What is Forex Fundamental Analysis?

When we discussed the types of forex analyses in the previous course about the basics of forex trading, we pointed to fundamental analysis as one of them.

This lesson goes into deeper detail about forex fundamental analysis.

What is Fundamental Analysis?

Generally, fundamental analysis studies how external factors impact an asset’s valuation. Regarding forex, fundamental analysis investigates how market drivers influence the pricing of currency pairs. The analysis tries to understand the external factors that can affect the price of currencies and in what direction they’re likely to drive the price.

A market driver is any information that may impact a given asset’s valuation model. Market drivers come in many shapes and sizes, varying by asset class.

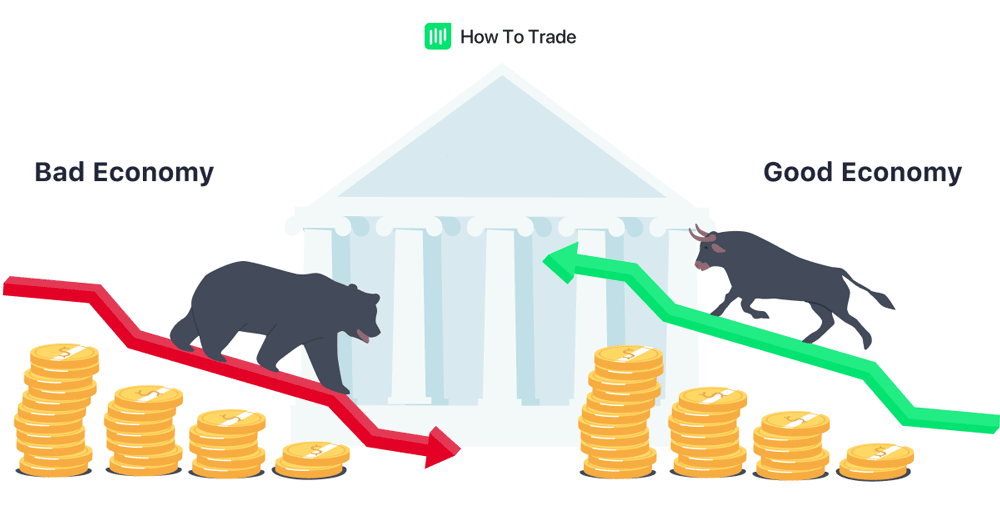

To illustrate the market driver concept, remember the 2020 COVID-19 pandemic. When nations started to enforce lockdowns, everyone was at home and not working. But when no one is working, the economy slows to a halt. Unsurprisingly, the prices of most currency pairs dropped. Why? Because the strength of any currency is the economy of its country.

The Goal of Fundamental Analysis

Remember, fundamental analysis aims to identify opportunities in the forex marketplace using external factors. You want to be able to break down the external factors into upward or downward price movements for the currency pair you’re trading.

If, for instance, the unemployment rate in the US rises dramatically, you expect this would be bad for the US economy. As a result, you believe the value of the US dollar would weaken.

For the EURUSD, where the dollar is the quote currency, you would buy. Why? Because you expect the value of the dollar to weaken so that it costs more of it to equal one Euro. But you’ll sell for a pair like USDJPY, where the dollar is the base currency. Why? Because you expect the amount of JPY needed to equal one USD would be lesser.

Perhaps the most important thing to understand about market drivers is that they can quickly prompt enhanced forex participation and severe exchange rate volatility.

Common Forex Market Drivers

If you plan to delve into fundamental analysis, here are some common market drivers you’ll need to stay ahead of.

News

Generally, news comes in two forms: planned and breaking. Planned news events are pre-scheduled, such as official press conferences or the annual G-7 Summit.

On the other hand, breaking news items come as a complete surprise. Examples include terror attacks, election results, or a pandemic’s onset.

If you’ve ever spent a week in front of a forex trading screen, you know how any country’s currency can react to breaking news and how many forex traders use news trading. That’s why most forex traders try to secure access to a live news feed from platforms like the HowToTrade economic calendar.

