The USD/JPY pair is currently trading at 140.176, down 0.45% from today’s open, reflecting heightened expectations of an aggressive interest rate cut from the Federal Reserve this week.

Key Points

- Markets now see a 60% chance of a 50 basis point Fed rate cut, weakening the dollar and lowering Treasury yields.

- The Bank of Japan is expected to hold rates steady, but growing sentiment for higher rates is strengthening the yen by narrowing the U.S.-Japan interest rate gap.

- Technical analysis indicates a bearish USD/JPY trend, with the pair below the 200 EMA and RSI under 50.

USD/JPY Daily Price Analysis – 16/09/2024

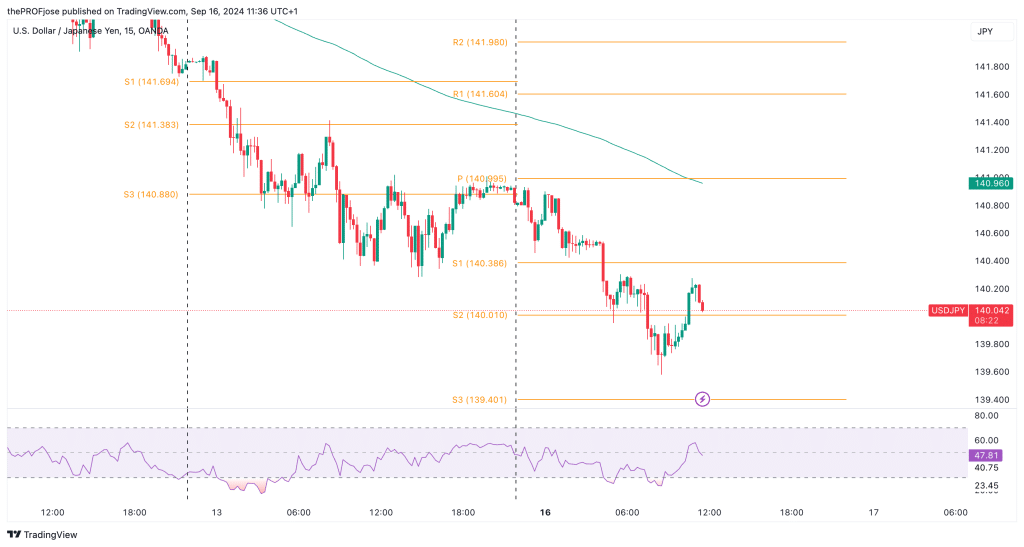

The USD/JPY pair is currently trading at 140.176, down from today’s open of 140.805, marking a 0.45% decline. This follows Friday’s sharp drop, where the pair closed at 140.822, down 0.70% from the open of 141.834. The decline in the dollar against the yen reflects heightened expectations of an aggressive interest rate cut from the Federal Reserve this week, which has pushed the yen to its strongest levels in over a year.

Fed Rate Cut Speculation Drives Dollar Weakness

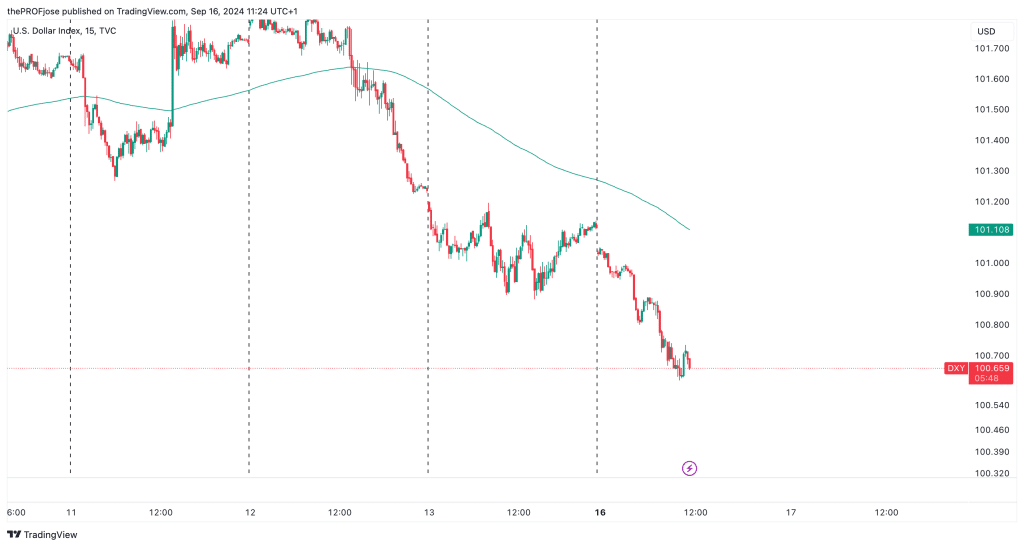

The market is increasingly betting on a 50 basis point rate cut at the Federal Reserve’s September 17-18 meeting, with futures markets pricing a 60% chance of such a move. This marks a significant shift from last week when only a 15% chance of a larger cut was anticipated. The uncertainty surrounding the size of the cut—whether it will be 25 or 50 basis points—has weighed heavily on the dollar, pushing it down to its current levels. The dollar index (DXY), which measures the greenback against a basket of six major currencies, has fallen by 0.3% to 100.69.

The softer U.S. dollar is also tied to declining U.S. Treasury yields. The benchmark 10-year yield has dropped by 30 basis points in the last two weeks, while the two-year yield, which is more sensitive to monetary policy expectations, has fallen from 3.94% to around 3.55%. The drop in yields has made selling the dollar for the yen an attractive trade, as speculators align with the trend of a weakening dollar ahead of the Fed’s decision.

Bank of Japan’s Policy Outlook Adds Further Yen Support

While the Fed is expected to lower rates, the Bank of Japan (BoJ) is likely to hold its short-term policy rate steady at 0.25% at its Friday meeting. However, there is a growing sentiment among BoJ board members favoring higher rates, which has already led to two rate hikes this year. This policy divergence between the BoJ and the Fed is narrowing the interest rate differential between the U.S. and Japan, further strengthening the yen.

The yen’s strength is also being fueled by the unwinding of yen-funded carry trades, which had been widely used when the U.S.-Japan rate differential was larger. As expectations grow for higher rates in Japan and lower rates in the U.S., this gap continues to shrink, providing additional upward pressure on the yen.

USD/JPY Technical Analysis – 16/09/2024

USD/JPY has continued its bearish trend this week. The pair is currently trading below the 200 EMA. Although the price is currently retracing, a bearish continuation is more probable in the short term.

The RSI has crossed below the 50 level into a bear-dominated zone. This also can be considered as a weak bearish confluence for a short trade.

USD/JPY Fibonacci Key Price Levels 16/09/2024

Short-term traders planning to invest in USD/JPY today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 140.386 | 141.604 |

| 140.010 | 141.980 |

| 139.401 | 142.589 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.