The yen’s recent 11% drop against the dollar has prompted intervention signals from Japan’s Finance Minister as volatility heightens, especially as USD/JPY approaches 156.

Key Points

- USD/JPY dipped 0.62% after strong gains, showing a brief USD cooling.

- Dollar strength is fueled by fewer expected Fed cuts amid inflation fears from Trump’s policies.

- Fed Chair Powell’s cautious stance reduces December cut odds below 50%, bolstering USD appeal.

USD/JPY Daily Price Analysis – 15/11/2024

The USD/JPY closed at 156.278 on Thursday, marking a 0.52% gain from its open of 155.475. Today, however, the pair opened at 156.277 but has dipped to 155.304, reflecting a 0.62% decrease. This reversal underscores a momentary cooling in USD strength against the yen, which has seen significant downward pressure in recent weeks as it approached levels that could trigger Japanese intervention.

Dollar Strength and Fed Rate Expectations

The U.S. dollar has experienced a robust weekly gain, buoyed by expectations of fewer Federal Reserve rate cuts due to inflationary pressures potentially resulting from Trump’s upcoming fiscal policies. His plans around tax cuts and tariffs are widely perceived as inflationary, prompting investors to reconsider the pace of potential Fed rate cuts.

Fed Chair Jerome Powell has echoed a sentiment of caution, reinforcing the Fed’s data-dependent stance but acknowledging that economic growth, a strong labor market, and persistent inflation make aggressive cuts less probable. Consequently, market participants have recalibrated their rate cut expectations, with the likelihood of a December cut now below 50%, down from nearly 82%.

The DXY index remains near a one-year high at 106.81, marking an almost 1.8% increase this week. This index reflects growing confidence in the dollar as a safe-haven currency and has significant implications for the USD/JPY pair.

Yen Weakness and Potential for Japanese Intervention

The yen has depreciated to levels that historically have triggered intervention by Japanese authorities. USD/JPY reached 156 in the previous session, marking an 11% decline in the yen’s value since September. This sustained depreciation has heightened volatility concerns, with Finance Minister Katsunobu Kato indicating that Japan may intervene to curb further weakness.

The swift decline is not just a function of domestic economic factors but also reflects the yen’s struggle to maintain parity against a resurgent dollar. With Japan’s economy still facing growth challenges and low inflation, the yen has been pressured against the backdrop of stronger U.S. fundamentals.

Analysts have pointed out that intervention considerations are now critical, particularly given the yen’s quick decline. The pace at which the yen has weakened amplifies concerns that Japan might soon take “appropriate action” to address excessive currency moves.

USD/JPY’s decline today to 155.304, a 0.62% decrease, hints at profit-taking on recent highs and cautious sentiment among traders as they await potential signals from both Japanese authorities and the Fed.

Key Economic Data and News to Be Released Today

For today, Core Retail Sales and Retail Sales m/m data from the U.S. are anticipated, which could influence USD/JPY. Core Retail Sales m/m is expected at 0.3%, down from a previous 0.5%. While Retail Sales m/m is expected at 0.3%, slightly lower than the previous 0.4%.

While the anticipated numbers are slightly lower than prior data, any surprises could impact the pair. Stronger-than-expected retail sales could support the dollar, reinforcing the Fed’s cautious approach on rate cuts. Conversely, weaker sales could pressure the USD, potentially giving the yen some breathing space amidst intervention concerns.

USD/JPY Technical Analysis – 15/11/2024

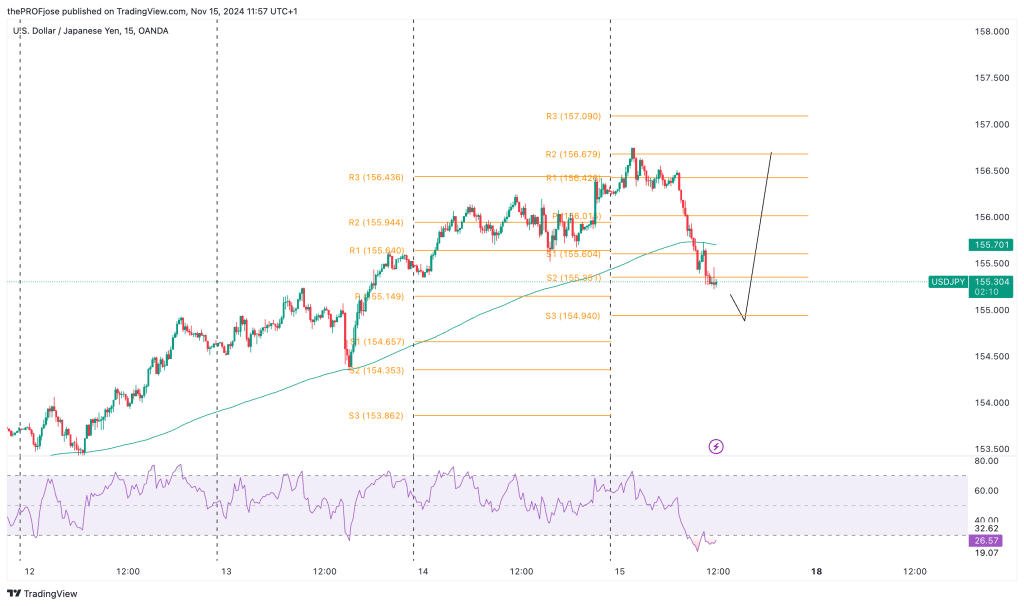

USD/JPY dropped significantly earlier in today, going even below the 200 EMA but does this sudden drop mean the uptrend is over? In our opinions, no. Rather, what we are seeing on the pair today is more or less of a pullback to a bullish point of interest.

The RSI shows that price is oversold, giving us enough reasons to look forward to an upward reversal in price. Although the intraday momentum is clearly bearish, the overall trend is bullish. So, what do we do in this kind of situation? We await further confluence.

So, if the price goes back to close above the 200 EMA, it is safer for short-term traders to start opening long positions, otherwise, it’s better to sit on one’s hand and wait for a clearer setup.

USD/JPY Fibonacci Key Price Levels 15/11/2024

Short-term traders planning to invest in USD/JPY today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 155.604 | 156.426 |

| 155.351 | 156.679 |

| 154.940 | 157.090 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.