How to Find Your Best Risk/Reward Ratio in Forex?

In the forex market, risk management is vital to any trader’s success in the forex market. No matter what type of trader you are, you must earn more money than you lose.

One way to do this is to focus on trade setups with positive expectations. By doing so, you can build trading strategies that incorporate risk-reward ratios designed to sustain profitability over the long haul.

- In forex trading, the risk-reward ratio plays a pivotal role in ensuring traders earn more than they lose.

- Adopting the right risk-reward ratio can be the key to sustained profitability over the long term.

- Mastering the concept of risk-reward is vital for strategizing and maintaining a positive expectancy in trades.

Understanding Positive Expectancy

Understanding the concept of positive expectancy is an integral part of approaching the financial markets from a position of strength. Within the realm of psychology, positive expectations are a foundational aspect of the Pygmalion Effect.

Back in 1968, scholastic researchers, Rosenthal and Jacobsen observed that when higher expectations were placed on students, these students returned greater results. Rosenthal and Jacobsen established the correlation and named their findings after the ancient Greek king Pygmalion.

So, what does ancient Greece have to do with the financial markets and forex trading? On the surface, not much. But, Rosenthal and Jacobsen’s work may be readily applied to any trading strategy in the world’s currency markets. In acknowledging that taking a particular trade gives you a better chance of long-term profit than loss, you have confirmed a positive expectation. Thus, your given trading strategy has a defined purpose: to make money!

To be clear, having positive expectations has nothing to do with your win rate; it has everything to do with ensuring that your winning trades will produce greater returns than your losing trades! This may be accomplished in various ways, one of which is by implementing a risk/reward ratio designed for success.

What is Risk and Reward in Forex?

When it comes to building a trading strategy with a positive expectancy, forex traders rely on the risk-reward ratio. A risk-reward ratio is the comparison of a trade’s potential liability and payoff. It is calculated by dividing the amount of money being put in harm’s way by the anticipated profit. This is done in the live market by first identifying the trade entry point, stop loss, and profit target.

Risk Reward Basics

In simpler terms, the risk-reward ratio measures your possible reward for every US dollar you risk. Let’s talk examples. For instance, say you have a risk-reward ratio of 1:5. This entails the following:

- You are risking $1

- You expect to make $5

- Given the 1:5 risk-reward ratio, you have a 20% breakeven win rate

What does this mean? To avoid losing money, your win rate must be above 20% (ignoring commissions and fees).

Also, it tells us that your profit targets must hit at least 20% to break even, with the rest being losing trades. If your win rate is under 20%, then you are guaranteed to lose money over the long run.

EUR/USD Case Study

Let’s say you have a risk-reward ratio of 1:10. Now, you risk $1 to potentially make $10, and your breakeven win rate shrinks to 10%. A 1:10 risk-reward ratio is a bit outlandish for most forex traders; it is more applicable to a trade relative to penny stocks.

In any case, here’s how a 1:10 risk-reward ratio would play out for Erin, the euro trader, and the EUR/USD currency pair. The following example illustrates how Erin could start trading the EUR/USD with a 1:10 risk reward:

- Erin spots a strong bullish market trend in the EUR/USD.

- A buy market order for one lot of EUR/USD is filled at 1.1250.

- The 1:10 risk-reward ratio is assigned to the trade.

- Profit targets are placed at 1.1300, 50 pips north of the trade entry point.

- Stop loss orders are placed at 1.1245, 5 pips beneath entry.

As you can see, Erin’s chance at success is modest, given the tight stop loss and 1:10 reward ratio. Nonetheless, it only takes a few winning trades for Erin to be profitable; if one in ten trades is a winner, Erin breaks even.

So, what is the risk/reward ratio forex participants rely on? More on that in a minute.

How to Find Your Best Risk/Reward Ratio

What’s the best risk-reward ratio in Forex? The answer largely depends on your trading capital resources, aversion to losing money, and trading strategy. For instance, if you’re a fan of conservative financial market day trading strategies, your risk-to-reward ratio will be smaller than those of crypto swing traders.

Why? To break down this concept, let’s review the basic tenets of the risk/reward ratio as it pertains to risk management:

- Risk is the total amount that could potentially be lost from a trade.

- The reward is the potential profit you could gain from trade.

- The risk-to-reward ratio is the relationship between these two numbers.

Essentially, your best risk-reward ratio is one that contributes to a long-run, positive expectation trading strategy. If you are an average financial markets retail trader, a smaller risk-reward ratio of 1:2, 1:3, or 1:4 is more appropriate than a “homerun” 1:10 risk to reward.

This is because various risk/reward ratios have different probabilities of success. Accordingly, the chances of executing a winning trade with a 1:10 risk/reward ratio are much smaller than standard 1:2 and 1:3 risk-reward ratios.

