Key economic data releases today, including Eurozone employment figures and the US CPI report, are expected to have a significant impact on market sentiment and the DAX’s performance.

Key Points

- The DAX 40 gained 0.82% yesterday, driven by tech stocks on Fed rate cut expectations.

- Germany’s ZEW Economic Sentiment plummeted, raising recession concerns.

- The DAX opened slightly higher today at 17,867.29 amid cautious optimism.

DAX 40 Daily Price Analysis – 14/08/2024

The DAX 40 closed yesterday at 17,854.69, reflecting a 0.82% increase from the previous day. This upward momentum was largely supported by a rally in tech stocks, driven by rising bets on a Fed rate cut, which boosted demand for riskier assets. Hannover Re’s better-than-expected earnings also contributed, pushing its shares up by 1.67%. However, the session was mixed for auto stocks, with Volkswagen and Mercedes-Benz Group experiencing minor losses due to the deteriorating macroeconomic environment in Germany.

The positive sentiment was somewhat dampened by the significant drop in Germany’s ZEW Economic Sentiment, which plummeted from 41.8 in July to 19.2 in August. This sharp decline highlighted growing concerns over the German economy, aligning with weaker growth forecasts that suggest the country is nearing a recession.

As of today, the DAX opened at 17,854.69 and is currently trading slightly higher at 17,867.29, a modest 0.08% increase. The market is cautiously optimistic, with investors likely digesting yesterday’s mixed signals. The German economy’s grim outlook and recent economic data have kept market participants on edge, limiting the DAX’s upside potential.

Key Economic Data and News to Be Released Today

Today’s trading will be heavily influenced by key economic releases. Eurozone employment change, industrial production, and GDP figures are on the docket, which could significantly sway investor sentiment. Economists expect only a slight 0.2% increase in Eurozone employment for Q2 2024, and any deviation from this could impact the ECB’s rate path, potentially affecting the DAX.

Additionally, the much-anticipated US CPI report is due later today. With core inflation expected to ease slightly, this report could further bolster Fed rate cut bets if the numbers come in softer than expected. Such an outcome might boost demand for DAX-listed stocks, especially those with significant exposure to US markets.

DAX 40 Technical Analysis – 14/08/2024

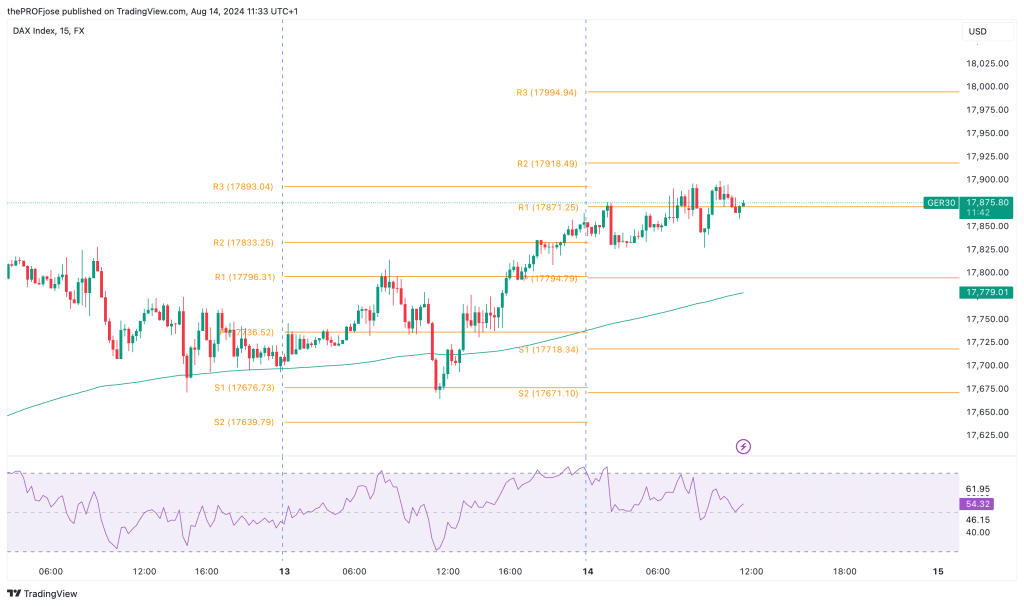

The DAX 40 is showing signs of an upward trend on the 15-minute chart. This is evidenced by the price action moving above the 200 EMA. The price has recently touched the R1 level and is showing some consolidation just below it. A break above R1 could signal a potential move towards R2 and possibly R3 if bullish momentum continues.

If the DAX fails to break R1 and starts to decline, watch for a test of the 200 EMA around 17,779.01. A break below this level could see the index drop towards S1 at 17,718.34, with further downside potential if support does not hold.

Dax 40 Fibonacci Key Price Levels 14/08/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 18292.96 | 18481.94 |

| 18234.59 | 18540.31 |

| 18140.10 | 18634.80 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.