Key Points

- Natural gas is on a four-session losing streak, off more than 10% from last Tuesday’s highs.

- For the first time since 2022, Russia has become the EU’s number-one natural gas and LNG supplier.

- The Ukraine/Gazprom transport deal expires at the end of 2024.

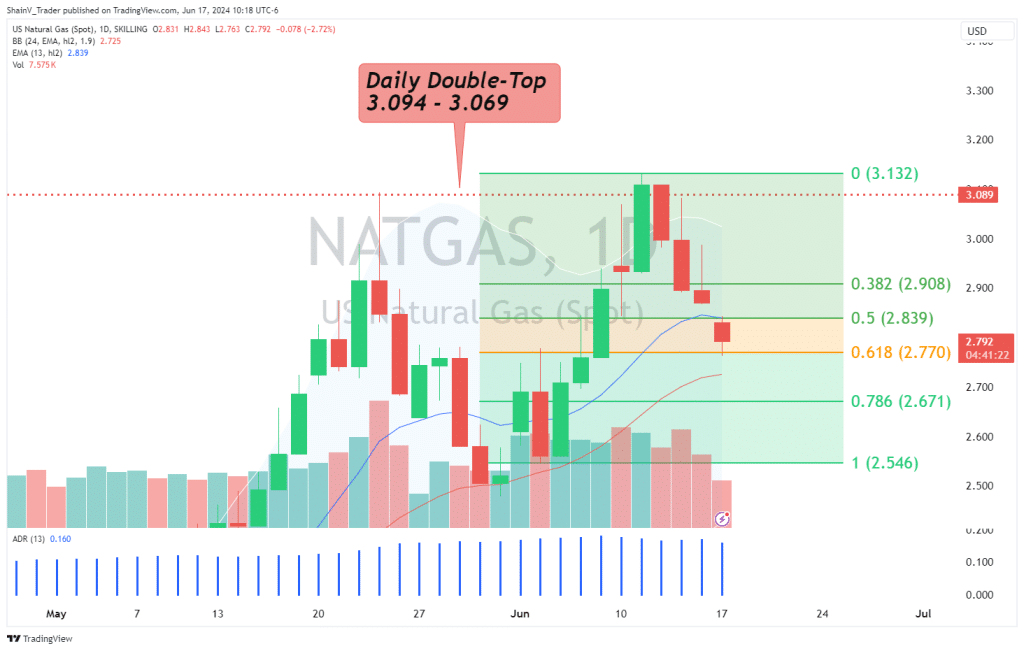

- NATGAS is now trading in the daily Fibonacci Golden Zone.

Market Overview

The past four sessions have been extremely bearish for natural gas (NG). Prices are off more than 10% amid heavy selling. Now, the NG market has a clearly defined daily double-top formation originating from the 3.000 area.

Russia Top NG Supplier To EU

Since 2022, Russia’s global exports of natural gas have fallen beneath historic norms. Now, the supply chain of gas and liquified natural gas (LNG) from Russia to Europe is back online.

For the month of May, Russia became the largest supplier of NG and LNG to the European Union (EU). This came as a surprise to many analysts, given the progression of the Russia/Ukraine War. Comments from Independent Commodity Intelligence Services (ICIS) head of gas analytics Tom Marzec-Manser sums up the situation:

“It’s striking to see the market share of Russian gas and LNG inch higher in Europe after all we have been through and all the efforts made to decouple and de-risk energy supply.”

Russia is responsible for roughly 15% of the NG supply to the EU. For perspective, the US accounts for 14%; so, it’s relatively tight between numbers one and two. But this may soon change. Ukraine has pledged to terminate its transit deal with NG megalith Gazprom at the end of the year. Experts believe this move will vastly reduce Russian exports to the EU and open the door to increased US exports.

The Gazprom/Ukraine deal and the onset of winter are potentially bullish market drivers for natural gas. However, these factors are not expected to affect prices until the end of 2024. NG is currently stable, with a technical ceiling established at the 3.000 level.

Technical Outlook

The daily chart provides a comprehensive overview of the past several months of price action. Back in May, NG prices were dominated by the AI boom and developing heat waves in the Northern Hemisphere. Now, it appears traditional spring seasonality has finally arrived.

At press time, the NATGAS CFD is trading in the Fibonacci Golden Zone, which is the area between the 50% and 61.8% retracement levels. If the bottom of the zone at 2.770 holds, this could be a position-buy trade location. If not, a significant bearish break to the 78% retracement level at 2.671 is likely.

If you’re trading NG this week, be aware of the JuneTeenth holiday on Wednesday. The mid-week holiday will push the EIA crude oil inventories report to Thursday and the EIA natural gas inventories report to Friday.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.