What Are the Best Ways to Manage Risk in Forex?

It takes money to make money. But how do you know how much money too much money to risk in forex trading? How do you manage forex trading risk, and what are some of the best forex risk management strategies you need to know and use as part of your forex trading plan?

What is Risk Management?

According to Investopedia, risk is the “chance that an outcome or investment’s actual gains will differ from an expected outcome or return.” Or, put another way, the chance of suffering a capital loss rather than a capital gain.

In forex, risk is the amount of money you’re willing to lose for every trade you take and the cumulative of all your trades.

Thus, risk management can be defined as a set of rules and measures you can put in place to ensure that the impact of being wrong is manageable. This includes the potential for loss and – if you’re trading using leverage – the potential to lose even more than you put in.

At the end of the day, Forex is a numbers game. And to win, you have to tilt as many factors as you can in your favor. Risk management strategies can help you eliminate the chance of financial ruin while pursuing rewards in the market.

Always remember, forex is not gambling. In most cases, gamblers have trouble paying the rent while one percenters own the building. Over the long run, it’s always better to be a consistent winner and have a shot at joining the 1%.

Top Forex Risk Management Tips and Tools

Selecting the right Forex risk management strategy and tools can be a game-changer in your trading journey. Make no mistake, it might take time to understand your risk tolerance and the liquidity risk you are willing to take. This basically means that you are not likely to get into forex trading with a risk trading strategy from day one. It takes to realize the dynamic in the forex markets, and thus, to create your forex risk management strategy.

Still, there are some basic risk management rules you must consider in each trade you make. Some of them might look obvious but you have no idea how beneficial it could be for you to force these risk management rules and use them in your forex trading.

With that in mind, let’s take a quick look at some of the most important risk management strategies.

1. Always Do the Maths

Before you start trading and placing trades in the forex market, it is important you always calculate how much you could lose in the worst-case scenario. The market can move quicker than you thought or gap. A million other things can prevent you from getting out of the trade at the level you wanted to. This is how novice forex traders lose money – when they get into positions without any calculation or account balance.

Beyond that, you always need to be aware of market news and central bank decisions. Sometimes, you can do everything the right way, but you didn’t check the economic calendar and missed a speech from the Fed chairman or… whatever. That could be frustrating.

This is super important to remember especially when using leverage, as your losses could be bigger than your deposit.

2. Ignore Your Emotions

It is important you distinguish between rational and emotional decisions when trading.

Making decisions based on your gut feeling will most likely end in disaster, so it’s crucial you back up your decisions with analysis. Simple as that.

Unfortunately, new forex traders typically fall into this trap. They learn the basics of the market and forex trading and have a feeling that they will enter the market and make huge profits from the beginning.

So, make sure you read about the asset you are trading, use the right risk-reward ratio, and know the personal finance of your account. And with that in mind, let’s move to the next point or your next trade…

BONUS: Try our Forex Profit Calculator to estimate your profit and loss, compare open/close prices, and adjust position sizes before making an emotional decision.

3. Diversify

Don’t put all your eggs in one basket. Don’t put all your capital into a single currency pair trade. Why?

You might lose it all if the market goes in the other direction. If you put all your money on one forex trade, you basically can lose all the funds you have in your account in just one trade – that is a high-risk trade, and most likely, you will lose in this trade because you cannot think rationally.

Instead, keep your options open with other currency pairs. Then, your losses won’t have such a devastating impact on your overall trading account, and if you lose, you simply move on to the next trade.

4. Calculate how much you want to risk in the forex market

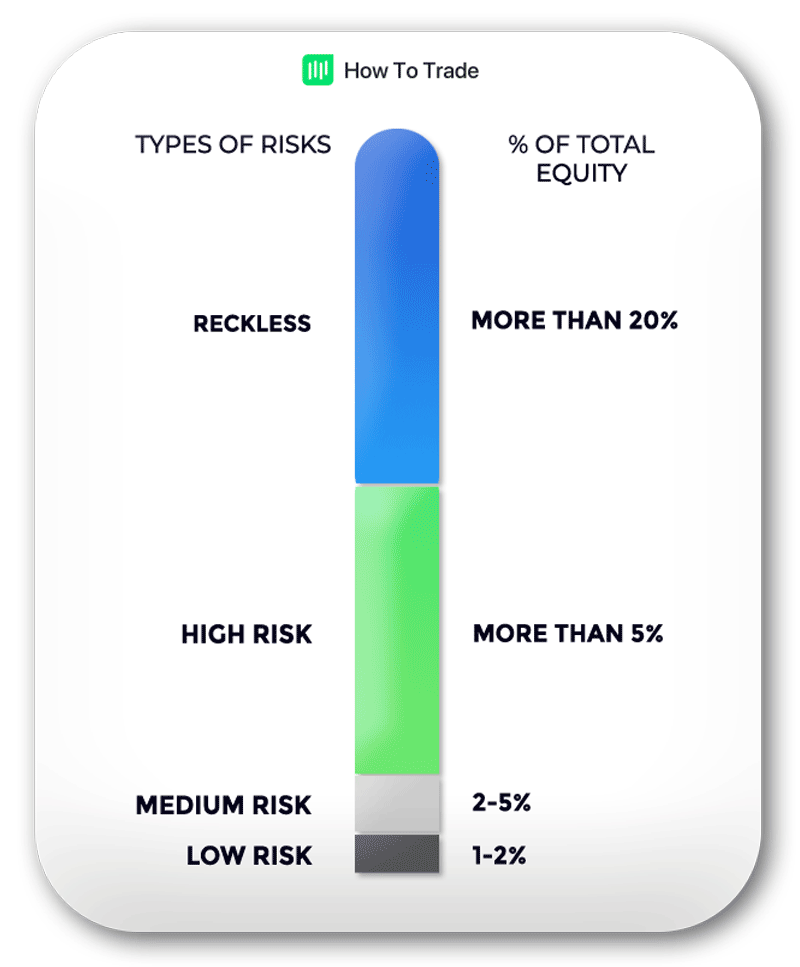

Choosing how much to risk per trade is completely up to you. You will find many forex traders who advise not to risk more than 2% of your trading capital per trade, while others say it’s okay to go all the way up to 10%.

