Key Points

- The NASDAQ 100 (US100 CFD) is very near all-time highs.

- NVIDIA (NVDA) is up more than 150% in 2024, which is a huge reason why the NASDAQ is overtly bullish.

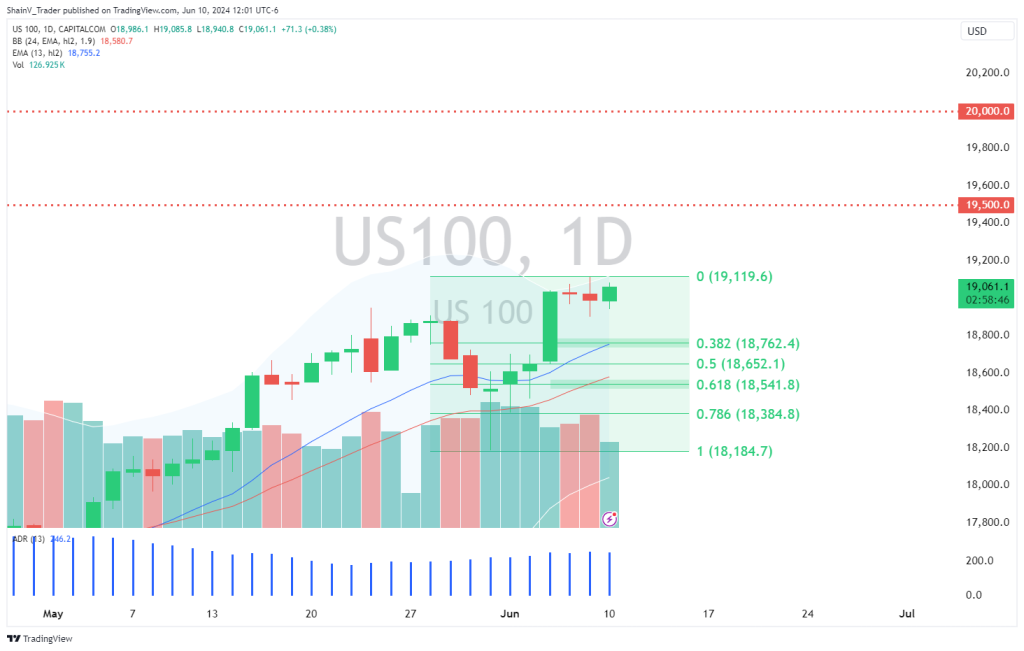

- Daily support is present at 18,762 and 18,541; natural resistance resides at 19,500 and 20,000.

Market Overview

Since the COVID crash of 2020, the NASDAQ 100 (NQ) has posted a rally for the ages. Seemingly, every day, new all-time highs are made on heavy volumes. Names like NVIDIA (NVDA) now dominate headlines as investors clamor to cash in on the AI boom. For opportunistic traders, few markets offer the volatility and depth of the NASDAQ 100.

New All-Time Highs In View

Thus far, June has been a great time to be long the NASDAQ 100. Prices are up 2.75% monthly and close to making fresh all-time highs. Values are already north of 19,000 — will the NASDAQ test 20,000 in 2024?

It’s certainly possible. But if the NQ is to surpass 20,000, NVIDIA stock will need to continue its winning ways. Today, NVDA executed a 10/1 stock split that took prices from upwards of $1,200 per share to approximately $120. The move hasn’t hurt the stock, which is up more than 1% on the session.

NVDA’s huge valuation is a key to the NASDAQ’s 2024 success. The computer chip manufacturer is up nearly 150% over the past six months, leading the NQ into uncharted territory. Unless NVDA experiences a major selloff, it’s difficult to see the NQ making an intermediate-term top. The bottom line is that as long as NVDA keeps grinding higher, the NQ will likely keep posting new all-time highs.

Technical Outlook

As active traders, the trend is our friend. Nonetheless, it can be difficult to join trends when they don’t pull back. We see that in the NASDAQ 100 — a breakaway trending market.

On the daily timeframe, potential buying opportunities exist around 18,762 (38% retracement) and 18,541 (62% retracement) for the US100 CFD. Natural resistance is present at 19,500 and 20,000. One can trade this market by buying support and selling resistance, whichever entries present themselves.

If trading the US100, be aware of the mid-week news cycle. On Wednesday, both US CPI and the Fed Interest Rate Decision will hit the newswires. This will create turbo-charged trading conditions and significant volatility. Be sure to have your stops down and leverage in check ahead of these headline economic events.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.