Ultimately, your ideal risk-to-reward ratio gives you the best chance of reaching your trading and investment objectives. It depends on how much money you have, your expected return, and your acceptable loss. Remember, good risk management relies on positive expectation risk-to-reward ratios!

How is the Risk to Reward Ratio Calculated?

To calculate the risk-to-reward ratio, you’ll first have to derive each of them separately. As a general rule of thumb, it is wise to first address your assumed risk before turning to your prospective reward.

This is done by subtracting your market entry from your stop-loss order. When you’re done with risk, calculate the reward by subtracting the take-profit order from the market entry.

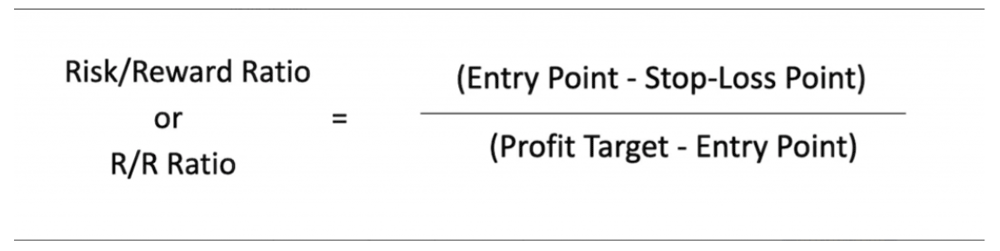

The formula for the risk/reward ratio goes like this:

It’s important to remember that the risk-reward ratio is dynamic and changes with each trade setup. However, in broad terms, if the risk-to-reward ratio is more than 1, the potential risk is bigger than the potential reward.

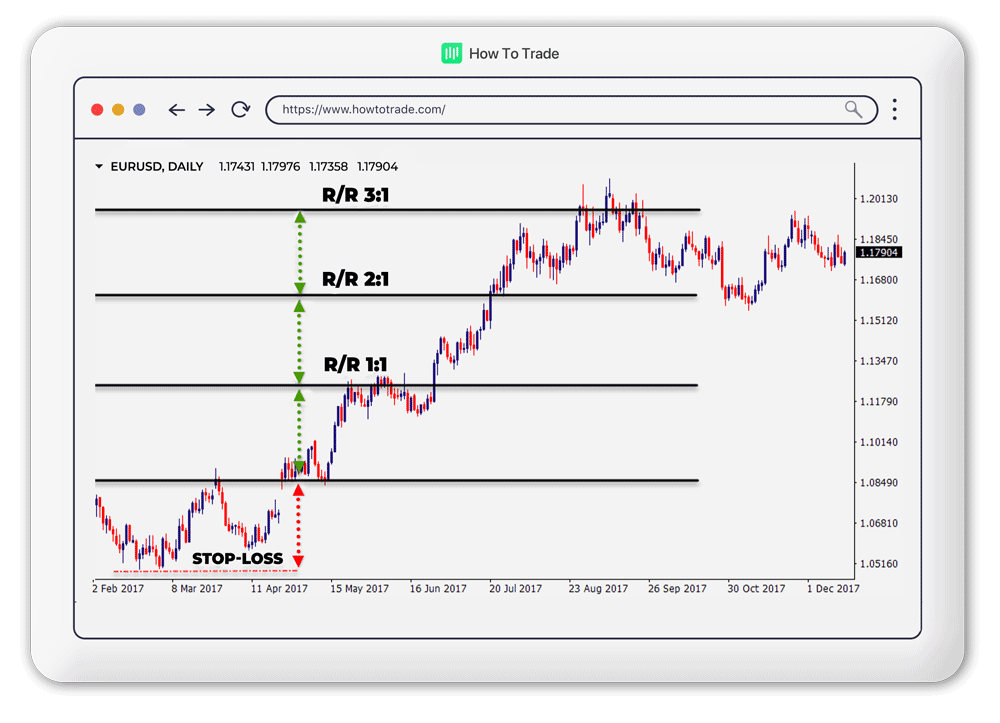

Conversely, if the ratio is less than 1, the potential profit is bigger than the potential loss. Take a look at the example below to see the different risk-reward ratios on a Forex chart.

What Risk to Reward Ratio is Good?

Many experts and Forex traders believe that if you want to increase your chances of being profitable, you want to trade with the potential to make three times more than what you risk.

This theory suggests that trading with a 3:1 reward-to-risk ratio is the right way to go about trading Forex!

