How Much Should I Risk Per Trade in Forex?

One of the biggest questions any trader faces is, “How much should I risk on each trade?” Well, the answer isn’t so simple. There is no “fixed dollar risk amount” that all traders adhere to. To truly answer this question, you must factor in your trading account balance, strategy, and risk tolerance.

Read on to learn more about per-trade risk management and how to maximize the profit from your trading capital.

What is Per-Trade Risk Management?

For active traders, one of the best ways of managing risk is on a per-trade basis. While it’s important to view profitability within the context of longer time frames, it’s also crucial to respect the risk posed by every trade. So, how can we do that? Ensuring that a single trade doesn’t place the trading account in undue danger. In other words, don’t bet it all on one roll of the dice!

A good per-trade risk management plan clearly defines the following:

- The trade’s maximum loss: Defining your maximum loss on a given trade is vital before you take it. Typically, this involves locating an astute stop-loss location for each trade.

- The trade’s capital outlay: You must know how much trading capital it will take to properly execute a trade before diving into the forex market.

- The trade’s potential realized P&L: Each trade may be executed according to prudent money management principles (More on that in a minute!).

From a practical standpoint, the forex market is a dynamic atmosphere with countless possibilities. Therefore, every forex trader has many potential profit and loss outcomes.

In reality, you may make a lot of money, lose a lot, or hover near break-even with your trades. However, there is one thing for certain — without risk management, your trading capital is in jeopardy!

What is Money Management?

Money management is the process of monitoring the impact of financial transactions. This means many different things, as individuals, corporations, banks, and even governments actively manage their finances. If they don’t, insolvency and bankruptcy aren’t too far away!

Whether one is investing, swing trading, or day trading currencies, money management is the study of capital inflows and outflows. Money comes in when you succeed and out when you fail; that’s all there is to it.

Get the Most From Your Money

Forex money management’s primary goal is to maximize your trading capital’s potential. To do so, it aligns risk to reward and makes sure that no one trade can blow out the trading account. Contrary to risk management, money management puts a hard dollar value on the risk assumed during each trade, session, week, month, or year.

For active forex traders, money management is the implementation of rules designed to preserve and grow the trading account. These rules are typically applied on a per-trade basis via the parameters listed below:

- Only trading strategies with positive expectations are implemented.

- Single trade losses are manageable and viewed as a “part of doing business.”

- Per trade profits and losses are relative and designed to promote long-run success.

- Leverage is applied respective of account size.

- A stop loss value or price point is applied.

One of the great things about forex trading is that there are no concrete rules. The “right” way to trade is one that makes money! Nonetheless, to be consistently profitable, you must aggressively manage your money and ensure that no one trade sinks your entire operation.

How Much Should You Risk Per Trade?

Now that we know a bit about per-trade risk management and money management, we can talk about how much to risk per trade. Once again, there’s no clear-cut answer to this question. The most popular answer is to limit your risk to 2% per trade. But even that may be too high-risk for newbie retail traders.

