Drawdown and Maximum Drawdown in Forex

As discussed in the previous chapter, risk management in forex trading can make you money in the long run if you approach it with a good strategy and patience. Still, it is not all unicorns and rainbows.

There’s a different side to it that we will explore further in this lesson. It may not be as pretty, but you must understand the risks each trade can carry. In other words, how can you use forex drawdown to better manage the risk in your trading account?

What is Drawdown in Forex Trading?

So, if you didn’t use proper risk management rules, what could happen? There’s always a significant risk of losing money when you trade different asset classes, especially when placing trades in volatile markets.

For example, if you had $200,000 in your account and lost $100,000, how much of your overall balance would you have lost? The answer is 50%. This is what many traders call a drawdown. Your account has experienced a $100,000 drawdown.

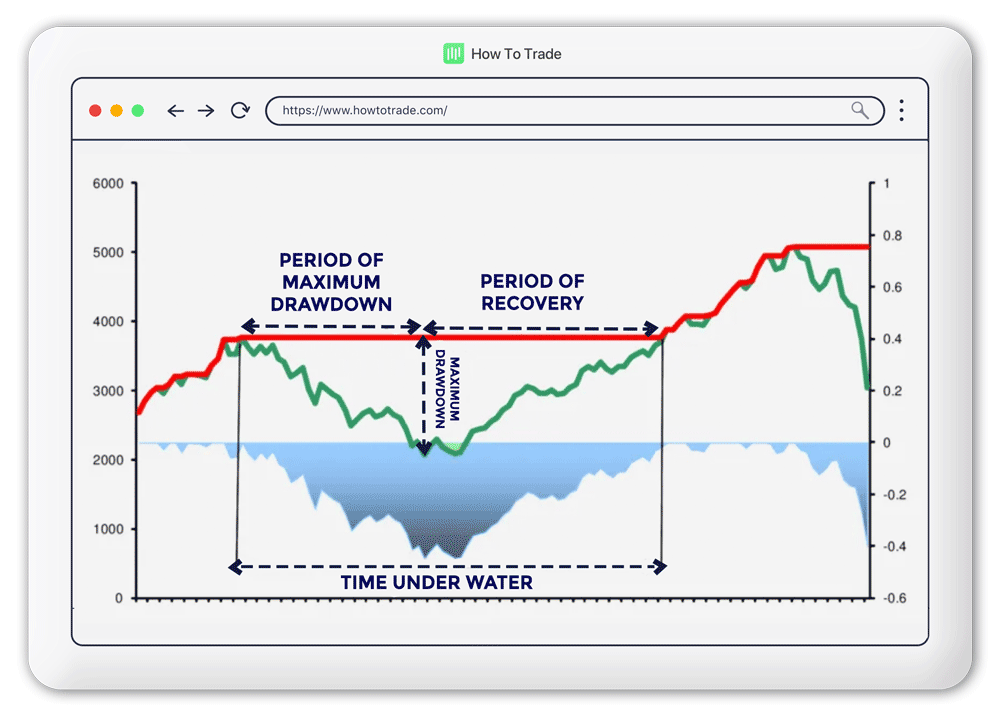

Simply put, a drawdown refers to the reduction on one’s capital after a significant amount of losing trades. It is calculated as the percentage a trader lost from the initial peak value to the new peak (or the low point at the same period).

In a simple explanation, a forex drawdown is the largest amount you lose when trading currency pairs before you start making a profit again in your trading portfolio.

The Biggest Causes of Drawdowns in Forex Trading

Several factors increase your drawdown risk and the downside volatility in a trader’s account. These include:

- Poor risk management strategy

- Greediness

- Fear of losing money

- Over-trading or revenge-trading

- Trading with too much leverage

Beyond that, you should consider that trading is a tricky business. Occasionally, even the most successful forex trader can experience a period of ’tilt,’ a poker term that refers to when a trader loses control, makes bad trading decisions, and ignores his trading plan.

In this situation, when you experience a large drawdown in your account, there’s a high risk that you will continue your losing streak. Therefore, we recommend you stop trading and return to the trading routine when you are more focused and set aside all the negativity. Also, if needed, you can use a demo account from your forex broker for several days and return to forex trading in the real live market when you regain your confidence.

What Can You Learn From a Drawdown and Losing Trades?

We forex traders always look for an edge when trading the forex market. After all, it is one of the main reasons we develop trading strategies and a trading system. Sure, a trading strategy that is 80% profitable sounds like a pretty decent edge to have. But just because it is 80% profitable doesn’t mean you will win eight out of every ten forex trades you make, and thus, a forex drawdown could occur.

