback announcement.

Eurozone GDP and Labor Market

The second estimate of Eurozone GDP and labor market data is due today. The initial GDP estimate indicated a 0.4% quarter-on-quarter expansion in Q3 2024, up from 0.2% in Q2. Any downward revisions could amplify investor expectations of a 50-basis point rate cut by the ECB in December, which could offer short-term support for DAX-listed stocks by easing borrowing conditions.

Labor market performance will also be closely observed, with a forecasted 0.2% increase in Eurozone employment for Q3, matching Q2’s growth. Weaker employment numbers may bolster the case for a dovish ECB stance, particularly if private consumption slows. Given the ECB’s sensitivity to labor market dynamics, disappointing data could further reinforce bets on an ECB rate cut, potentially boosting investor interest in the DAX.

Impact of US CPI Data and Fed Rate Cut Expectations

Wednesday’s US CPI report added momentum to the possibility of a December Fed rate cut, with the core inflation rate holding steady at 3.3% and the annual inflation rate rising from 2.4% in September to 2.6% in October. These figures, aligning with consensus estimates, calmed fears of rising inflation pressures, with the CME FedWatch Tool now indicating an 83.0% probability of a 25-basis point December cut, up from 58.7% earlier in the week.

This trend has bolstered sentiment in US markets, driving gains in the Dow (+0.11%) and S&P 500 (+0.2%), though the Nasdaq fell by 0.26%. For the DAX, a more accommodative US monetary policy could lead to a favorable shift, especially if it encourages inflows into European equities.

Key Economic Data and News to Be Released Today

For the DAX 40, the most critical data to watch today includes Eurozone GDP Second Estimate for Q3 2024, expected to confirm the Eurozone’s quarter-on-quarter growth of 0.4%. Any downward revision could bolster expectations of a December ECB rate cut, impacting investor sentiment around Eurozone equities.

US producer prices are forecasted to rise by 2.3% year-on-year in October. A higher-than-expected result could dampen Fed rate cut hopes, indirectly influencing the DAX by impacting global equity flows. Similarly, a slight increase in US jobless claims is expected, though more substantial changes could alter Fed rate expectations and create potential spillover effects in European markets.

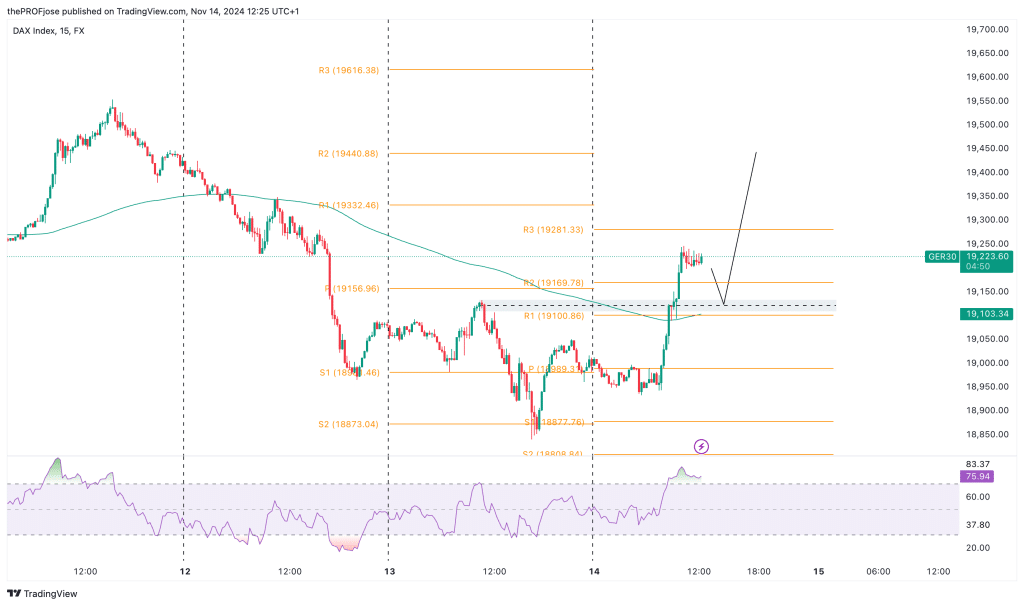

DAX 40 Technical Analysis – 14/11/2024

Dax 40 moved significantly to the upside earlier today, crossing above the 200 EMA into a bullish sentiment. While price has been dropping for the past two days, today is gearing up to be a reversal day.

From the present price action, we are expecting the price to keep breaking structure to the upside. In the short-term, we may see price retesting the key level around 19,150 before the bullish trend continues.

Dax 40 Fibonacci Key Price Levels 14/11/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 18877.76 | 19100.86 |

| 18808.84 | 19169.78 |

| 18697.29 | 19281.33 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.