Interest Rates in the Forex Market

Let’s start from the end. Interest rates are the driving force behind economies and our global financial system. Not only are they a significant driving force, but they’re also the product of economic efforts made by the government. Interest rates are so powerful they affect the exchange rates of currency pairs in the foreign exchange market.

In this lesson, we’ll show you how interest rates affect the forex market.

What is an Interest Rate?

Interest rate is the cost of borrowing. It’s simply the amount the borrower pays back to the lender in addition to the money they borrowed (principal). A country’s interest rate is the percentage a commercial bank or any other lender must pay when they borrow funds from the central bank or other commercial banks.

So, if you borrow $1000 at an interest rate of 1% per annum, you’ll have to repay $1100 back to the lender. The extra $100 is the interest.

Interest rate figures are important because they are useful tools in the hands of the government and central banks of a country to stimulate or slow down the economy.

How so?

The interest rate a commercial bank gets from the central bank is passed on to businesses and individuals who want to take loans. So, when interest rates are low, this will encourage lending. Businesses are more likely to take loans and spend more, stimulating the economy.

When interest rates are high, though, businesses are less likely to take loans. Instead, they go into “money-saving mode” and spend less. Because there’s less money in circulation, the economy slows.

Having said all of that, interest rates shouldn’t be too high or low. In fact, that’s one of the reasons central banks exist. Central bank interest rates are the number one way to curb inflation.

Why Do Interest Rates Matter in Forex Trading?

Now, you know that high interest rates cause the slowing of an economy, and low interest rates cause the stimulation of the economy. Typically, you would expect that a country’s value would grow when the economy is booming and slow when the economy is slowing. In the forex market, however, that’s not the case.

How?

When commercial businesses take loans or when the economy is booming, we’re likely to buy goods and products that are denominated in other currencies, thereby raising the demand for those other currencies. And that’s when a nation’s currency drops.

But when interest rates are high, money stays in banks because nobody is willing to borrow at that high rate. If the economy isn’t great, there isn’t enough for luxuries from outside the country. This causes a scarcity of that country’s currency and its value increases in the global foreign exchange market.

To put it simply, higher interest rates increase the value of a currency, and lower interest rates reduce the value of a currency.

To help drive the understanding deeper, let’s take a look at the relationship between the economic cycle and interest rates.

The Economic Cycle and Interest Rates

Normally, interest rates tend to mirror the economic cycle. A booming economy with rising inflation typically prompts the central bank to increase rates, cooling off growth to prevent an overheated economy. Conversely, during a recession, central banks lower rates to make borrowing cheaper, spur lending, and stimulate economic activities.

How to Predict Interest Rates Movements

Now that you understand the general concept of interest rates and the effect they have on capital movements around the world, you need to try to predict central banks’ next monetary policy moves. That’s the hard part.

Below, we mention several methods that can help you to predict future interest rates set by central banks.

Economic Data and Rvents

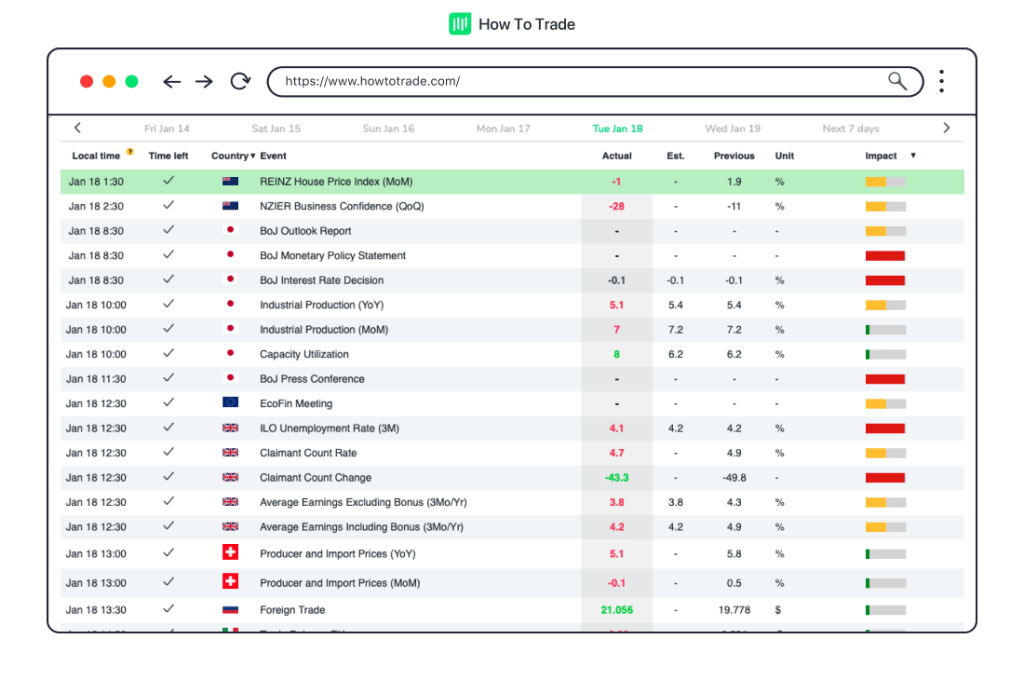

As mentioned, factors like inflation have a huge impact on forex market interest rate movements. Inflation is primarily caused by economic growth, which means that if a country releases good economic activity data, there’s a high chance for a rate hike. Simple as that. What you need to do is learn how to read an economic calendar and use different economic indicators and market news to evaluate the strength or weakness of the economy.

