GBP/USD opened at 1.29691 and is currently at 1.29706, showing a modest increase of 0.02% driven by risk-on sentiment and expectations of dovish Fed moves.

Key Points

- The 200 EMA below the current price indicates a bullish trend, with RSI at 61.11 suggesting further gains.

- Ongoing risk-on sentiment and dovish Fed expectations underpin GBP’s strength against the USD.

- The US Retail Sales report today and the UK CPI report tomorrow are key to GBP/USD direction.

GBP/USD Daily Price Analysis – 16/07/2024

On the previous trading day, GBP/USD closed at 1.29682, opening at 1.29693 and marking a slight decline of 0.16%. This minor drop was influenced by a strengthening USD across the board following mixed economic data from the US. The soft US CPI report, coupled with benign Jobless Claims figures, had initially weakened the USD, but a later adjustment in market sentiment slightly bolstered the dollar’s position.

Today, GBP/USD opened at 1.29691 and is currently trading at 1.29706, representing a modest increase of 0.02%. The pair has shown resilience despite the mild fluctuations, primarily due to the ongoing risk-on sentiment as market participants anticipate more dovish moves from the Federal Reserve. The expectation of at least two rate cuts by the Fed without alarming recession signals continues to underpin the GBP’s strength against the USD.

Key Economic Data and News to Be Released Today

The US Retail Sales report due later today is expected to provide further direction. If the data comes in stronger than expected, it might provide some support to the USD, potentially capping the GBP/USD’s gains. Conversely, a weaker retail sales figure could amplify the current bullish momentum for the GBP.

Tomorrow, the UK CPI report is expected, which could be crucial in shaping market expectations about the Bank of England’s monetary policy. Any significant deviation from the forecast could result in heightened volatility. Additionally, Fed’s Waller’s speech tomorrow will be closely watched for insights into the Fed’s future policy direction. On Thursday, the UK Labour Market report and the latest US Jobless Claims figures are scheduled, followed by the UK Retail Sales data on Friday.

GBP/USD Technical Analysis – 16/07/2024

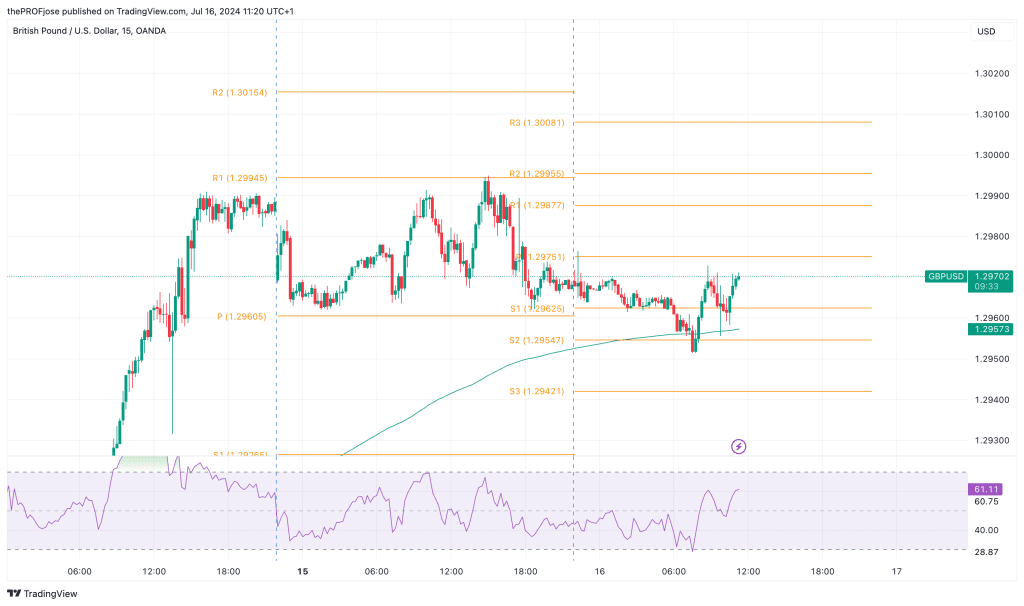

Looking at the GBP/USD chart, we can see that the 200 EMA is positioned below the current price, suggesting a bullish trend. The price has rebounded off the support level near the 200 EMA, which typically indicates strong buying interest at these levels.

The RSI is currently at 61.11, which is above the neutral 50 level but below the overbought threshold of 70. This suggests that while the GBP/USD pair is experiencing upward momentum, it is not yet in overbought territory, leaving room for further gains before any potential reversal.

In the short term, the GBP/USD is likely to test the R1 level at 1.29877. If it breaks through this level, the next target would be R2 at 1.29955. However, traders should watch for any bearish divergence in the RSI or any reversal patterns near the resistance levels, which could signal a potential pullback.

GBP/USD Fibonacci Key Price Levels 16/07/2024

Short-term traders planning to invest in GBP/USD today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 1.29625 | 1.29877 |

| 1.29547 | 1.29955 |

| 1.29421 | 1.30081 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.