How to Read a Forex Economic Calendar?

Most Forex traders use an economic calendar to stay informed with upcoming data releases and news events that can assist them in their fundamental analysis. However, it can be daunting for a forex trading beginner to understand how to use it.

Fortunately, knowing how to read the Forex economic calendar is not a science rocket, but it’s a knowledge and skill you must have in Forex trading.

So, in this lesson, we’ll show you how to read a forex economic calendar and how to integrate it into your trading strategy.

What is a Forex Economic Calendar?

A Forex economic calendar shows the scheduled economic data releases and news events related to the different economies around the world. Traders and investors use it to evaluate future monetary policy decisions and the economic growth of countries and areas from all over the world. Such data releases cover a range of information, including unemployment rates, GDP growth, inflation figures, and more.

The forex market is particularly susceptible to monetary policy announcements and significant economic events, which can lead to high volatility in currency pairs. For instance, decisions made by major central banks, such as the Federal Reserve or the European Central Bank, can cause fluctuations in currency values as they reflect the financial health and expected performance of economies.

Most Forex brokers and trading firms provide an economic calendar for retail investor accounts that covers all financial and economic events. Further, if you use the MetaTrader4, you can get an economic calendar plugin directly on the trading platform.

How to Read a Forex Economic Calendar

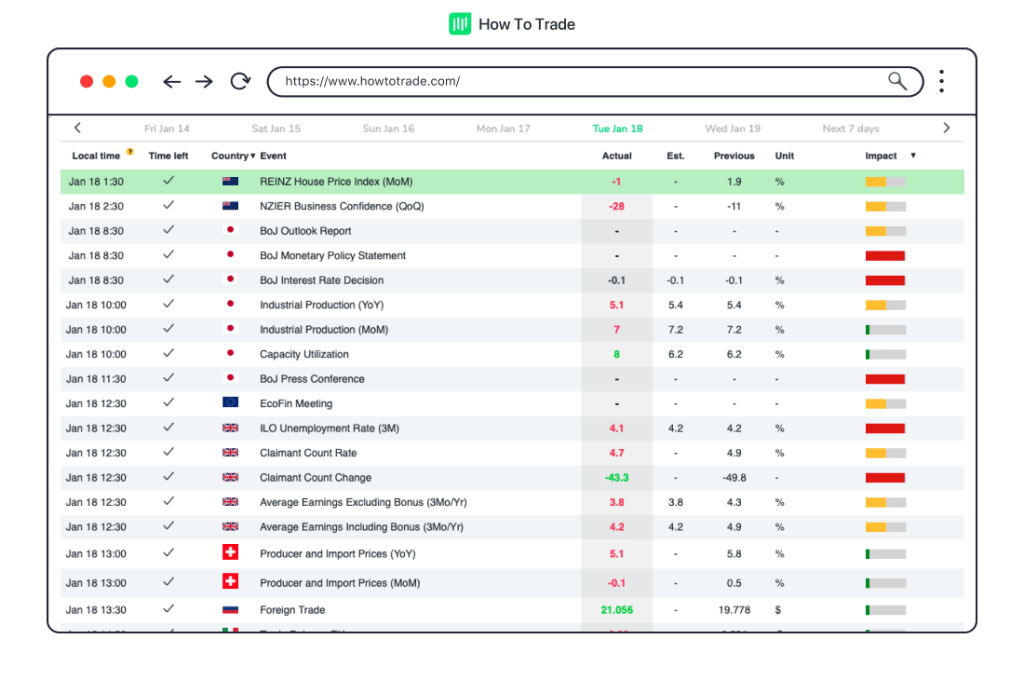

As mentioned earlier, knowing how to read a Forex economic calendar is fairly easy. The events or economic indicators are listed on the economic news calendar, and you’ll be able to see all the economic reports that were already published on the same day and the upcoming news events that are likely to impact the prices of currency pairs in the Forex markets.

Moreover, you can go back and forth through different days and weeks to see previous data releases (as seen in the image below).

Each economic event contains the following information:

- Time of release

- Country/Currency

- Event/Economic Data Release

- Actual data

- Market estimation/market expectations

- Previous data

- Unit – percentage or value

- Impact of the event

Forex economic calendars typically use color coding to signal whether the actual data is above or below market expectations for released news. Green indicates better-than-expected outcomes, while red shows worse-than-expected results. In a nutshell, most traders are looking at the actual versus forecasted values to determine their next trade.

