The yen depreciated following BoJ comments on future bond purchase reductions, causing fluctuations and touching its weakest level in over a month during Asian trading.

Key Points

- USD/JPY rose 0.17% yesterday, closing at 157.006 from 156.732.

- Today, the pair opened at 157.006 and is trading at 157.094, up 0.04%.

- Focus today is on the Michigan Consumer Sentiment Index and FOMC comments.

USD/JPY Daily Price Analysis – 14/06/2024

On Thursday, USD/JPY closed at 157.006 after opening at 156.732, marking a modest increase of 0.17%. This upward movement was influenced by market reactions to various economic indicators and global market sentiments.

Today, the USD/JPY opened at 157.006 and is currently trading at 157.094, reflecting a slight increase of 0.04%. Early in the session, the pair experienced volatility, dropping to a low of 156.932 before climbing to 157.262 ahead of the BoJ’s monetary policy decision.

The yen’s depreciation followed comments from the Bank of Japan (BoJ) suggesting a future reduction in bond purchases, which signaled a cautious approach to policy tightening. This announcement caused fluctuations in the pair, with the yen touching its weakest level in over a month during Asian trading before recovering slightly in early European trading.

Key Economic Data and News to Be Released Today

Later today, the focus will shift to the US economic calendar, particularly the Michigan Consumer Sentiment Index, expected to rise from 69.1 to 72.0 in June. Investors will also keep an eye on the Michigan Inflation Expectations Index and any commentary from FOMC members, especially Austan Goolsbee. His remarks on inflation and interest rate hikes could significantly impact USD/JPY movements. Additionally, global market sentiment remains risk-averse, with falling equities and strong bond bids, which could continue to influence the pair’s trading range.

The Michigan Consumer Sentiment Index will be a critical indicator for today. A stronger-than-expected reading could bolster the USD, pushing USD/JPY higher. Conversely, any signs of persistent inflation concerns from the Michigan Inflation Expectations Index or hawkish comments from FOMC members could lead to increased volatility.

USD/JPY Technical Analysis – 14/06/2024

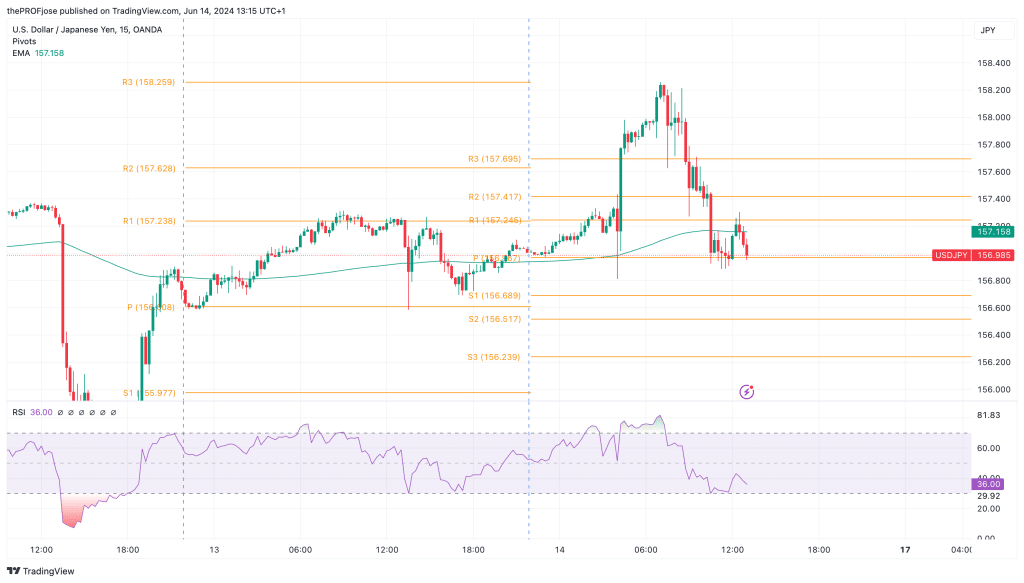

From technical analysis perspective, the USD/JPY pair is currently consolidating, following significant moves both to the upside and the downside earlier today. Looking at the price reaction with the intraday 200 EMA, price direction is still unclear.

The RSI trading close to the oversold level suggests that although price may be bearish, the direction may be turning to the upside soon. The current consolidation, however, seems to be anticipating the USD news release that is due later today before a clear direction can be established.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.