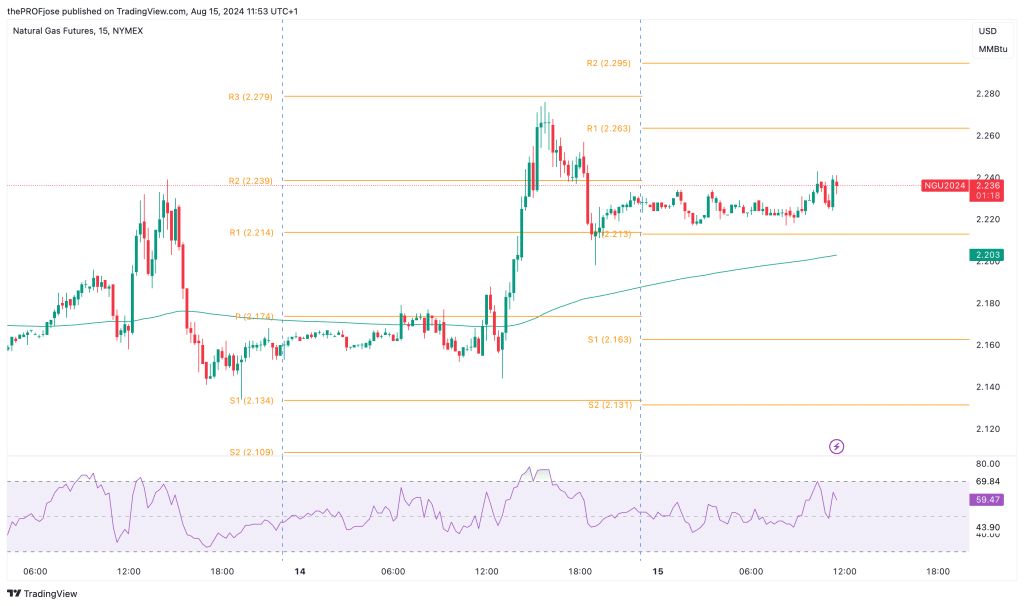

Technical analysis suggests that natural gas prices may consolidate between $2.214 and $2.263, with potential for further gains if resistance is broken.

Key Points

- Natural gas hit a three-week high at $2.219, boosted by forecasts of hotter U.S. weather.

- Today’s price increased slightly to $2.226, continuing yesterday’s bullish momentum.

- The EIA storage report, expecting a 43 Bcf build, could heavily influence today’s price action.

Natural Gas Daily Price Analysis – 15/08/2024

On Wednesday, Natural Gas rallied to a three-week high, closing at $2.219, up by 3.31% from its opening price of $2.160. The surge was driven by forecasts for hotter weather across the eastern and southwestern U.S., which is expected to increase demand for natural gas as electricity providers ramp up production to meet the needs of air conditioning. This weather shift was a significant factor in the price rally, alongside expectations of a below-average increase in natural gas inventories. Analysts anticipated the weekly EIA report would show a minimal build of just 1 billion cubic feet (Bcf), far below the five-year average of 43 Bcf for this time of year.

Today, the market opened slightly higher at $2.228 but has since seen a modest increase of 0.36%, bringing the current price to $2.226. The early trading action reflects a continuation of yesterday’s bullish sentiment, though with less intensity. The natural gas market appears to be consolidating as it awaits further developments, particularly the upcoming EIA inventory report.

Key Economic Data and News to Be Released Today

Today’s price action will likely be influenced by the release of the weekly EIA natural gas storage report. The consensus expectation is for a build of 43 Bcf, which is notably higher than last week’s 21 Bcf increase but still below the five-year average. A lower-than-expected build could support prices, as it would signal strong demand amid the ongoing heatwave. On the other hand, a larger-than-expected build could put downward pressure on prices, especially as we approach the end of the summer cooling season.

In addition to the inventory data, traders are also keeping an eye on broader market sentiment. Recent U.S. inflation figures have sparked speculation that the Federal Reserve might ease its monetary policy, which has generally supported commodities. However, natural gas remains highly sensitive to weather patterns, and any shifts in the forecast could lead to increased volatility.

Natural Gas Technical Analysis – 15/08/2024

Given the technical indicators and the current market structure, natural gas prices are likely to experience a period of consolidation between the $2.214 pivot point and the $2.263 resistance. A break above $2.263 could open the door for further gains towards $2.279 and potentially $2.295. However, if prices fail to hold above $2.213, we could see a pullback towards $2.163 or even lower.

The RSI suggests that the market is not yet overbought, but it also does not show strong bullish momentum, indicating that while there is room for an upside, it might be limited unless accompanied by strong fundamental catalysts, such as a bullish EIA report or continued heatwave forecasts.

Natural Gas Fibonacci Key Price Levels 15/08/2024

Short-term traders planning to invest in NG today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 2.163 | 2.263 |

| 2.131 | 2.295 |

| 2.081 | 2.345 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.