As such, if you see a data release that is better than the expectations, you will likely see the respective currency increase in value versus other currencies. However, while this assumption is valid and true in theory, you must remember that this is not written in stone. The currency pair price may fluctuate towards both sides before taking a direction.

Also, upcoming events are color-coded according to their expected impact on the financial markets. Red-coded news will have a significant market impact, while green-coded news won’t affect the market much. Finally, yellow-coded news will have a medium impact on the forex market.

Nine times out of ten, you only need to focus on the red-coded news.

When looking at economic events, you are likely to see a time measurement next to the economic event. This could be quarterly data (Q1, Q2, etc), monthly data MoM (month on month), or yearly data YoY (year over year data).

How to Customize a Forex Economic Calendar?

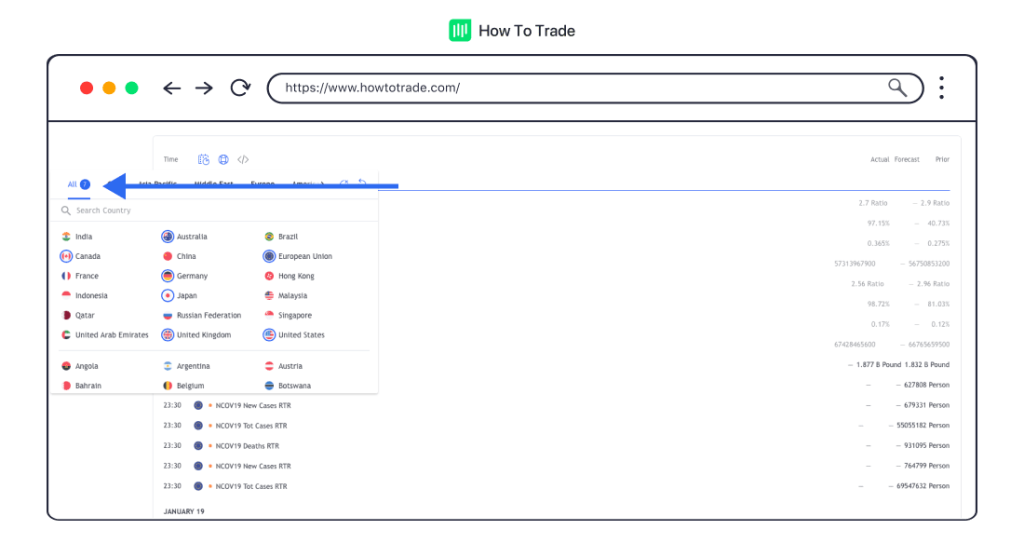

If you see lots of irrelevant economic events whenever you look at an economic calendar, there’s a way around that. These irrelevant economic events often stem from countries whose currency pairs you don’t trade.

Fortunately, many calendars enable you to customize to the markets and economies that are relevant for you.

To customize your calendar and view the most important events for your Forex trading, you’ll need to search for the Filter button. Most economic calendars have this feature. Then, you can set the Forex economic calendar so it shows you news and events coming out from the countries and zones you wish to focus on.

On the HowToTrade economic events calendar, though, you won’t find this filter button. However, you’ll be able to click any column you want to edit to see your options.

As you can see in the image below, the settings have been changed, and the economic calendar will now show you financial events from the seven chosen countries only.

