Lower German inflation fueled expectations of a 25-basis-point ECB rate cut, potentially supporting corporate earnings.

Key Points

- DAX 40 opened slightly higher at 19,399.96, up 0.13%.

- China’s weak fiscal stimulus hurt luxury and auto stocks.

- Energy and tech sectors may benefit from a dovish ECB.

DAX 40 Daily Price Analysis – 14/10/2024

The DAX 40 index opened slightly higher today at 19,399.96, up 0.13% to 19,427.05, following Friday’s 0.86% gain. The index has shown relative strength against its European peers, driven by cautious optimism ahead of key central bank decisions later this week.

A key drag on broader market sentiment comes from the disappointment around China’s fiscal stimulus announcement over the weekend. Despite hopes for a robust plan, the lack of specific details underwhelmed investors. This weighed on luxury and auto stocks in particular, as China remains a crucial market for both sectors. Brands like Volkswagen (-0.4%) and Mercedes-Benz (-0.4%) felt the strain, while Continental was down 0.9%.

The market is closely watching the ECB’s upcoming policy decision. Recent declines in German inflation, which fell from 1.9% in August to 1.6% in September, have fueled expectations for a 25-basis-point rate cut. Lower borrowing costs would likely support corporate earnings, providing a potential tailwind for the DAX 40.

Key sectors such as energy and technology may benefit from these expectations, as reflected in Friday’s performance when Siemens Energy surged 3.29% and SAP climbed 0.7%. A dovish ECB stance could push the DAX toward the 19,500 mark. However, any signs of caution from ECB policymakers regarding rate cuts could limit gains and bring the index closer to 19,000.

Within the DAX, individual corporate performance remains mixed. Siemens Energy (+1.5%) and Adidas (+1.8%) continue to shine, while auto stocks remain a notable underperformer. This trend may persist if investors remain skeptical about the growth potential in key markets like China.

Key Economic Data and News to Be Released Today

As of today, there are no major economic data releases expected that could significantly impact the DAX 40 or broader markets. Investors are largely awaiting central bank decisions later this week, particularly from the ECB, which is expected to play a more decisive role in influencing market sentiment.

While today’s trading may be relatively quiet in terms of data-driven movements, any unexpected ECB policymaker commentary or global geopolitical developments could introduce volatility into the session.

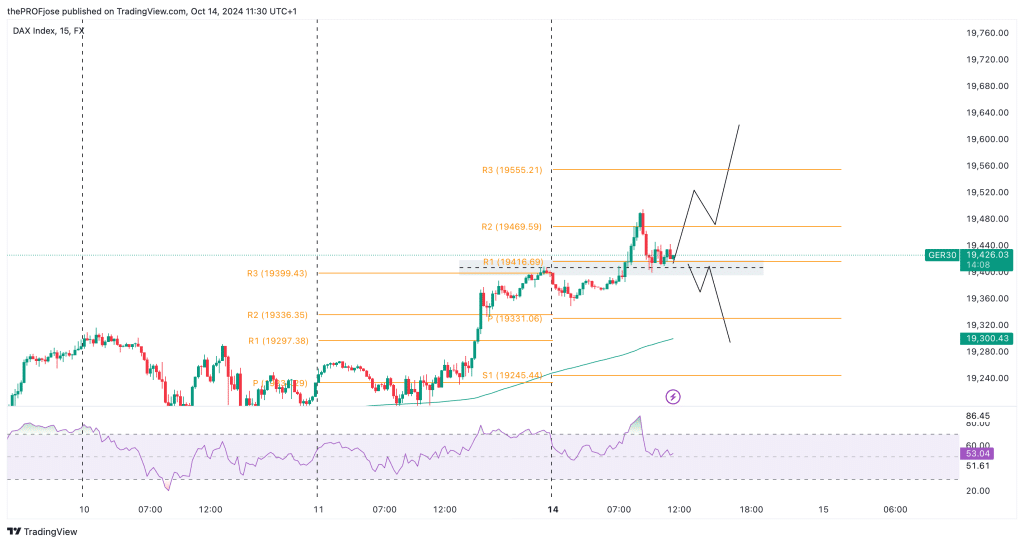

DAX 40 Technical Analysis – 14/10/2024

The best approach to today’s price action on the Dax 40 is to react rather than predict. Here’s what it means: a closer look at the chart shows that we have both valid buy and sell trading opportunities.

For the BUY scenario, the pair is currently trading above the 200 EMA, indicating a bullish trend. Also, the price has broken above the key resistance level and formed a flip zone, turning the resistance into a support zone. Should the price form a bullish candlestick pattern, it is a perfect confluence to go long.

On the other hand, the market also provides a valid short-term bearish reversal opportunity. Although the index is bullish a counter trend can be seen as the RSI is overbought while price has reacted to a resistance zone earlier this morning. A safer opportunity to short the market is after the market breaks below and retest the current key level.

So, it is best to watch out for these scenarios and be flexible enough to adapt to the changing market conditions as the day goes by.

Dax 40 Fibonacci Key Price Levels 14/10/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 19245.44 | 19416.69 |

| 19192.54 | 19469.59 |

| 19106.91 | 19555.21 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.