However, most traders do agree that going anywhere above that would be MAD. Why? If you go on a big losing streak, the amount you are risking per trade will have a huge effect on your capital and the ability to claw back your losses. After all, there’s always a downside risk when the currency pair moves against you – so you need to be prepared for every scenario in the FX market.

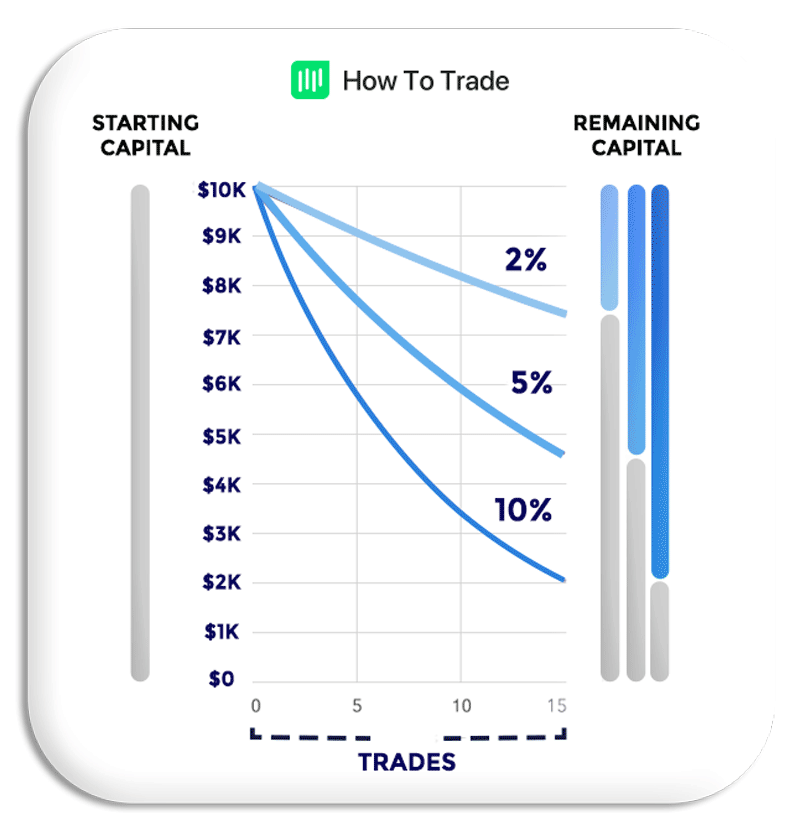

For example, say you’ve got $10,000 in your trading account, and so it happens that you lose 15 trades in a row. Here’s the difference between risking 2%, 5%, or 10% per trade:

- With 2% risk per trade, even after 15 losses, you’ve lost less than 25% of your trading capital. You can still easily win your money back and ultimately reach your profit target!

- However, with a 5% risk per trade, you’d have lost over half your initial trading capital. You’d have to win more than double this amount to get to your original level.

- With a 10% risk per trade, things are even worse. You’d be down over 75%, making it extremely difficult to make back the money you’ve lost.

The reduction of capital after a series of losing trades is called a drawdown, and it essentially refers to the amount of money (in percentage) you can afford to lose. But, more on that later.

You can also work out a risk-per-trade scale. It might look like this:

Remember, all traders will be affected by a losing streak at some point, but the ones who plan their trading and have developed risk management strategies to cope with those streaks are usually more successful in the long run. If necessary, you can also use a demo account to get familiar with the Foreign exchange market and develop your trading system. It’s a great way for retail traders to see how the market moves and get used to the broker’s trading platform before risking real money.

5. Work Out the Risk vs Reward Ratio of Every Single Trade

The truth is that it is possible to lose more times than you win and yet still be profitable. Many traders have the trading skills to ‘lose’ many trades and win this one big trade that makes more money than the other losing trades.

Yes, really. It’s all down to risk vs reward.

For example, if your maximum potential loss on a foreign currency trade is $300 and the maximum potential gain is $900, then the risk vs reward ratio is 1:3.

Pretty simple, right?

This is how you need to develop your own risk/reward ratio based on the risk tolerance you have and the leverage risk you are willing to use. On this aspect, you should note that most traders suggest using a risk-reward ratio of 3:1 or 2:1 for long-term and win trading strategies and 1:1 and even lower for active trading (day trading and scalping).

Key Takeaways

- Risk management involves managing your trades so that you are in the market long enough to be profitable.

- To help manage your risk, always diversify your trades. Don’t put all your capital on one trade.

- Do the Maths, as well. Calculate how much you would be losing if that went against you. Also, it is better not to risk more than 2% of your capital on a trade.

The Bottom Line

To sum up, if you stick to these 5 rules, the chances are you can significantly improve your forex trading strategy and make it a Forex trader. Such distribution could help you trade in a risk-free environment and to be able to control your currency trading and avoid losing money rapidly. And we are not just saying it. In fact, we want to be there when it happens and you become a successful trader.