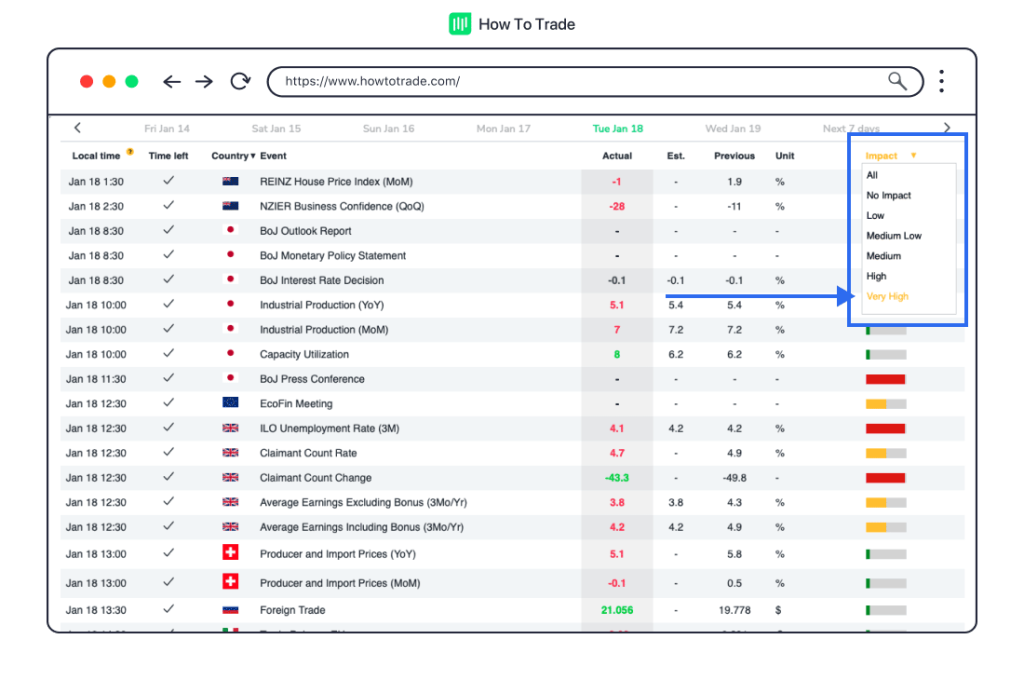

Another useful feature used by many Forex traders is to remove low-impact events from the calendar. To set this feature, click on a tab or a button on the economic calendar menu (as seen in the image below).

How to Trade Big Economic Events?

Significant events have the power to move the market, and as a Forex trader, it’s essential to have strategies in place to trade these events effectively. Here’s a detailed approach to tackling major economic announcements:

When monitoring an economic calendar, pay special attention to these key economic data releases:

- Central Bank Interest rate decisions

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI) or Inflation data.

- Consumer Confidence Index (CCI)

- Employment data

- Non-Farm Payrolls (NFP)

- Trade balances

- Retail Sales

- Existing Home Sales

- Durable Goods Orders

- Labor statistics

- Central bank meetings.

- Manufacturing reports from major economies.

These key economic events can trigger significant market movements and provide trading opportunities.

Regarding how to trade economic events – There are essentially two basic methods when trading Forex currency pairs during and after economic news releases. Let’s take a closer look at both methods.

- Directional Trading: This strategy involves taking a position immediately after an economic release based on whether the actual data betters or worsens market expectations. For instance, if the NFP report is positive, surpassing expectations, you might consider buying the US dollar against other currencies as an immediate response to capitalize on the expected increase in value.

- Post-Release Analysis Trading: Alternatively, this method requires patience, as you’ll have to wait for several minutes (usually 15-30 minutes), analyze the data, and enter a position when the price of the currency pair takes a direction. This way, you might ‘lose’ the spike and market volatility following the news release. However, you can maintain a more effective risk management system.

Key Takeaways

- A Forex economic calendar shows upcoming economic events and news related to the different economies around the world.

- Traders use the economic calendar to predict future price movements of currency pairs.

- An economic calendar lists pieces of information such as the country and currency mostly involved in the news event, the news event itself, the time of release, and the expected impact of the event.

- Some major economic indicators to look out for when trading the financial markets are interest rates, PPI, NFP, and CPI.

The Bottom Line

No matter what your trading strategy and what currency pairs you want to focus on in your Forex trading, you will find it useful to keep an eye on upcoming financial events daily.

Whether you will use fundamental or technical analysis as your trading strategy or both – having an economic calendar web page open is a must-have tool for a Forex trader. And knowing how to read and analyze economic news events on an economic calendar is the first step in evaluating the strength or weakness of a certain economy and its currency value. And ultimately, you’ll make better-informed trading decisions.

For those who plan to trade the news and focus on fundamental analysis, an economic calendar will definitely help you find triggers to enter trades in the Forex market.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."