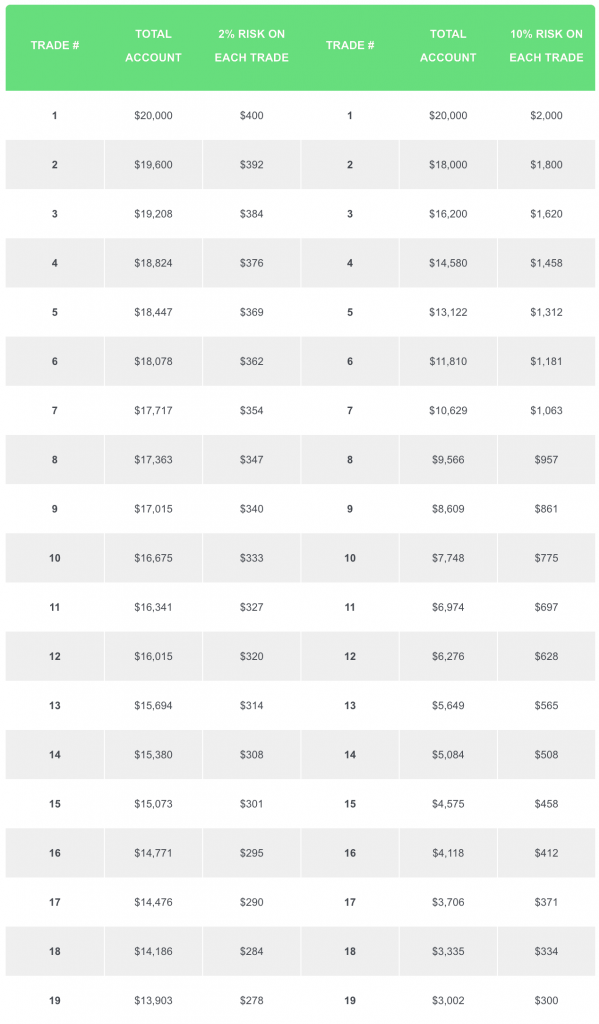

Let’s defer to the hard statistics. Take a quick look at this table showing the difference between risking 2% of your capital per trade and risking 10% percent. The stats don’t lie; the greater your risk appetite, the greater your chance of going bust!

It’s clear that there’s a HUGE difference between risking 2% vs risking 10% of your capital on just a single trade. Remember, it really doesn’t matter if you are scalping, day trading, or investing for the long haul — the more you risk, the greater your exposure. Take our word for it: many forex day traders have learned this lesson the hard way!

Consecutive Losers and Your Trading Capital

When it comes to money, sometimes looking at a real-world scenario helps. Imagine that you hit a losing streak day trading and lost 15 trades in a row, risking 10% on each trade. If your starting balance was $20,000, you would only be left with $4,575. That’s over 85% of your account gone. Boom. Just like that.

On the other hand, assume that you only risked 2% on each trade. While the damage is still severe, you’d have only lost 30% of your total account and still have $13,903 in your pocket. Although you’re down nearly half of your cash, there’s still time to study the actual trading results. Perhaps adjust your trading rules? Fine-tune your stop-loss locations? Adjust your position sizes?

Expect the Unexpected

The consecutive-losers scenario is ominous. Many traders don’t even want to think about losing 15 trades in a row. You probably believe such a bad run is impossible or, at the very least, a Black Swan.

Well, these things happen. Just ask the forex day traders who worked for Long Term Capital Management (LTCM) in the 1990s. After being consistently profitable for years, the bottom fell out, and the firm lost billions. Ultimately, LTCM’s risk per trade was way too high, and a bad run cost upwards of US$4 billion.

Ok, so it’s improbable that you will lose 15 trades in a row; we’ll concede that. Nonetheless, the difference would still be significant even if you had only lost five trades in a row. And losing five trades in a row isn’t uncommon when scalping or day trading. In fact, it happens more often than you would like to think; that’s why most pros put a stop loss on every trade!

Make Your Trading System Bullet Proof

When you implement your trading strategies, you must set up your risk management rules so that when you hit a rough patch, you will still have enough $$$ to stay in the game. This means actively addressing your risk per trade and implementing stop-loss orders.

