USD/JPY showed mixed performance this week, closing at 155.430 on Wednesday and dropping to 154.503 today, reflecting a -0.60% intraday decline driven by U.S. monetary policy expectations and Japan’s intervention concerns.

Key Points

- The dollar stays strong near its one-year high, driven by inflation resilience and fewer expectations of Fed rate cuts.

- The yen nears 155.00 intervention levels, with BoJ policy speculation and inflation data fueling volatility.

- USD/JPY shows 4-hour bullish momentum, but traders await alignment with the 15-minute timeframe to go long.

USD/JPY Daily Price Analysis – 21/11/2024

The USD/JPY pair has exhibited mixed performance this week, reflecting shifts in market sentiment driven by U.S. monetary policy expectations and ongoing concerns over Japan’s intervention stance. After Wednesday’s close at 155.430, the pair opened lower at 154.658, reflecting a +0.50% change. However, today, the pair is trading lower at 154.503, representing a -0.60% intraday decline.

This decline highlights the market’s sensitivity to the strength of the U.S. dollar, which is underpinned by expectations of prolonged higher interest rates and Japan’s verbal intervention strategies as the yen hovers near levels deemed intervention territory.

U.S. Dollar Outlook and Influence

The U.S. dollar remains elevated, supported by the DXY index holding at 106.62, close to its one-year high of 107.07. This strength stems from expectations that the Federal Reserve may scale back its rate-cutting cycle amid resilient inflation.

Market pricing for a 25-basis-point rate cut next month has decreased to 55.7%, down from 72.2% a week ago, reflecting shifting sentiment toward a more hawkish Fed. This narrative has buoyed the dollar across major currency pairs, including the yen, although the USD/JPY pair’s drop today signals profit-taking or positioning ahead of key risk events.

Japanese Yen Dynamics and BoJ Factors

The yen remains under pressure near the 155.00 psychological level, prompting Japanese officials’ verbal warnings about potential intervention. While Governor Kazuo Ueda reiterated the BoJ’s data-dependent stance earlier this week, his remarks failed to sustain hawkish momentum, causing spot USD/JPY to revert higher after an initial dip.

Market participants are now eyeing key upcoming data, including Japan’s consumer inflation numbers on Friday, which could signal whether rising wages are contributing to broader inflationary pressures. Strong inflation data may increase speculation about the BoJ tightening its ultra-loose monetary policy, influencing the yen’s trajectory.

Additionally, the BoJ’s December 19 meeting and speeches by BoJ officials, such as the upcoming address by board member Toyoaki Nakamura on December 5, remain pivotal. Any indications of policy shifts could significantly impact the USD/JPY.

USD/JPY volatility is expected to increase as markets approach December 18-19, encompassing both the Federal Reserve and BoJ policy decisions. Implied volatility in USD/JPY options has surged, reflecting traders’ anticipation of significant moves. This sensitivity underscores the importance of ongoing data releases and geopolitical developments as drivers of market sentiment.

Key Economic Data and News to Be Released Today

Later today, we’re expecting the unemployment claims figures to come in. A higher-than-expected reading could dampen dollar strength, weighing on USD/JPY, while a stronger-than-expected result may reinforce expectations of tighter Fed policy, potentially boosting the pair.

Apart from this, no other significant economic data or speeches are expected from Japan or the U.S. today that could impact USD/JPY movement substantially.

