Key Points

- A heat wave is predicted for the US Northeast. This may drive extensive demand to NG.

- Wednesday’s CPI and Fed Announcements are likely to impact NG pricing. Also, Thursday’s EIA stocks report will spike short-term volatility.

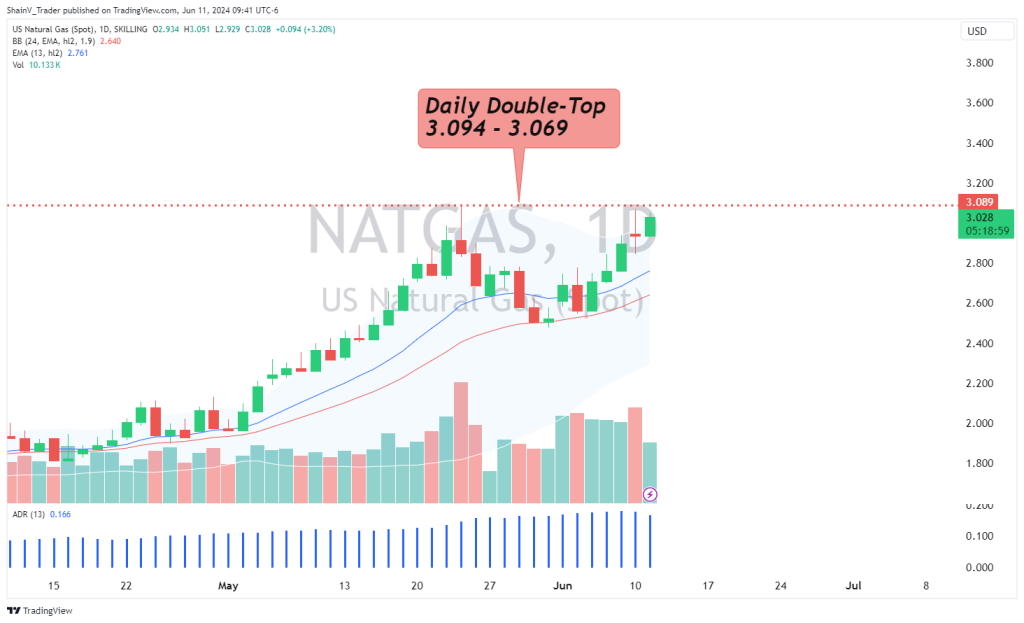

- The Daily Double Top (3.094 – 3.069) is the key zone to watch in the NATGAS CFD.

Market Overview

2024 has been a fascinating year on the natural gas (NG) market. Traditional pricing influences such as seasonality have not applied. New dynamics, including the artificial intelligence boom and extreme weather patterns, have become primary market drivers. The result? A bullish spring season, with prices almost doubling since mid-April.

Hot Weather Outlook

The growing dependence on natural gas as an electricity source has been evidenced by the recent onset of hot weather. Analyst Gary Cunningham of Tradition Energy sums the current weather/natural gas situation up:

“Frequent revisions to the weather outlooks for the balance of the month [June] have caused some significant swings in gas demand outlooks.”

Last week, several extreme heat warnings were issued for the Southwest United States. This brought bidders to the market in anticipation of growing NG demand for cooling purposes. Now, temperatures are estimated to be consistently above 90 degrees Fahrenheit in heavily populated areas of the US Northeast by week’s end. Once again, the hot weather is expected to spike electricity and natural gas demand.

EIA Inventories For Thursday

The US Energy Information Administration (EIA) is due with its weekly underground storage report on Thursday. Last week, supplies came in well above estimates, suggesting that a standard springtime build was in effect. Despite the supply growth, NG prices rose, eclipsing the 3.000 threshold.

Traders eagerly anticipate this Thursday’s 10:30 AM EST EIA number to see if stocks rose past last week’s 98 billion cubic feet. If so, the bullish heat-wave pricing of natural gas may be held in check. Conversely, a major draw on supplies may send prices even higher.

Technical Outlook

At press time, the natural gas CFD NATGAS is in rotation just above 3.000. This is a huge psychological barrier that is acting as downside support.

Over the past two weeks, NG is up nearly 20%. Accordingly, the trend is up and buy-side entries are advised. Be on the watch for a bullish breakout above the Daily Double Top at 3.094 – 3.069. If price takes out this zone, a rally to 3.250 isn’t out of the question.

For the time being, a bullish bias toward NG is warranted. Nonetheless, this may soon change. Wednesday is a huge day on the economic calendar, with CPI and the Fed Announcements hitting newswires. If these events spark a hawkish USD, then some short-term bearish action in natural gas is likely. Either way, it’s best to be ready for anything in NG over the next 48 hours.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.