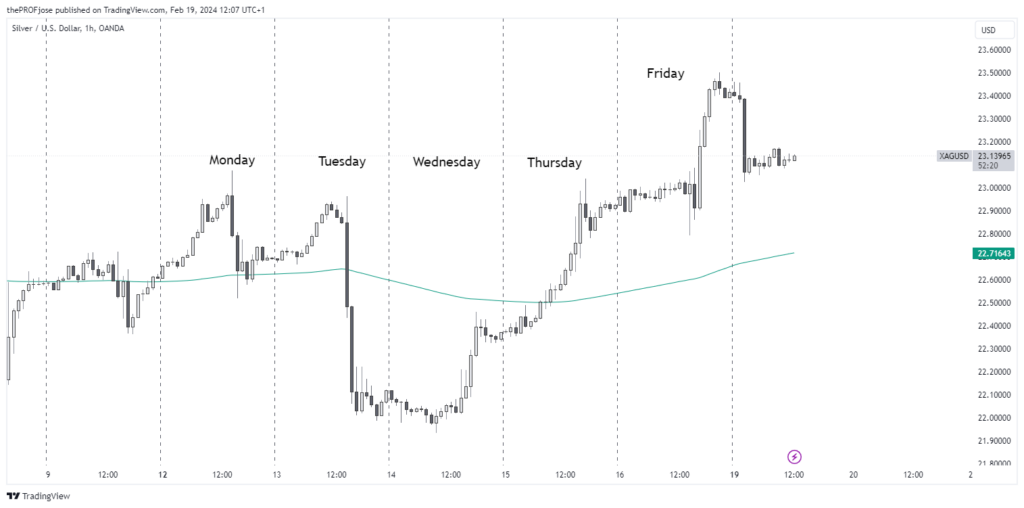

Silver’s performance last week and today has painted a complex picture for traders. After a period of steady ascent, the white metal faced a steep drop, shaking market confidence. Yet, today’s trading session hints at a more tempered scenario, with price movements suggesting a tentative consolidation around the $23.1400 mark.

Key Points

- Silver saw significant volatility last week, with a sharp drop from its peak levels today.

- The metal is trading near a pivotal support level, hinting at a potential consolidation.

- Traders should be cautious due to mixed technical signals and potential fake-outs.

Silver Daily Price Analysis – 19/02/2024

Last week’s price action on silver was an interesting struggle between buyers and sellers, as silver encountered a huge decline on Tuesday, and it would only get back to Tuesday’s high later on Thursday. On 16th February, the price aggressively broke through the range, closing at 23.4014 from the $22.9790 opening price, leaving traders in confusion about whether to jump on a buy trade following the breakout or stay put since Silver is known for its notorious “fakeouts “

After a modest opening today, the commodity struggled to maintain its footing, slipping from Friday’s high as sellers exerted downward pressure. This push was evident as the price tumbled, breaking below the pivot point for the day. At the time of writing, Silver is down -1.23%, trading at $23.1305.

Silver’s price is currently found trapped in a consolidation after the huge drop earlier today, with silver hovering between the pivot and the S1 levels, suggesting a standoff between bullish optimism and bearish caution.

However, although silver’s price is currently trading at $23.1305, having made a -1.23% from the day’s opening price, the uncertainty that grips today’s trading session could unravel as the day unfolds. Should silver sustain its position above the S1 support level, we might witness a gradual ascent as buyers regain confidence. Conversely, a breach below could trigger a sell-off, propelling the commodity toward the next support level.

Key Economic Data and News to Be Released Today

No direct economic data impacting silver has been highlighted for release today, but broader market trends should be monitored. Analysts have cautioned against expecting a surge in silver prices based on fundamentals alone, as historical tendencies suggest possible declines. Market sentiment is mixed, and the silver market’s traditional unpredictability warrants a cautious approach from investors.

Silver Technical Analysis – 19/02/2024

Today, there’s not much happening, as the price is currently trapped in an uptrend. The 200 EMA suggests that silver’s price is still on an uptrend. However, the RSI is hovering around the level 50, showing that the price is undecided on its next direction.

Traders, in these kinds of scenarios, are expected to sit on their hands and watch how the market reacts to key support and resistance levels today.

Silver Fibonacci Key Price Levels 19/02/2024

Short-term traders planning to invest in Silver today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 23.0865 | 23.1404 |

| 23.1014 | 23.1496 |

| 23.1106 | 23.1645 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.