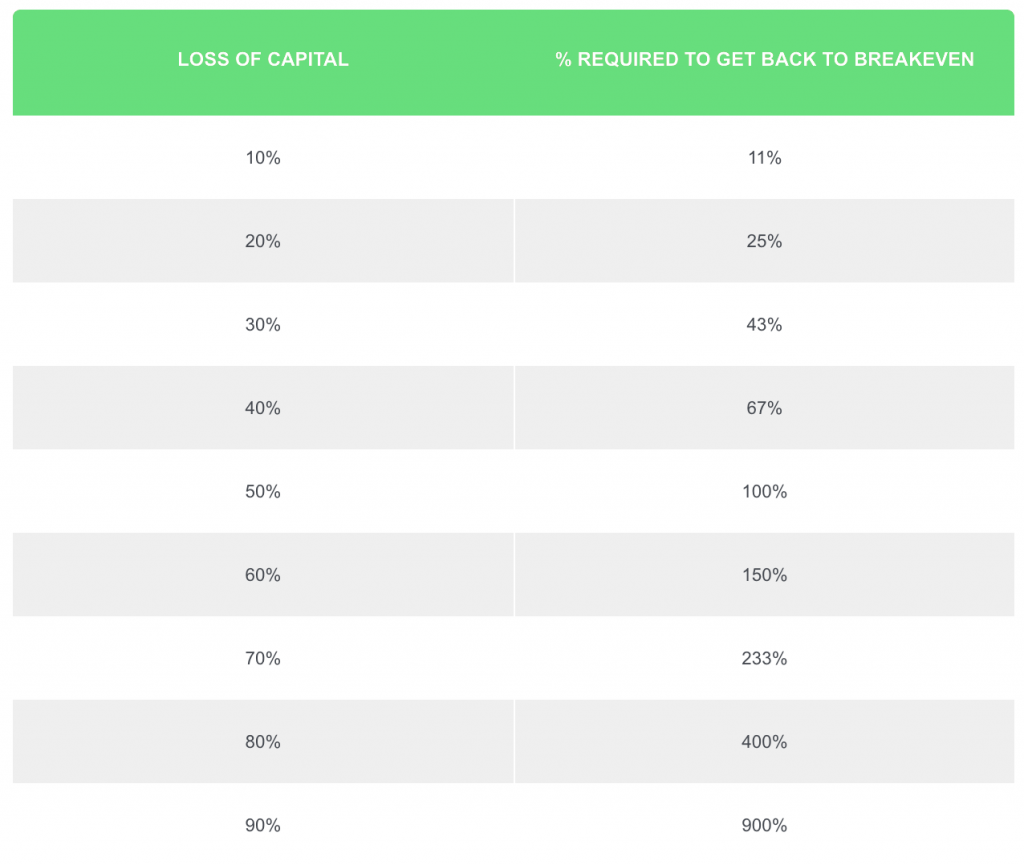

Can you imagine losing 80% of your account balance?!! You would have to make a 400% profit of your remaining balance to break even. 400%!!!!!!!!!

The table below provides several examples illustrating how much you’d have to earn to break even if you lost a certain percentage of your account balance. The truth is evident: The more you lose, the harder it is to regain your starting capital.

There’s no doubt that money and risk management are critical aspects of a successful trade. It doesn’t matter if you’re taking a long or short trade using a tight or baggy stop loss — you must apply trade-based rules that address risk. A great way to do this is by adopting a per-trade risk management philosophy.

We can’t stress this enough: PROTECT YOUR TRADING ACCOUNT.

You Are Your Own Best Stop Loss!

It’s an old saying, but it’s true: you are your own best stop loss! Only you are responsible for how much money you lose on a given trade — only you. That’s why understanding how to protect your trading account is key to growing your total capital.

From the first trade of the day to the last, you must always keep risk in check. If not, an unfortunate run of losing trade setups can spell doom for even the strongest strategy. Don’t fall victim to bad luck; adopt an approach to the market that will help you survive the worst-case scenario.

Key Takeaways

- Per-trade risk management involves defining your maximum loss per trade, calculating your trade’s capital outlay, and understanding the potential realized P&L.

- Money management is the process of aligning risk to reward and ensuring that no one trade can blow out your trading account.

- Your maximum risk per trade depends on your individual risk tolerance and trading style. However, a good rule of thumb is to limit your risk to 2% per trade. This will help protect your account from a losing streak and give you time to adjust your trading strategy if needed.

Summary

Successful traders are always mindful of their account balance and assumed risk per trade. These are critical factors driving sustainability in the marketplace. If you’re not in tune with your risk, get on top of the situation immediately.

Remember, only risk a small percentage of your account balance on any one trade. That way, if you hit a losing streak, it won’t be the end of the world!

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."