A decline in Eurozone inflation could support DAX-listed stocks by lowering borrowing costs and improving corporate earnings.

Key Points

- The DAX rose 0.07%, with investors awaiting the FOMC decision.

- The FedWatch Tool signals a 65% chance of a 50-basis point Fed rate cut.

- A Fed rate cut could push the DAX toward 19,000, or down to 18,000 if hard landing concerns rise.

DAX 40 Daily Price Analysis – All Eyes on the Fed Meeting

The DAX 40 experienced a slight uptick on Wednesday, climbing 0.07% to trade at 18,710.90 following Tuesday’s close at 18,697.02. Despite the modest gain, investor sentiment remains cautious as market participants await the highly anticipated FOMC interest rate decision later in the day, which could set the tone for the DAX in the coming sessions.

Zalando SE emerged as a standout performer, surging 7.33% and driving gains in the retail sector. Kingfisher’s raised profit forecast further boosted sentiment in the retail space, adding strength to DAX-listed retail stocks. Rate-sensitive stocks such as Siemens Energy AG and Infineon Technologies also saw notable gains, up 4.26% and 3.24%, respectively, as investors speculated on the possibility of upcoming rate cuts from the ECB and the Fed. Auto stocks contributed to the positive momentum, with Volkswagen and Porsche closing up 1.36% and 1.18%, respectively.

However, the broader market mood remained mixed, weighed down by a sharp drop in the German ZEW Economic Sentiment Index, which fell from 19.2 in August to just 3.6 in September. This decline highlights growing concerns over Germany’s economic outlook, with ZEW President Professor Achim Wambach noting dwindling hopes for an early recovery.

Key Economic Data and News to Be Released Today

Today’s inflation data from the Eurozone will be pivotal for the DAX. Preliminary figures suggest a slight decline in the annual inflation rate, down from 2.6% in July to 2.2% in August. Should the finalized data confirm this trend, investors may increase bets on an ECB rate cut in Q4 2024. This could create a more favorable environment for DAX-listed companies, particularly those in rate-sensitive sectors like energy and technology, as lower borrowing costs could enhance corporate earnings.

In the US, retail sales data released on Tuesday indicated resilience in the economy, with a 0.1% increase in August following a strong 1.1% rise in July. This suggests continued strength in private consumption, a key driver of US GDP. Nonetheless, the CME FedWatch Tool now signals a 65% probability of a 50-basis point rate cut by the Fed, up from 62% on Monday, reflecting growing expectations of looser monetary policy. This has provided a boost to global equity markets, including the DAX.

Looking ahead, much will depend on the outcome of the Fed’s interest rate decision and its implications for the US economy, and major US indices. If the Fed opts for a sizeable rate cut and projects a soft landing for the US economy, the DAX could see upward momentum, potentially pushing it toward the 19,000 mark. Conversely, a rate cut paired with concerns about a hard landing could pressure the index, with a potential pullback toward 18,000.

The outcome of the FOMC meeting later today could set the tone for the next leg of the DAX’s journey, with both upside and downside risks in play. Traders will also be closely watching US housing data, which may offer additional clues about the strength of the US economy heading into Q4.

DAX 40 Technical Analysis – 18/09/2024

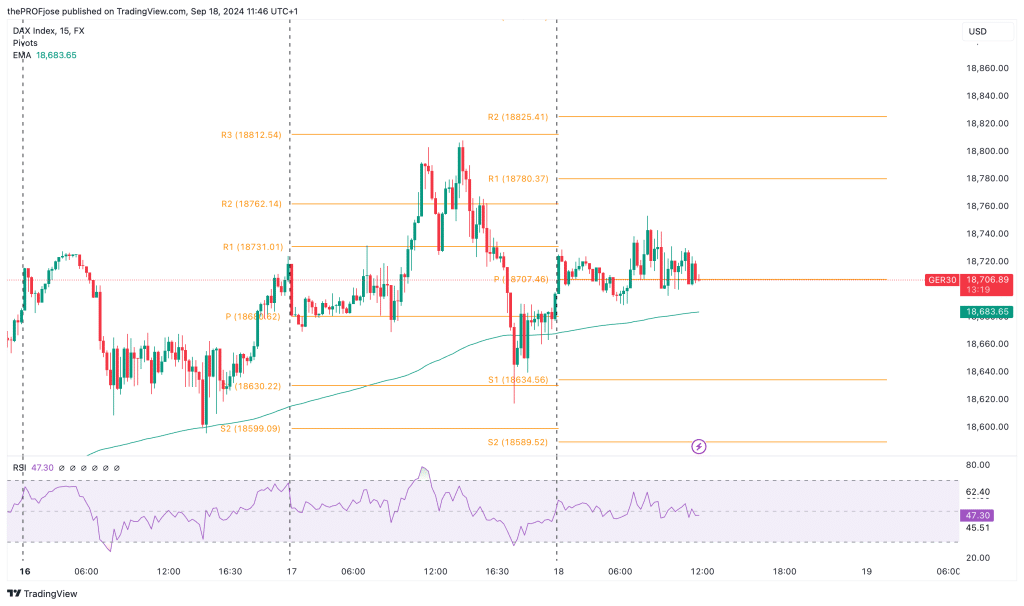

Dax 40 is currently in a bullish trend as price has been above the intraday 200 EMA. However, the price movement today has been consolidating, making it a little complex to take a long trade in the overall market direction.

The RSI is also just reluctantly moving around the 50 level. The slow movement in price is not a suitable environment for short-term traders to enter a position. As it stands, a viable long position can only be expected after the price has decisively broken above today’s high.

Dax 40 Fibonacci Key Price Levels 18/09/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 18634.56 | 18780.37 |

| 18589.52 | 18825.41 |

| 18516.61 | 18898.31 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.