Key Points

- Tuesday’s PPI number came in above expectations, suggesting that inflation continues to run hot.

- CPI is the key event this week for the gold market. It will be released to the public on Wednesday at 8:30 AM EST.

- The XAU/USD is in the midst of a strong uptrend. However, there are two 4-hour resistance levels that offer potential short scalping opportunities.

For the majority of 2024, gold (XAU/USD) has been on a rocketship north. Prices have dug in above $2,000 and show no signs of retracing. The primary market drivers? Geopolitical angst and monetary policy. Now, traders are beginning to question whether gold will come back down to Earth or ride high for the rest of the year.

Inflation Continues To Run Hot

During Tuesday’s pre-Wall Street open, the US Producer Price Index (PPI) was released to the public. Both Core PPI and PPI shattered expectations to the upside, posting 0.5% for April. Analysts expected the figures to come in at 0.2% and 0.3% respectively.

The unexpected growth in PPI poses major questions regarding the fight against inflation. Wednesday will be an even bigger day for inflation readings as the US Consumer Price Index will be released to the public. The markets anticipate CPI growth to fall slightly month-over-month.

Inflation figures can have a large impact on the gold market. Traditionally, when the USD strengthens, the price of gold falls. Higher-than-expected PPI and CPI numbers suggest that the USD will appreciate in anticipation of hawkish Fed policy. If Wednesday’s CPI report follows Tuesday’s hot PPI, then bearish action in gold is possible.

FOMC Expectations

Fed Chair Jerome Powell is scheduled to speak Tuesday during the US session. At the last FOMC meeting, Powell was reserved when addressing the timeline for rate cuts. He reinforced that policy was in a “good place” and that interest rates were sufficiently restrictive.

In short, Powell reassured the markets that interest rates were unlikely to be raised. However, he also pledged to do whatever it took to bring inflation back to the 2% objective. That means the “higher for longer” talking point has become especially relevant and may be the theme of Powell’s comments on Tuesday.

As of this writing, the CME FedWatch Index estimates that the earliest an interest rate cut will come is at the September FOMC Meeting (64% of at least a ¼ point cut). Wednesday’s CPI report can shift these expectations. If CPI comes in above estimates, these probabilities will change, potentially negatively impacting gold pricing.

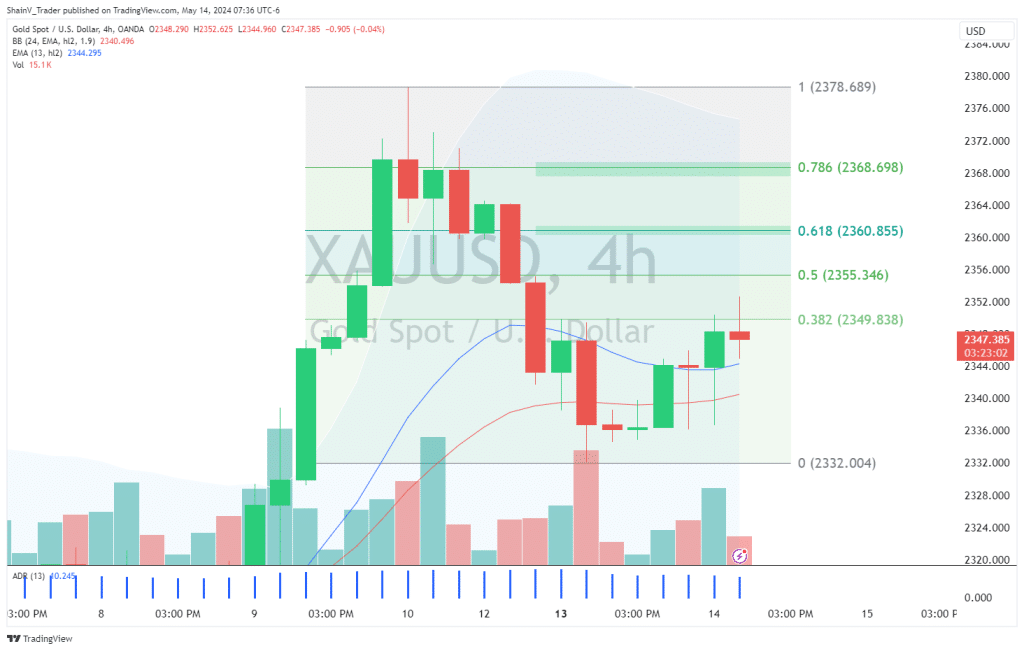

XAU/USD: Bullish Bias, 4-Resistance Levels In View

It’s difficult to be anything but bullish towards the XAU/USD. This market is in the midst of a strong uptrend and isn’t that far from all-time highs. Nonetheless, the 4-hour chart gives us a few technical levels that may hinder short-term price action.

The 2350 area has set up to be a key intraday resistance zone. If bidders drive XAU/USD prices higher, then the 4-hour 62% Retracement (2360.85) and 78% Retracement (2368.69) may also come into play. Short scalps from these levels aren’t a bad way to play the action. Conservative risk vs. rewards (1:1) and modest profit targets ($1.50 to $2.50) are advised.

If you’re trading gold this week, CPI is the key event. Be sure to manage your risk ahead of, during, and after CPI hits the newswires on Wednesday at 8:30 AM EST.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.