Some of the most important events that indicate the growth of an economy are the unemployment rate, GDP, CPI, Non-Farm Payrolls (in the US), trade balance, housing index prices, etc. Additionally, perhaps the biggest factor of all is interest rate decisions and speeches from leading central bankers.

CME FedWatch Tool

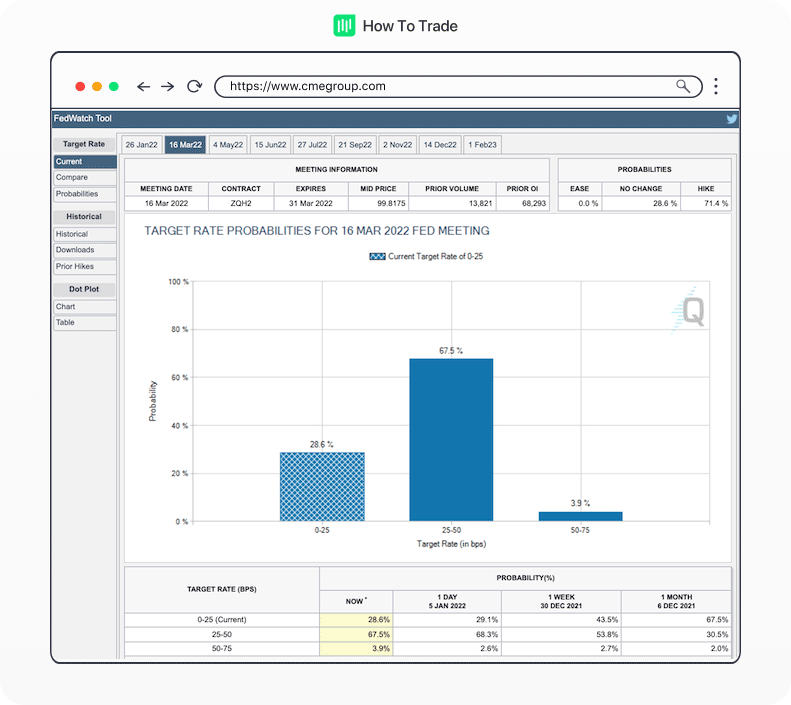

The CME FedWatch tool might be the most useful tool to predict interest rates, especially if you want to predict shifts in the US monetary policy. Ok, what is the FedWatch tool??? It is a tool offered by the Chicago Mercantile Exchange that analyzes the probability of the Federal Reserve central bank interest rate moving for the next meetings.

Nice, right?

As you can see in the image above, there’s a 94.4% chance that the Fed will leave rates at the current level of 0%-0.25% in their meeting on 26th January 2022. But… for the next meeting in March, there’s a probability of 67.5% that the Fed will increase rates to 0.25%-0.50%.

Housing, Stocks, and Commodity Prices

Another way to try forecasting the next interest rate movements is to look at the general state of the economy and think like… a central banker. After all, economists and central bankers are responsible for maintaining financial and economic stability and keeping inflation in a range of 1%-3% (although many economists believe that an inflation rate of 4%-5% is acceptable).

So, because we all want to buy a house or rent a place to live in, and we need to eat – central banks must control prices and keep housing and food prices at a fair level. I mean, these are the two most basic needs for humans. When this happens and you are able to identify rising housing and commodity prices (as well stock prices), then you can predict that central banks will increase rates in the near future.

Using Interest Rate Differential in Forex Trading

Forex traders use the interest rate differential (IRD) between two currencies to engage in what’s known as a “carry trade.” This strategy involves buying a currency with a higher interest rate and selling a currency with a lower one, allowing traders to potentially earn the interest difference as profit, regardless of market trends.

Here’s a step-by-step guide to understanding carry trades:

- Identify a High-Yielding Currency Pair: A trader seeks a pair where the purchased currency yields a higher interest rate than the sold currency.

- Assess the Interest Rate Spread: The profit potential lies in the IRD—the wider the spread, the greater the potential return.

- Enter the Position: The trader goes long on the high-interest-rate currency and short on the low-interest-rate currency.

- Collect the Differential: Over time, the trader aims to earn the difference in rates.

For instance, by buying the New Zealand dollar (with its nominal interest rate of 0.75%) and selling the Japanese yen (which has had a nominal interest rate of -0.10% since 2016), a trader stands to gain a 0.85% annual return simply from the interest rate differential.

Unfortunately, in the current market conditions, using the carry trade strategy is less attractive due to the near-zero-interest-rates-central-bank policies across the world. Nonetheless, using the carry trade and taking advantage of interest rate differentials is still one of the most popular trading strategies in the Forex markets. So, keep it in mind and use it to evaluate a currency pair exchange rate price movements.

Key Takeaways

- Interest rate is the cost of borrowing paid by a borrower in addition to the borrowed amount.

- Some of the tools with which to predict interest rates are economic data and events, the CME FedWatch tool, and the prices of commodities, housing, and stocks.

- At the end of the day, higher interest rates cause a country’s currency to gain value. Conversely, lower interest rates cause a country’s currency to lose value.

Wrapping Up

All things considered, changes in interest rates are crucial to forex traders since they have a significant impact on financial markets and Foreign exchange currency prices. And because central bank rates are already priced into currency pairs’ prices, traders usually try to anticipate the next move of central banks. In other words, it’s all about interest rate expectations.

Higher interest rates of one economy will lead to a higher valuation of its currency versus other foreign currencies, especially when considering the forex carry trade strategy used by many investors and financial institutions. So, whatever trading strategy you are going to use, following interest rate changes and interest rate expectations is vital for good fundamental analysis.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."