Today, the DAX 40 is down 0.56%, currently trading at 18,445.78, impacted by disappointing corporate earnings and weak economic data.

Key Points

- Deutsche Bank’s 7% drop and other financial declines tempered the overall gains.

- German flash PMIs showed a contraction, heightening economic concerns.

- The DAX 40 faces potential further declines, struggling to stay above the 200 EMA.

DAX 40 Daily Price Analysis – 24/07/2024

On the previous trading day, the DAX 40 experienced a positive movement, closing at 18,548.14 with a 0.38% gain from its opening price of 18,478.12. This upward trend was driven by a strong performance from Rheinmetall, which rose 2.3% following its impressive Q2 results that surpassed market expectations.

The company also reaffirmed its guidance for 2024, boosting investor confidence. However, the index’s overall gains were tempered by a significant drop in Deutsche Bank’s shares, which fell by 7% after reporting a quarterly loss due to a provision for an ongoing lawsuit over its Postbank division. Additionally, Commerzbank and Daimler Truck Holding saw declines of 2.9% and 3%, respectively, reflecting broader concerns in the financial and industrial sectors.

Today, the DAX 40 has faced downward pressure, currently trading at 18,445.78 after opening at 18,548.14. This represents a 0.56% decline. The index’s movement has been influenced by disappointing corporate earnings across several sectors, with the market reacting negatively to the latest financial disclosures.

Additionally, weak economic data has played a role in the index’s decline. The release of the flash PMIs for Germany showed the private sector unexpectedly returning to contraction, driven by a deeper fall in manufacturing activity and a slowdown in the services sector. This data has heightened concerns about the economic outlook, contributing to the bearish sentiment in the market.

Key Economic Data and News to Be Released Today

Asides the manufacturing PMI data that has been released earlier, there’s no high impact news to be released again today. However, market participants are closely monitoring further corporate earnings reports and any updates on Deutsche Bank’s legal situation, which could influence the market’s direction.

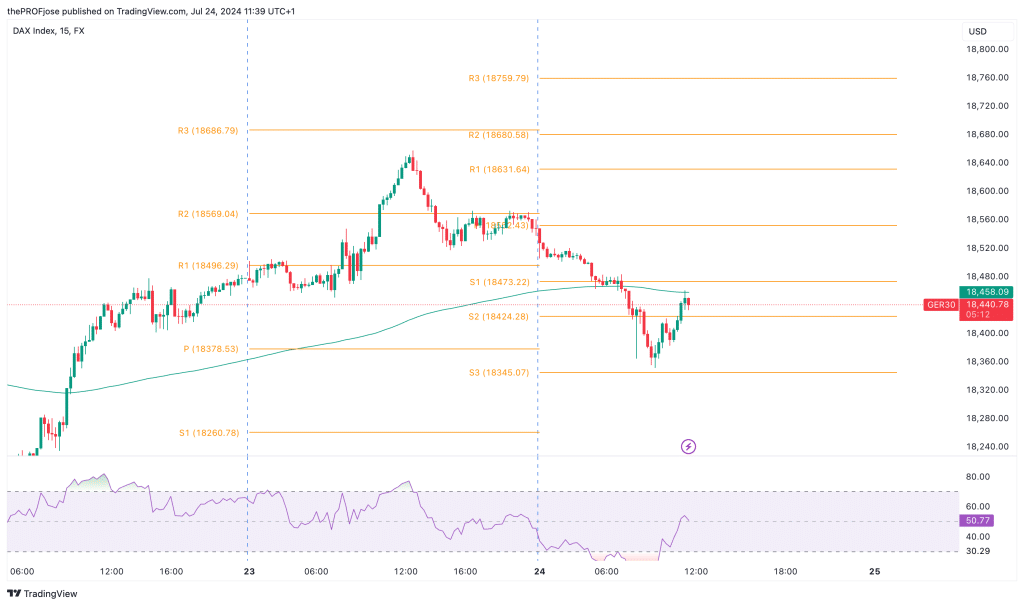

DAX 40 Technical Analysis – 24/07/2024

The market has been showing signs of weakness, particularly with the inability to maintain gains above the 200 EMA. This indicates that bearish pressures are still present, potentially leading to further declines.

Given the current technical indicators, the DAX 40 is likely to experience continued downward pressure in the short term. The RSI’s neutral position suggests that there is room for further downside without entering oversold territory. The recent bounce off the 200 EMA could lead to further declines, potentially testing the support levels at S2 and S3.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.