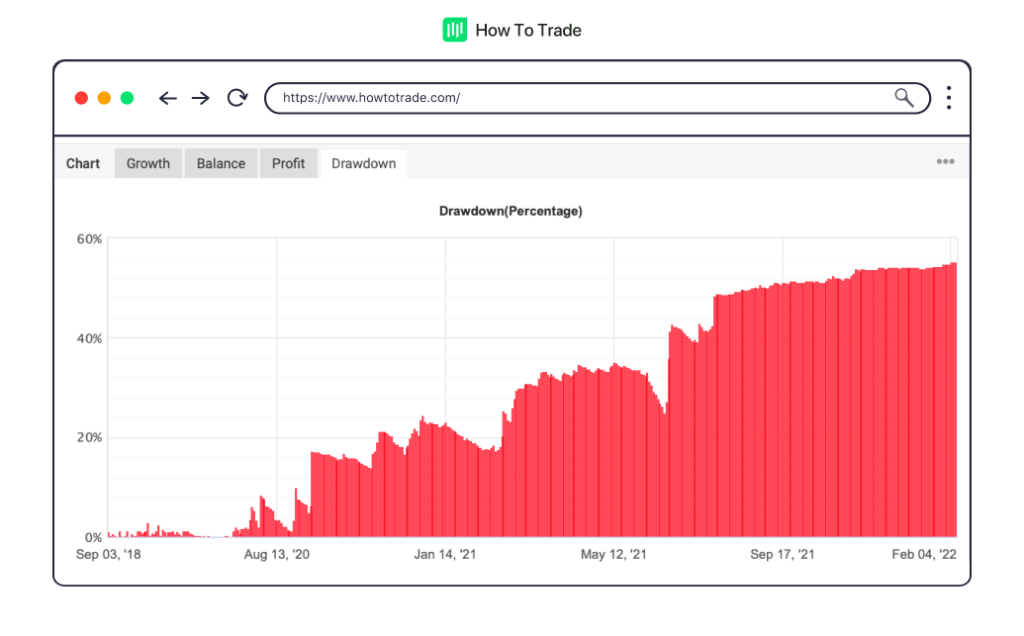

Basically, you could lose the first 20 and win the other 80 trades. That way, it is still an 80% profitable trading strategy, but it does raise some questions. For example, would you stay in the forex trading game if you lost 20 trades in a row? Do you think you have a risk tolerance for drawdown periods? And, what’s the drawdown percentage you can take in your account value to continue trading and winning trades?

And this is precisely why having your risk management strategies in place is crucial! More importantly, you need to set a maximum drawdown percentage you are willing to risk when you lose money in the markets. This is the most critical trading system many successful forex traders use – make sure you have a maximum relative drawdown amount you can lose in one trade, in one trading day, or at a specified period of time.

Because no matter what other trading system or strategy you use, you will at some point experience a losing streak when trading forex or, in general, in your trading career. There is no avoiding it. I tried.

Even the best Forex traders and the most profitable traders have losing streaks, but they still end up profitable. Why? Because they risk only a small percentage of their initial capital, analyze the drawdown risk in their account balance and use the right relative drawdown percentage to protect their trading account.

You must do this to succeed in such a vibrant and ever-changing market. Ensure you have a maximum drawdown amount of your trading capital, and always follow this rule.

Key Takeaway

- Drawdown is a common occurrence in forex trading. It is the peak-to-trough decline in a trader’s account equity during a specific period. It represents the amount of money that a trader has lost before they start making a profit again.

- Drawdowns can be caused by a number of factors, including poor risk management, greed, fear, over-trading, and trading with too much leverage. It is important to develop effective risk management strategies to minimize the impact of drawdowns.

- Traders should set a maximum drawdown limit that they are willing to tolerate. This will help to prevent them from losing too much money and will help them to stay disciplined in their trading.

Bottom Line

The bottom line is that your goal is to develop risk management tools and a trading system that will enable you to survive these periods of bigger losses. Whether you are planning to focus on forex trading and trading CFDs, or you plan to focus on the stock market trading stocks and mutual funds- setting up a maximum drawdown could help you manage how much money you are willing to lose in each bad trade.

Remember, if you practice and stick to your absolute drawdown rule, you will likely become a part of the top 1%. You need to be aware of your risk tolerance and accordingly set an absolute drawdown amount to manage the risk in forex trading.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."