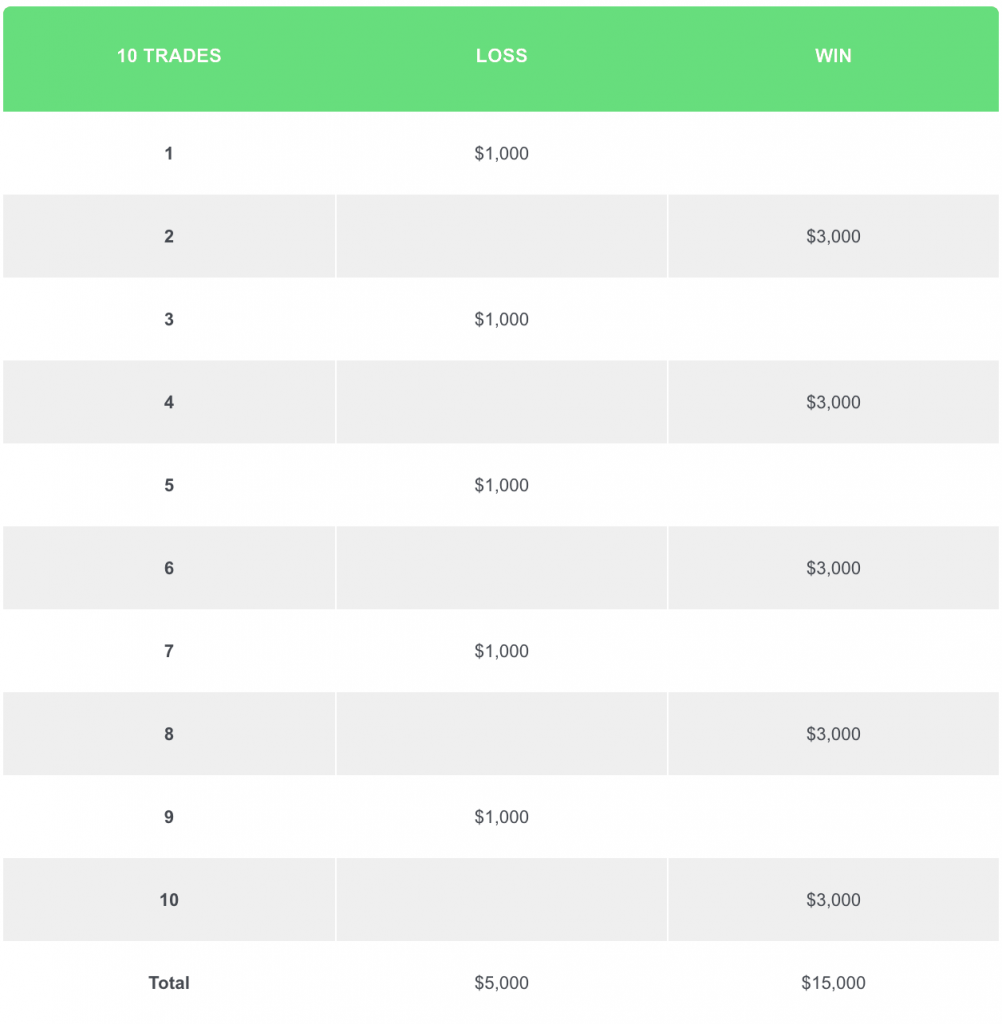

Let’s see what this would look like in practice by looking at the table below.

You can see that even if you only win half of your trades, you will still end up profitable in the end. In fact, with the 1:3 risk ratio, you’ll bag yourself $10,000. Not too bad, right?

Of course, you might wonder why forex market participants wouldn’t just go with higher reward-to-risk ratios and start trading. The reasons for this vary but include transaction costs, price action, and exchange rate volatility. Nonetheless, it’s simply because it’s more difficult for the price to reach a higher profit target than it is to hit the stop loss level.

At the end of the day, your forex trades need breathing room to cope with all the exchange rate fluctuations. Our advice? Don’t risk too much money trying to make big profits fast! Join the ranks of profitable traders by ensuring your risk/reward ratio matches your resources.

Key Takeaways

- The risk-reward ratio is a key measure of a trade’s potential profitability. It is calculated by dividing the potential profit by the potential loss.

- A higher risk-reward ratio means that there is the potential to make more money than you risk, but it also means that there is a greater chance of losing money.

- The best risk-reward ratio for you will depend on your individual trading style and risk tolerance. If you are a conservative trader, you will want to use a lower risk-reward ratio. If you are a more aggressive trader, you can use a higher risk-reward ratio.

Bottom Line

The risk-reward dynamic is a key aspect of successful forex trading. Accordingly, you must ensure that your risk-reward ratio is in line for every trade you take. This may be accomplished by ensuring your resources complement your risk-to-reward aspirations. If they don’t, sustaining profitability over the long haul will be difficult.