Demo vs Live Trading Accounts

So now that you know all there is to know about pips, spread, margin, and leverage, all that’s left is to pop those charts open and start trading the forex market! Right?

Yes. Well, no. Look, unless you’re the most humble thrill-seeker in the world. Then, by all means, you go ahead and enjoy the mild adrenaline rush of blowing all your money on a live trading account. But if you want to make things right, the first thing you need to do is open a demo account and use virtual money before you risk real money.

In this lesson, we’ll explore the best way to start trading and discuss the differences between a demo account and a live account.

What is a Demo Trading Account?

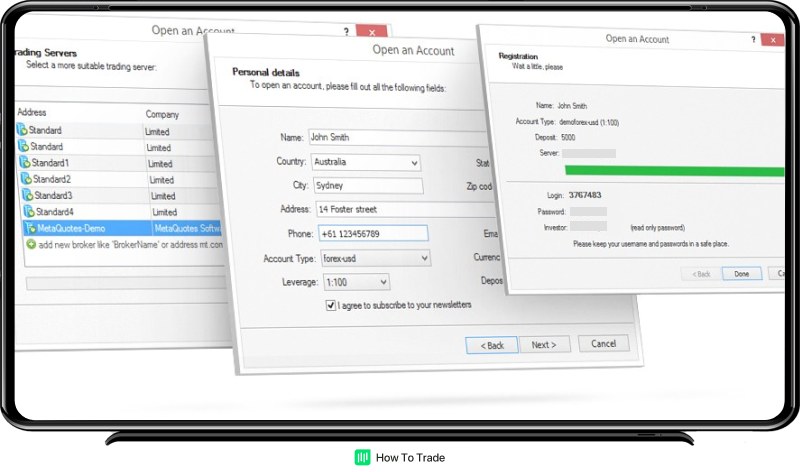

A demo trading account is a forex trading account that a broker provides you to practice trading on. It gives you access to real-life trading situations and a realistic trading environment. It is funded with virtual funds (fake money), with which you can practice all of your trading without risking your real money.

The idea behind the demo account is practice and nothing else. Any amount of money you make in demo trading is not withdrawable. And on the other side, any amount you lose on a demo account is not charged against you. It’s absolutely risk-free.

Benefits of Using a Demo Account in Forex Trading?

These are some of the benefits of using a demo account in your forex trading:

- A demo account provides a realistic trading environment, with real-life prices, indicators, and all the available tools a live account has, but without risking your hard-earned money.

- You get to practice your trading skills, get familiar with the broker’s trading platform, place orders, and get first-hand experience in the dynamic world of financial markets. Even professional traders use demo accounts to practice their trading strategies.

- Demo accounts are a great way to get your feet wet in trading, and because it is fake money, you can’t withdraw a penny if you have a winning streak, but equally, you can’t lose your money either.

Why Trade a Demo Account

There’s no shame in starting with a forex demo account – it’s where all the pros first honed and developed the skills that made them into profitable forex traders later.

A demo account is ultimately an educational tool. It offers something that simply can’t be taught by just reading or listening to another trader or a mentor. Using a demo trading account gives a trader a bridge from the theoretical world of trading to the practical one.

This first-hand education is invaluable in Forex trading as, more often than not, beginner traders end up burning their first live accounts. This is usually because they failed to develop the necessary skills, trading mindset, and discipline needed to trade on a live trading account successfully. That’s why experts recommend you place 50-75 virtual trades on your demo trading account before you start trading with your real money.

Further, with demo trading, you can test a particular trading strategy before you use it on a live account. As a matter of fact, many traders use demo accounts to test their algorithmic automated trading strategies and only then apply these strategies in a live trading environment.

As a rule of thumb, you should use a demo account until you develop a solid, profitable trading system before you even think about trading on a live account with real money! If needed, use a forex broker that provides a demo account without a time limit, which means you can use your demo account with no expiry (even if you have a live account with the chosen forex broker).

What is a Live Account?

Demo trading could help you to understand forex market dynamics and develop your own trading strategy and trading style. But eventually, you do not want to trade on a demo account forever. You simply can’t make real money on it. So, the final step is to upgrade to a live account.

A live account is where you trade forex with your own funds. Here, every single loss costs you, and every single win is actual money for you.

Trading live is a different beast altogether. It’s like the difference between sparring against your brother and fighting Connor McGreggor (unless your brother is McGreggor ?).

Differences Between a Demo Account and a Live Account

Here are the major differences between a demo account and a live account:

- The most significant difference between a demo and a live account is that with live accounts, the money is real. You can withdraw your profit at any time on a live account, but you can’t make any withdrawals on a demo account.

- Another factor that makes a significant difference between the live account and the demo account is trading psychology. A considerable percentage of Forex traders say that emotion is the main factor that cannot be recreated when comparing the two types of platforms. Honestly, don’t be surprised if you are making huge profits on a demo account from day one. That’s the way it is – trading is a mind game.

- With many brokers, slippages don’t happen in demo accounts, but they do in live accounts. This makes it more likely for you to lose money on a live account than on a trading account.

- Some brokers reduce their spreads to the minimum on demo accounts to give traders favorable learning conditions. The spreads on the live accounts, though, are unforgiving since that’s how the brokers make their money.

- Many brokers aren’t strict with their position size restrictions on demo accounts. They sometimes allow you to make trades the sizes of which you would normally not be able to trade on a live account.

Key Takeaways

- A demo account is a forex trading account where you get to practice your trades without risking your real money.

- Beginners use it to get accustomed to the forex trading experience, while professionals use it to test their new trading strategies.

- Live accounts, on the other hand, are for actual money trading.

- Also, live trading tends to attract more emotions, like greed and fear, because you’re trading your real money.

Bottom Line

Start with a demo account and learn how to trade the forex markets safely first. Then, once you have developed your own strategy and trading plan, open a live account with a reputable forex broker. That’s the right way to start your forex trading journey.