Economic Indicators

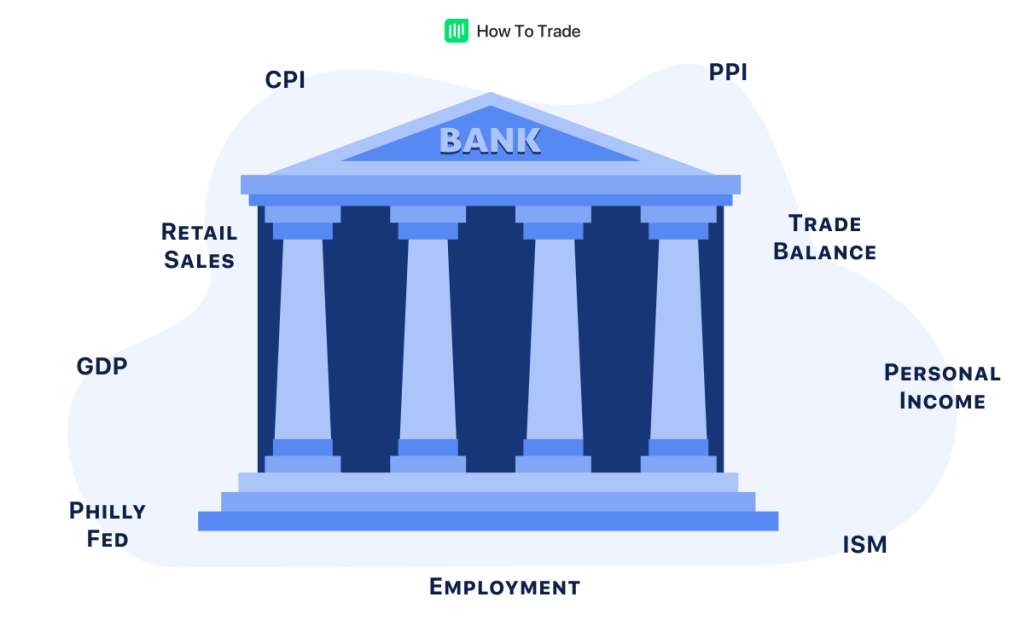

Perhaps the most important aspect of forex fundamental analysis to be aware of are official economic reports published on an economic calendar. These reports disclose both macroeconomic and microeconomic information, and they’re conducted by central banks, governmental bureaus, and independent research firms.

The primary function of an economic data release is to keep the public updated on financial affairs. To do so, a variety of economic indicators are used. A few of the most important to forex traders are gross domestic product (GDP), the consumer price index (CPI), and Non-Farm Payrolls (NFP).

Economic data is a vital element of the fundamental analysis as far as currency trading is concerned. By studying a country’s economic performance, active traders can determine how a country’s currency may be poised to move. Although the market reaction to economic indicators isn’t always predictable in the short term, these reports give us invaluable insights into a nation’s longer-term financial state.

Monetary Policy

Monetary policy is central banks’ toolset for fostering pricing stability, maximum employment, and economic growth. Central banks use them to control their country’s domestic money supply.

Among all forex market fundamentals, monetary policy is the most important. Take it from us — when central banks talk, it pays to listen!

Raising/lowering interest rates, enhancing/restricting credit, or adopting emergency measures can rapidly send any foreign exchange currency surging or retreating.

Fundamental Analysis Pros and Cons

Trading fundamental analysis comes with its benefits and limitations. You may want to consider all factors at play before considering which option to trade every time.

Pros

Some of the benefits of fundamental analysis are.

- Fundamental analysis gives investors and traders the requisite information and updates needed to make a trading decision based on financial data, news, and other market drivers.

- Longer-term traders will benefit from fundamental analysis because it is the best way to predict the exchange rates of currency pairs in the long run.

Cons

Fundamental analysis also has its limitations. Some of such challenges usually encountered by traders using it are listed below.

- Fundamental analysis sometimes takes a lot of time to conclude. This is because analysts would always have to dissect different areas of the economy and available data to synthesize useful information for trading. The entire process of arriving at a decision can sometimes be hectic.

- Also, fundamental analysis takes a broad view of the market dynamics and checks what price action does in the long term. This makes it unsuitable for short-term traders who want to profit from tiny market movements.

Key Takeaways

- Fundamental analysis uses external economic factors to predict currency pair price movements.

- Some of the external factors that are likely to move the forex market are economic indicators, news, and monetary policies.

- Other potential market movers are politics, natural disasters, and comments of influential people.

Wrapping Up

Fundamental analysis is a powerful tool for understanding which market drivers are actively influencing price action. Three of the most important market drivers are news, economic data, and the monetary policies of central banks.

When trading your favorite forex pair, keep an eye on the key market drivers. Even if you favor technical forex trading, you must stay in tune with the fundamentals!