USD/JPY started the week strong, closing at 149.752, but retraced to 149.048 in Tuesday’s session due to dollar strength and yen weakness.

Key Points

- The dollar is strong, backed by expectations of slower Fed rate cuts.

- Fed Governor Waller’s caution on cuts boosted the dollar, pressuring the yen.

- The yen is weak near 150 due to BoJ’s dovish stance and political shifts.

USD/JPY Daily Price Analysis – 15/10/2024

The USD/JPY pair started the week with a notable rise, closing at 149.752 on Monday, driven by the U.S. dollar’s broader strength in the forex market. Monday’s price action reflected a 0.42% increase from its open at 149.077, as the greenback gained momentum against major currencies. However, Tuesday’s session saw some retracement, with USD/JPY currently trading at 149.048, down 0.46% from its open of 149.827.

Dollar Strength on Fed’s Modest Rate Cut Outlook

The U.S. dollar has maintained its position near multi-month highs, underpinned by market expectations of a slower pace of rate cuts by the Federal Reserve. While inflation data for September showed a slight uptick, the resilience of the U.S. economy is giving traders pause when pricing in aggressive cuts. Current market sentiment reflects a high probability (89%) of a 25 basis point cut in November, with a cumulative 45 basis points of easing priced in for the rest of the year. This more cautious rate cut trajectory has boosted the U.S. dollar’s appeal, with the dollar index reaching 103.19, just shy of its 103.36 peak from August.

Fed Governor Chris Waller’s call for “more caution” on cutting rates further has contributed to the dollar’s strength, which has put added pressure on the yen. Traders are now paying close attention to upcoming U.S. economic data, which could further shape the Fed’s decisions and the dollar’s direction.

Yen Struggles Under Dovish BoJ and Political Shifts

On the yen side, the currency continues to struggle against the dollar, nearing the critical 150 per dollar mark. The yen’s weakness is attributed to the dovish stance of Bank of Japan Governor Kazuo Ueda, who has shown a reluctance to tighten monetary policy in the near term. Adding to the uncertainty, Japan’s new Prime Minister, Shigeru Ishiba, has opposed further rate hikes, signaling a continuation of accommodative policies.

Despite these factors, the yen showed slight strength in early European trading on Tuesday, recovering to 149.07 from Monday’s low of 149.98, its weakest level since early August. The yen has lost 3.7% this month, largely due to the widening policy divergence between the BoJ and the Federal Reserve.

Key Economic Data and News to Be Released Today

While there are no USD or Yen economic data release in sight for the day, further dovish signals from Japan’s policymakers could lead to a breach of this level, especially if the dollar continues to be supported by a resilient U.S. economy and cautious Fed rate cuts.

Traders will be closely monitoring the upcoming U.S. economic releases and any commentary from both the Fed and the BoJ. With a slim majority of economists expecting the BoJ to forgo rate hikes this year, the yen may remain under pressure in the near term.

USD/JPY Technical Analysis – 15/10/2024

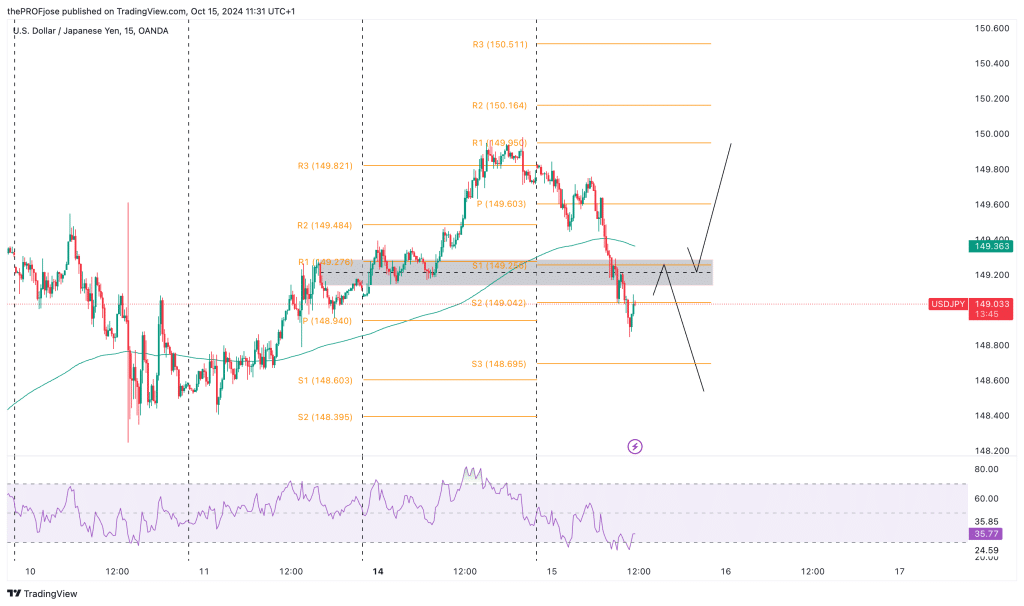

USD/JPY has crossed below the 200 EMA today, signifying a change of momentum from bullish to bearish. Despite this, the RSI has given an equally opposite signal as the indicator labeled the pair oversold.

These contrasting signals from the technical indicators open us to a dual possibility of how the price might move later today. First off, we can expect a bearish continuation if price rises to retest the support turn resistance key level above or simply bounce off the 200 EMA to the downside, as indicated in the chart below.

Another possibility that may unfold is the bullish reversal following the RSI showing that sellers are getting tired and buyers are stepping in. If the price breaks above the above key level and the 200 EMA, traders may get ready for a short-term bullish movement.

USD/JPY Fibonacci Key Price Levels 15/10/2024

Short-term traders planning to invest in USD/JPY today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 149.256 | 149.950 |

| 149.042 | 150.164 |

| 148.695 | 150.511 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.