The Producer Price Index released earlier showed a year-on-year decrease of 1.6%, matching the estimated figure and improving from the previous month’s decline of 2.2%.

Key Points

- DAX 40 dropped 0.66% on Thursday to 18,324.50 after ECB kept rates steady.

- Industrial and tech sectors plunged, with Siemens down 4.5% and SAP 1.5%, while autos gained 2%.

- Trading at 18,230.29, DAX 40 is down 0.31%, nearing three-week lows amid rate and trade worries.

DAX 40 Daily Price Analysis – 19/07/2024

On Thursday, the DAX 40 experienced a decline of 0.66%, closing at 18,324.50 after opening at 18,446.50. The market struggled to maintain early gains and closed 0.4% lower, largely influenced by the European Central Bank’s decision to keep interest rates steady. These comments received mixed reactions because traders are still banking on a rate cut in September, though ECB President Christine Lagarde said the decision is far from done.

Shares in the industrial and technology sectors posted large losses, with Siemens down 4.5% while SAP was 1.5% lower respectively. On the other hand, one of the most resilient performances was delivered by the auto sector (around +2% for Porsche, Mercedes-Benz or BMW). Pressure has also been ongoing due to fears of potential US-led trade restrictions on China, while a major IT outage impacting Microsoft services yesterday gave some traders cause for concern.

For the day, as of last check on today’s trading session DAX 40 is at 18,262.29 down with -0.31% Percent and it turns off from opening level of 18,324.50. It is now hovering close to three-week lows after the index extended its fall. Market sentiment was weak across the broader European markets on continuing concerns over interest rates and trade policies.

Key Economic Data and News to Be Released Today

Earlier in the trading session, the Producer Price Index was released, showing a year-on-year decrease of 1.6%, which matched the estimated figure and was an improvement from the previous month’s decline of 2.2%. This data release has been a key factor influencing market sentiment today, providing some relief amid the broader economic uncertainties.

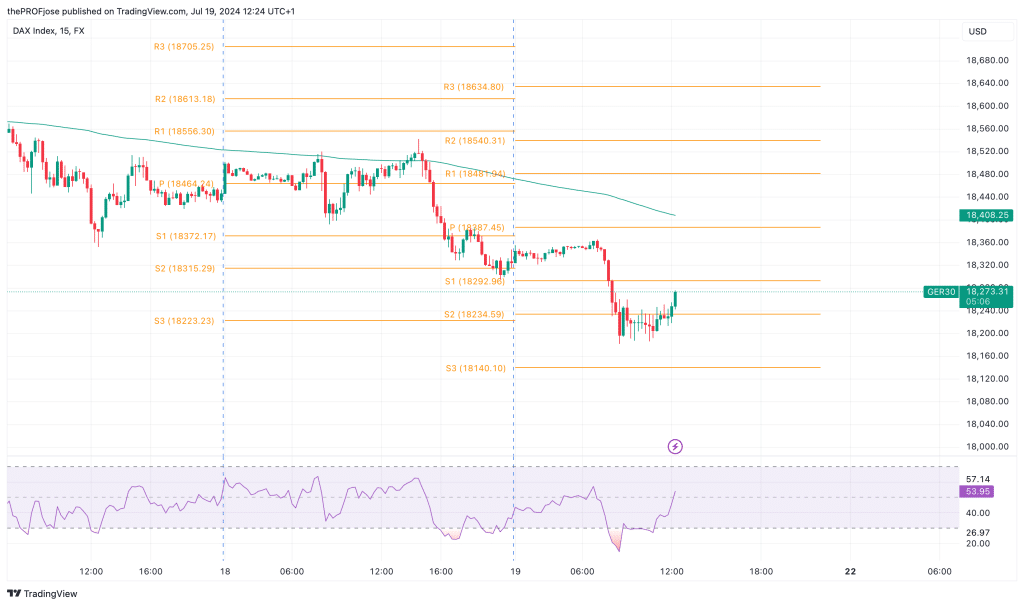

DAX 40 Technical Analysis – 19/07/2024

The DAX 40 is currently in a bearish trend, as evidenced by the price trading below the 200 EMA. However, the DAX is currently trading around 18,273.31, just above the S2 level of 18,234.59. This indicates that the market has found some short-term support at this level.

Given the RSI’s positioning and the overall market trend, the DAX 40 may see a short-term rebound towards the nearest resistance level at 18,372.17. However, the broader bearish trend suggests that any upward movement could be limited and met with selling pressure around the resistance levels.

Dax 40 Fibonacci Key Price Levels 19/07/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 18292.96 | 18481.94 |

| 18234.59 | 18540.31 |

| 18140.10 | 18634.80 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.