Weakness in the US dollar, driven by expectations of a Fed rate cut, continues to support silver prices as a hedge against inflation.

Key Points

- Silver saw mixed movement, with a 0.20% gain Monday and a 0.45% drop Tuesday.

- Geopolitical tensions and industrial demand, especially solar, boost silver’s outlook.

- Today’s U.S. retail sales data could further weaken the dollar, affecting silver.

Silver Daily Price Analysis – 17/09/2024

Silver has experienced notable price fluctuations over the last two trading days, reflecting a broader mix of industrial demand pressures, US dollar movements, and investor sentiment. On Monday, silver closed at $31.135, representing a modest 0.20% gain, buoyed by positive investor sentiment and a weaker US dollar.

However, Tuesday saw a reversal, with prices opening at $31.070 and dropping by 0.45% to a current value of $30.995, suggesting some profit-taking or market consolidation ahead of key events coming up this week.

US Dollar Weakness and Fed Rate Cut Anticipation

One of the primary drivers for silver’s recent moves is the ongoing weakness in the US dollar. Expectations surrounding a potential rate cut by the Federal Reserve have been pivotal in this trend. According to the CME Group’s FedWatch Tool, the market is pricing in over a 60% probability of a 50-basis-point rate cut, expected to be announced on Wednesday. Despite slightly stronger-than-expected US manufacturing data, the dollar continues to face selling pressure, increasing the appeal of silver as an inflation hedge.

With investors bracing for a dovish Fed stance, silver’s safe-haven status becomes more attractive. Lower interest rates generally reduce the opportunity cost of holding non-yielding assets like precious metals, thus supporting demand. A further rate cut would likely intensify the dollar’s decline, potentially benefiting silver in the short to medium term.

Geopolitical and Industrial Demand Factors

In addition to monetary policy, the geopolitical landscape and rising industrial demand are key forces driving silver’s price action. Heightened geopolitical tensions, particularly surrounding global trade and concerns about China’s economic outlook, continue to keep investors cautious. Silver, widely used in solar energy and medical technologies, benefits from these trends.

The ongoing global push toward renewable energy sources, including the rapid adoption of solar technology, has bolstered demand for silver, enhancing its bullish outlook despite recent short-term setbacks.

The performance of China Silver Group (HKG:815) also adds an interesting layer to the silver market. Shares of the company have surged 15% over the past week, signaling optimism for silver producers. However, long-term structural concerns remain for the company, with a 74% decline in stock price over the last five years and a -12% annualized return.

Key Economic Data and News to Be Released Today

Later today, the U.S. will release critical economic indicators: Core Retail Sales m/m and Retail Sales m/m. The Core Retail Sales are expected to increase by 0.2%, down from the previous 0.4%. These figures are crucial as they provide insight into consumer spending, a significant driver of the U.S. economy.

If retail sales come in weaker than expected, it could bolster expectations for a Federal Reserve rate cut, further weakening the U.S. dollar. A softer dollar typically makes silver more attractive to investors as it lowers the cost for holders of other currencies. Conversely, stronger-than-expected retail sales could diminish the likelihood of an aggressive rate cut, potentially strengthening the dollar and putting downward pressure on silver prices.

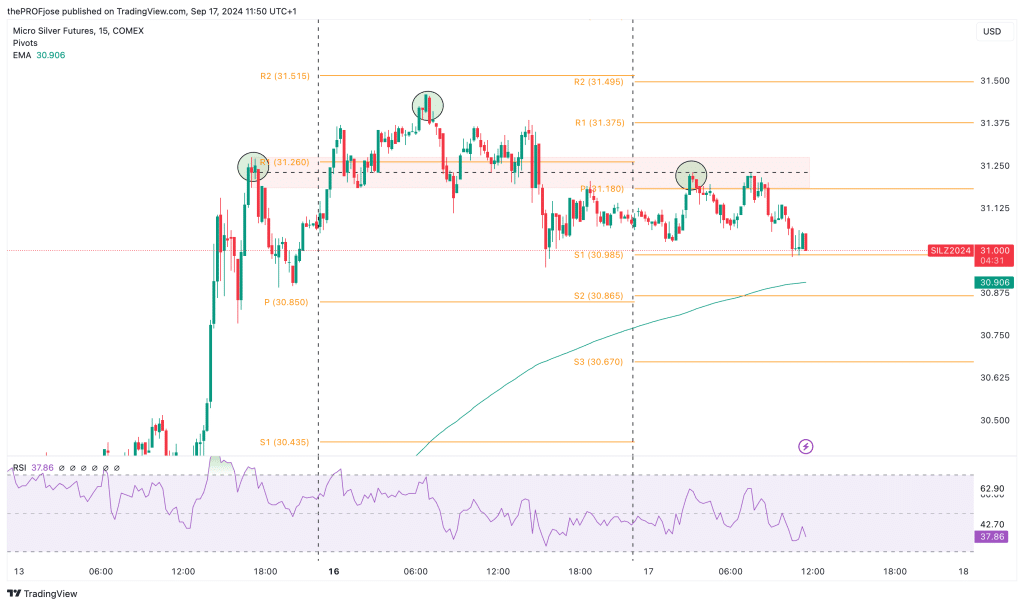

Silver Technical Analysis – 17/09/2024

Price action on the Silver today is a little dicey and might appear to be complicated. For instance, on one hand, price is above the 200 EMA, and at a support level, indicating a bullish environment.

On the other hand, the price is forming a clear bearish head and shoulder pattern, indicating a bearish environment. The RSI also seems to further confirm a short-term bearish movement till the metal is oversold.

In these kinds of scenarios, it is better to wait for further confirmation before deciding to open a position either to the upside or to the downside.

Silver Fibonacci Key Price Levels 17/09/2024

Short-term traders planning to trade XAG/USD today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 30.985 | 31.375 |

| 30.865 | 31.495 |

| 30.670 | 31.690 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.