USD/JPY Technical Analysis – 21/11/2024

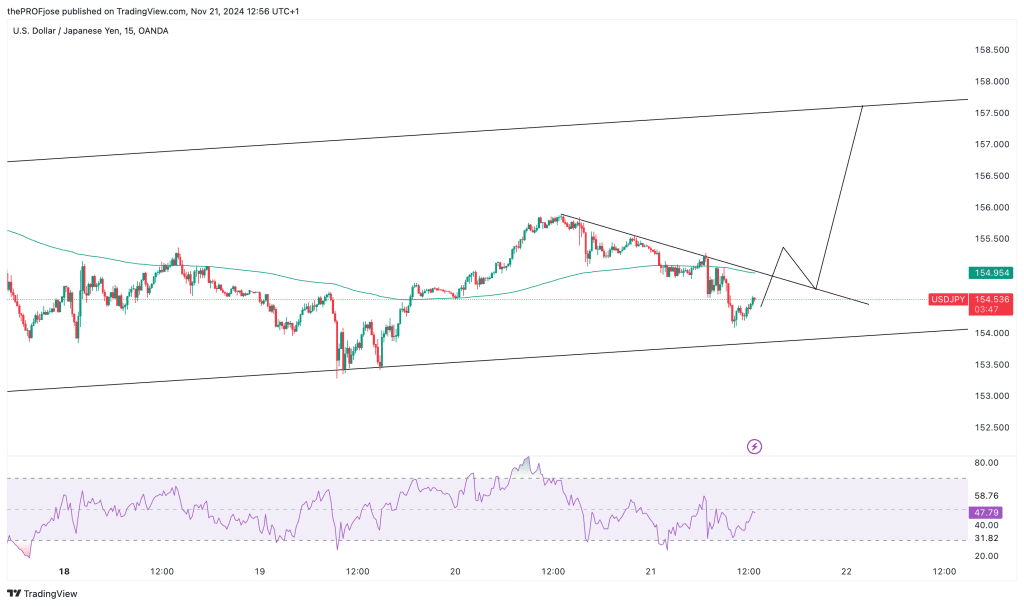

Usd/JPY is currently bearish on the 15-minute timeframe. However, there’s still some bullishness to the market. Generally, these kinds of price action is not an easy call. So, let’s break it down.

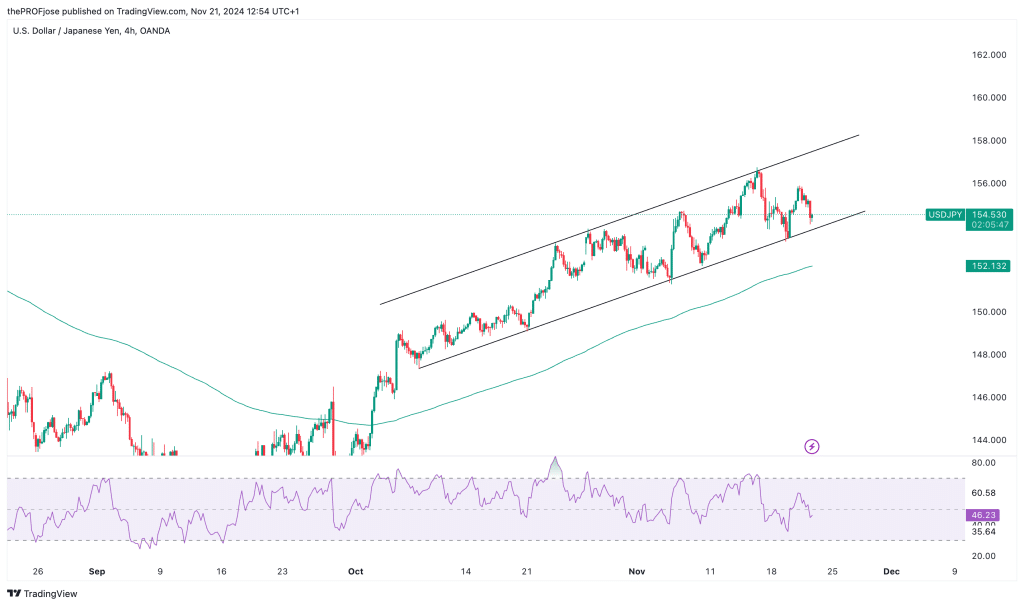

On the 4-hour timeframe, the price has been trading in a rising channel, giving up a strong bullish overall bias, as seen above.

But coming down to the lower timeframe, we see that the price is going through an exhaustion phase, where we see a little bit of pullbacks or consolidation before the price explodes to the upside to continue its bullish momentum.

So, what do we do here? Because we are looking to go long on this pair, we will have to sit on our hands strategically. The lower timeframe is currently bearish, while the higher timeframe is bullish. We simply have to wait for the bias on the 15-minute timeframe to match the 4-hour bias. In that case, the best spot to buy the market will be after the price has broken above the bearish trendline, as shown above.

USD/JPY Fibonacci Key Price Levels 21/11/2024

Short-term traders planning to invest in USD/JPY today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 154.764 | 155.803 |

| 154.443 | 156.124 |

| 153.923 | 156.643 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.